October.eu Reviewed | European P2P Lending for Europeans

October, formerly known as Lendix is a P2P lending company founded in France in 2014. October operates solely with medium to small businesses or SME in Europe. October uses a different business model from many other P2P lending companies and it's main distinction is that October does everything within its power to ensure that its users' principal is risk free. Rather than adapting to recent P2P lending companies who have an auto invest tool as well as a second market, October does the research itself and puts strong restrictions and limitations on who can and can not invest/borrow. By doing so, October's marketplace is full of individuals who are as trustworthy as humanly possible.

Types of Loans on October

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

October Loan Characteristics

Loan duration12 - 84 Months

CurrencyEUR

Buybacks Yes

CollateralYes

Available inEU

Returns rate3 - 7%

Default Rate3%

Recovery Rate100%

FeesNone

BonusesNone

October Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is October?

October's mission is, "To empower businesses to thrive by simplifying and democratizing their funding." October's main objective is focused on democratizing finance within Europe. Whether or not they choose to branch outside of Europe, only time and regulation will tell. October is picky when choosing who may or may not use their platform. Their main goal is to attract lenders and borrows who are credible and financially responsible.

Due to this decision, users can trust that the company does its own due diligence unlike other companies such as Housers or Mintos where supposedly credible entities have collapsed or become insolvent. October's objective also builds a sense of locality in Europe. If a European were to invest in something to see a return, why would they not invest in their own back yard.

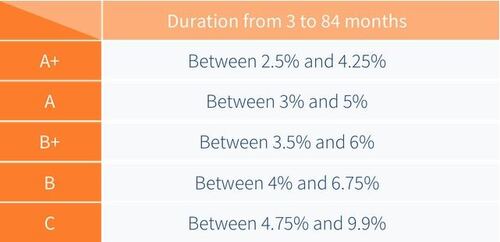

What democratizing finance really means is giving the power of choice back to the people. By allowing the lenders to choose the borrowers and by giving borrowers a new way to access credit, October, opens a new market for peer-to-peer lending that favors decentralizing the current economic landscape that banks are clearly dominating.The projected security and proposition of European's re-investing into Europe can be incredibly attractive. The sole downside is that October is infamous for having very low interest rates, some of the lowest in the market.

Lender/Borrower Ecosystem

October exists as a platform for small businesses to be funded by individuals. The marketplace promotes small businesses that need a lump sum of capital to either begin operating or continue operating.

October itself has a team of credit analysts who determine whether or not a company has the means to take on the loans and pay them back. In short, the borrowers are the businesses and the lenders are the investors. October operates as intermediaries between the two, as opposed to P2P Lenders that involve a loan originator. The advantage of a loan originator is that the originator may guarantee a buyback for the lender. In the case of October there are no buyback guarantees. It is important to assert here that October's mission is arguably less about bringing home an attractive internal rate of revenue (IRR) and more about promoting business in Europe.

This would explain why the company embarks on their own rigid due diligence. It would explain why businesses on October are subject to below market interest fees. And, explain why transparency between October, and borrowers and lenders is always under strict scrutiny. Another aspect of October is highlighted by their decision against having an auto investing feature. October puts forth as much data as possible on the borrowers, their business and their reliability regarding paying their lenders back. Rather than trying to make investing simple and easy, October's action indicate that they rather educate their investor's than have them make undesirable decisions.

There is an aspect of exclusivity in October that makes the platforms environment feel more professional and trustworthy. It is difficult to determine whether or not October would be better off changing with the times or if their decision is what will define the future of P2P lending.

| General | Data |

| Origin | France |

| Founded | 2013 |

| Offices | France |

| Loan Type | Consumer Lending |

| Sign Up Bonus | 20 € |

| Fees | 0% |

| Interest Rates | 4 - 7% |

| Min Deposit | 20 € |

| Investment Duration | 12 - 84 Months |

| Secured Lending | No |

| Currency | € |

How to Borrow?

October only offers business loans. Borrowers must be registered in the EU and can only request the loan for business purposes. These borrowers have to undergo a series of tasks and document uploads in order to receive a loan approval. October recommends their services for business who make at least 250,000 EUR annually in gross profit. Loans can be issued for all sorts of reasons such as, property acquisition, business acquisition, new employees, renovations or rebranding.

Registration & Withdrawal

Like many other sites, getting registered on October is a very straight forward procedure. After filling in the basics of name, email and phone number, users can then proceed to KYC verification. There is a minimum of 20 EUR deposit. Users need an European bank account in order to deposit in October.

It is generally recommended to deposit in EUR as the platform operates with EUR and to avoid loss on currency exchange.

For free EUR deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account. October does not charge any fees for deposits and withdrawals, however, depending on the transaction fees of a given bank, users may be charged by their bank for exchanging and handling fees.

The platform only allows phone numbers from very specific countries, however, users can message their customer support to have any phone number added to the database. Lenders can come from all over the world but the borrowers are solely European.

Marketplace

October's Marketplace is full of pre-approved borrowers. All of these borrowers are businesses in Europe, and lenders are privy to every financial detail of these businesses. Although the list of investment opportunities available is smaller than other platforms, October ensures lenders that the borrowers are credible by providing their credit history, revenue, number of employees, and profit and loss. These metrics enable lenders to make wise decisions and to fund projects that have the means and competency to pay back their loans.

Risks Involved

When assessing the risks of any fintech company it is of the utmost important to factor in their track record of success.

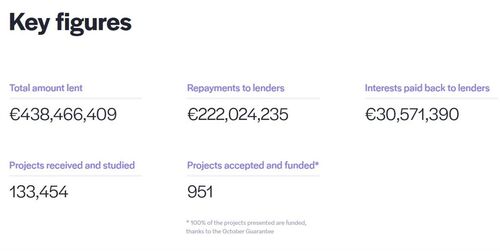

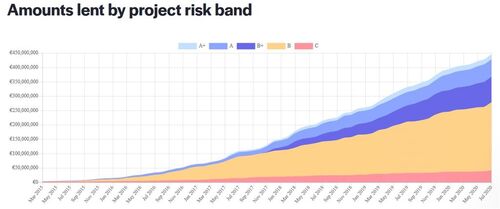

As one can see in the chart above October from the beginning of operations has maintained a healthy increase in loan size whilst retaining their low risk appeal to investing.

October some state guarantees on certain borrowers in France. Which means in the case of a loan defaulting, then the state will reimburse the lender. As of August 2020, this feature is only France and does not include all of the loans on the platform. Other states are weighing the options to possibly implement state guarantees for their loan affiliated companies. This feature would be welcomed on all loans on October.

Investment Strategy

October does extensive due diligence to ensure their lenders that their capital is at minimal risk. It is on the lender to determine which business he or she may want to invest in. For the sake of the lender, October puts every borrowers business through a 5 step process to get them listed on October's marketplace.

October's financial experts outline the 5 step approach October uses to analyze which business borrowers deserve to be on their platform and under what interest rates.

Step 1: The Eligibility Test

October assesses the executive employees of a given a business, the equivalent of CEO & CFO of the company. October's risk scoring algorithm, MagPie, is able to synthesize public data on a business as well as private data given by the borrower to determine what level of risk a business possesses.

Step 2: First Analysis and Meeting

If the business passes the first step they are required to submit financial statements, investment memorandums and bank statements. With these documents October can assess their management qualities, relevant experience and credit score.

Step 3: The Credit Score

The credit score will determine the projects validity. If a project does not pass this test it will not be shown to the credit committee or lenders. The score is calculated on projected earnings of the company rather than the past.

Step 4: The Credit Committee

When a credit score is decided. The project moves to the credit committee where 3 international credit directors have to give the project a go ahead. The borrower is presented with the loan that the platform is willing to offer. When the borrower accepts, the lenders are notified and have the option to invest.

Step 5: Fraud Prevention

The company takes a few additional steps to compare and cross reference data given to them. They ensure the financial flows are accurate, and confirm the data in the financial account and bank statements, and the main customers and suppliers are all legitimate. Lastly, the company does a background check on the founders and the companies statutes. Lenders are able to view projects in their last 48 hours of review.

These five steps are widely covered by October to not only explain their reasoning behind choosing the borrowers that they chose, but also to help lenders understand what October was looking for when deciding on who to add to their marketplace. One of the few downfalls to this method is that there are not a wide variety of loans to choose from. This in some sense takes away from the decentralization that alternative finance like P2P lending provides. October, in many ways, is reminiscent of a traditional bank, when conducting who should and should not have a loan. Finding the right balance between centralized finance and decentralized finance is incredibly difficult.

Customer Service

October provides an incredible customer service experience. They have an all encompassing help center for users to know all about October. They offer phone support, chat support and emails. Users can expect very fast response times as well as accurate answers. October invests a great deal into ensuring they provide top-notch service.

Transparency & Security

The security and transparency is truly something to behold at October. The only other company with comparable transparency is Mintos, Europe's leading P2P lending platform.

October has an incredible customer service team, very fast response times, and a blog that releases very in-depth articles clearly explaining October's position in every financial step they take.

October is regulated by French Financial Markets Authority (AMF) and work together with EU "to sustainly support the real economy". - as per October

Crisis Management

Companies like October are at the greatest risk when it comes to pandemics like Covid-19. Businesses all over Europe were forced to shut down their operations. If they still had to debt to pay back that could mean a lot of mess for October to clean up.

Fortunately, October had the supplies ready at hand. In the middle of March, October implemented "an automatic free of capital repayments". For three months borrowers were only obligated to pay interest on their returns as opposed to paying back capital as well. The implementation really just paused the borrowers obligation to pay for three months.

Considering the circumstance, October created an ideal solution. Borrowers did not have count their pennies and were able to breath a little easy. Lenders did not have to worry about an unreasonable percentage of loan defaults. And October did not have to stress over fund recoveries.

Other than PeerBerry, no other company dealt with Covid in such a logical and value conscience way.

Otherwise, it is important to note that Covid did decrease the loan amount and the amount of actual loans on October. When the market stabilizes, things will most likely change, however, only time will tell. Other than loans and the amount of loans, October has seen a steady increase in users every month since their founding. More individuals are seeing the unique and quality experience that October brings.

Our Readers Have Asked:

Is it safe to invest with October?

No investment is ever "safe". There is an inverse relationship between risk and reward, as the more risk you take, the higher your reward, as well as the chances of losing your investment.

How much money will I make with October?

October suggests that investors on their platform make anywhere from 3 - 7 percent in annually in returns.

What are the risks?

Investors on October have never lost any of their principal. October is one of the safest Peer-to-Peer lending platforms in that respect.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. October is certainly one of the hardest working ones. Though they are less profitable than many they are safer than most.

Where is October located?

Primary. 94, rue de la Victoire, Paris, Paris 75009, FR.

Watch & (L)earn

Discover more about October in this short but informative video.

Pros, Cons and the Verdict

Pros

- Manual Selection

- Secondary Market

- Regulated

- Low Default Rate

- Low Fees

- Low Minimum Entry

- Easy to Use

Cons

- Low IRR

- No Buy Back Guarantee

- No Auto-Investing Tools

October is a great platform for P2P investing. They are not the biggest P2P lending platform, not in Europe and not in the world. However, their platform is arguably of the highest quality. Their approach to risk management, company goals and user experience make this is an incredibly attractive P2P lending platform.

Their interest rates are very low in comparison to the rest of the market. This is ultimately justified by the amount of time that goes into ensuring investors are not throwing their money into hopeless projects.

October is a platform for more serious investors who are more interested in interest rates that will remain consistent. As opposed to higher interest rates on a platform that is less reliable.

At the end of the day, the most important thing for an investment is longevity. The interests may be low, but that is leveraged with the fact that investors can keep their money in October for a long time and can safely benefit from compounding interest.