Iuvo Reviewed | An Award-Winning Consumer-Loan Aggregator

Iuvo is an award-winning peer-to-peer (P2P) lending platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. Iuvo is wholly owned and funded by Management Financial Group (MFG), a financial-holdings firm with offices in Estonia, Bulgaria, the UK, Austria, and Spain.

Iuvo boasts nearly 250-million Euro in total investments stemming from approximately 30,000 investors. Iuvo works with several loan originators focusing mostly on personal loans below 2500 EUR. The platform requires a European Union bank account, or an account with a similar Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) system in place.

In 2017, Forbes Magazine, one of the world's leading business magazines, ranked Iuvo 3rd on the Forbes Best Start-Up list. In 2020, Forbes named Iuvo the Best Company in the finance category.

Types of Loans on Iuvo

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Iuvo Loan Characteristics

Loan duration1 Day - 60 months

CurrencyEUR, BGN, PLN, RON

Buybacks No

Collateral No

Available inWorldwide

Returns rate8 - 10%

Default Rate8%

Recovery RateUndisclosed

Fees1% (secondary market)

BonusesUp to EUR 750

Iuvo Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Iuvo?

In describing Iuvo's core values, CEO Ivaylo Ivanov explains that the Latin word "iuvo" means "to help." Iuvo strives to help clients invest their money effectively by implementing a strategy that focuses on prosperity, creativity, and simplicity. Ivanov pitched the idea of a P2P lending platform to MFG shareholders in 2016, and received €1.7 million in financing from them. The company is still financed and managed by MFG, with Ivanov at the helm.

According to Ivanov, a well-diversified portfolio on Iuvo should yield returns of 8-10% annual. In addition to its lending activities, the company offers a fully-automated savings program called iuvoUp, which offers a fixed return rate of 3 - 4% annual.

Those new to Iuvo will especially enjoy the site's extensive collection of articles, including, "The liquidity of your investments on iuvo," "Interview with an originator - iCredit Romania," and "Why should I invest in iuvoUp and iuvoP2P?"

Lender/Borrower Ecosystem

Iuvo works with various loan originators based in Europe and Asia. It's these originators, rather than Iuvo, that determine the credit worthiness of the borrower. Iuvo's function is to aggregate the offers and provide a platform on which investors can fund the loans in exchange for interest. At any given time, one can find scores of loans ranging from as little as €100 to as much as €2500, with 40% of loans maturing within 3 to 6 months, and another 40% within 12 months.

Those who wish to invest money but not time can benefit from Iuvo's auto-investing tool. This mechanism allows lenders to determine their investment strategy and preferences, after which the automated platform does the heavy lifting.

Iuvo offers a 100% buy-back guarantee on all loans more than 60 days in arrears. The guarantee covers the principle, but not accrued interest, so while you'll never lose your money you do risk some opportunity cost. Investors on Iuvo enjoy an average annual return of 9.2% though there are reports of 12% and even 15% returns in certain cases.

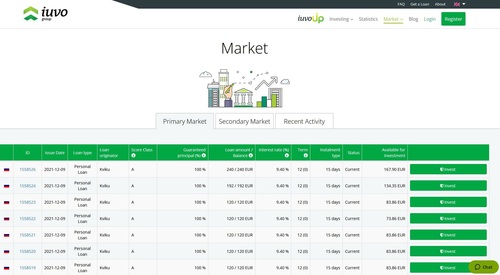

Iuvo also has a secondary market for those looking to buy, sell, or trade loans. There is a 1% fee for such transactions, and there is no buy-back guarantee for secondary transactions.

In addition to its loan offerings, Iuvo operates a savings platform called IuvoUP. Users can deposit any amount, and set the savings period to anywhere from 6 months to 10 years. IuvoUp reports consistent 3% to 4% annual growth.

General Data

| General | Data |

| Origin | Estonia |

| Founded | 2016 |

| Offices | Narva mnt 5, Tallinn City, Harju County, 10117, Republic of Estonia |

| Loan Type | Personal Loans |

| Sign Up Bonus | No |

| Fees | 1% |

| Interest Rates | 9.2% |

| Min Deposit | N/A |

| Investment Duration | Up to 5 years (60 months) |

| Secured Lending | No |

| Currency | EUR |

Registration and Withdrawal

The registration process on Iuvo is rather straightforward, and takes only a few minutes. First, you'll select an account type: Individual or Company. Next, you'll enter some personal information, including your name, location, and phone number. Then you'll be asked to verify your age (18+), identity and bank account (EU or AML/CFT), by providing documentation such as a passport, bank letter, and other forms of ID. This is a counter-fraud mechanism that protects both you and Iuvo.

Those who wish to invest with Iuvo but do not have an EU bank account should consider an online banking platform such as Paysera, Transferwise, or Revolut.

Having been approved to invest on the site, all that remains is to deposit money and choose your investment strategy. Iuvo allows you to get your feet wet, by investing in P2P for only 10 euro. There is no minimum amount for investment on the secondary market.

Minimum Investments - Other Currencies

- BGN 10

- RON 25

- PLN 25

- RUB 400

In January of 2020, Iuvo added a real-time currency exchange to its platform. In a few simple steps, investors with money on Iuvo in the form of one currency can quickly and easily convert their funds into another currency prior to making a transaction in the latter currency. Currencies can be converted to and from any of the available currencies.

Marketplace

Once an individual has been approved for a loan by one of the originators, the loan appears on Iuvo's Market page under Loans. The listing includes all the relevant information, including the Loan Type, Originator, Score Class, Loan Balance, Term, and amount currently Available for Investment. One need only select a listed loan, enter the amount one wishes to invest, and confirm the decision.

Loyalty Programs

Iuvo has a Refer a Friend program that offers bonuses based on the deposits and investments of users referred to the site. The bonuses start at 1.5% of the deposit, assuming the referred user deposits and invests over €1000. The bonuses are capped at €150 (for a €10,000 deposit and investment) per referral.

In addition, Iuvo has two loyalty clubs: Iuvo Silver Club and Iuvo Gold Club. The Silver Club offers investors faster processing time on deposits and withdrawals, lower fees for transactions on the secondary market (0.5% instead of 1%), and 2% bonuses for referrals. The Gold Club offers even faster processing times, zero fees for secondary-market transactions, and 3% bonuses on referrals. Gold Club members also receive early info on new promotions and loans.

To join the Silver Club, users must deposit and maintain a portfolio of €10,000, while the Gold Club requires €25,000.

Risks Involved

To reduce risk, Iuvo selects its loan originators with great care, thereby ensuring the approved loans are credit-worthy and less likely to default. To be sure, no loan is default proof, but the difference between a reliable and unreliable loan originator is often measured in millions of euro. After all, the loan originator is the one determining the credit worthiness of the borrower, so if the originator is unprofessional or suspect, the entire process is in danger.

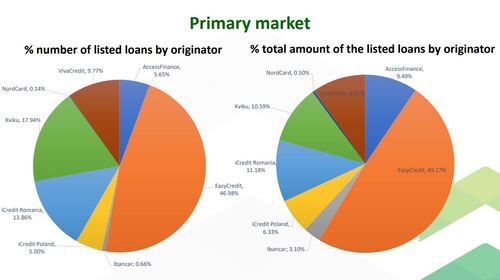

Among the top originators listing loans on Iuvo are EasyCredit, with a loan portfolio of approximately 67 million BGN (€34.25 million), Kwiku, with approximately €21.5 million, and Access Finance, with approximately 31 million BGN (just under €16 million). Any originator listed on Iuvo must stake 30% of the loan ("skin in the game"), thereby indicating its commitment to both the the loan and the borrower.

On their blog page, Iuvo posted a short article titled, "How do we select our originators?" in which they explain the rigorous process they follow when selecting loan originators. According to the article, "Each originator passes a due diligence period during which property, financial health, and portfolios are tracked."

Transparency & Security

Arguably the biggest concern users have when investing online is the safety and security of their money and personal information. There is no shortage of unscrupulous financial websites, particularly in the largely unregulated world of lending platforms. There are also many sites that might be trustworthy, but can provide little assurance other than their word. Iuvo, on the other hand, is a licensed and regulated credit intermediary.

While it might not be a "major" country, Estonia is a member of the European Union. Like all EU countries, it must comply with the European Single Supervisory Mechanism (SSM), which has been responsible for financial oversight in EU countries since late 2014. In Estonia, such oversight is conducted by the Estonian Financial Supervision and Resolution Authority (EFSRA).

Among the many institutions supervised by the EFSRA are all Estonian banks, insurance companies, fund managers, pension funds, and of course, Iuvo. To meet its obligations to the EFSRA, Iuvo must provide quarterly financial reports, as well as an end-of-year report. It must also maintain a Conflict-of-Interest policy, comply with the EU's General Data Protection Regulation.

On the Iuvo site, users can find a link to Iuvo's EFSRA license, privacy policy, Conflict-of-Interest policy, and financial reports dating back to 2017. Iuvo also posts monthly financial updates on its blog.

Crisis Management

Throughout the course of the pandemic, Iuvo posted regular updates to its blog, in a section titled Covid-19 Updates. The platform describes how their employees were in touch with loan originators on a daily basis, facilitating moratoriums and other measures designed to mitigate the financial crisis. Since then, according to the blog, the site has "completely restored its normal work rhythm."

Iuvo also provides a detailed "Insolvency of Originators" plan one can access on the site. This plan describes precisely how Iuvo Group handles one of its loan originators going under, or even indications it might go under in the near future.

Our Readers Have Asked:

Is it safe to invest with Iuvo?

All investments carry inherent risk, and the potential profitability of any investment is proportionate to that risk. That being said, Iuvo is a reputable organization regulated and licensed by Estonian and EU government entities. Iuvo is a safe choice both for borrowers and investors.

How much money will I make with Iuvo?

The average return enjoyed by Iuvo users is 9.2%, but your exact earnings are impossible to predict. Loans have a range of interest rates, default rates, and so on. Some investors report making as much as 15%, while others only 5-6%.

What are the risks?

Unfortunately, Iuvo doesn't report its exact default rates, but it's fair to assume they face the industry-average default rate of approximately 8%. Given their buy-back guarantee, users don't face extreme risk, and are likely to make money over the long term.

Why do I need to submit ID verification?

The internet is replete with hackers, scammers, and frauds. To curtail any fraudulent activity, Iuvo requires users to prove they are who they claim. In doing so, Iuvo protects itself and you, the consumer. These security measures, which are known as "Know Your Customer" (KYC) protocols, prevent someone from making investments in your name or with your money.

Is P2P lending a Ponzi scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies.

Where is Iuvo located?

Iuvo headquarters is located in Estonia, and its parent company, MFG, has offices in several countries.

Watch & (L)earn

Discover more about Iuvo in this short but informative video.

Pros, Cons and the Verdict

Pros

- User-friendly platform

- No minimum deposit

- Auto-invest tool

- Licensed and regulated

- Secondary market

- Informative blog

- Consistent performance

- Buy-Back guarantee

- Transparency

- Loyalty Clubs

Cons

- 1% fee on secondary market

- Expensive loyalty programs

- Website needs upgrade

Iuvo has managed to develop a very good reputation for itself. Being controlled by a major financial firm means Iuvo is well-funded and properly managed. The platform is easy to navigate, and the auto-investment tools allow your money to work for you. Iuvo seems to perform due diligence on its loan originators, and they provide a excellent of transparency. This is certainly a site one can trust, and with an average yield of 9.2%, one is likely to enjoy very good returns over the long term.