How Our Portfolio Performed In Q3 of 2022

Please read P2PIncome's most recent investment-portfolio report for 2026.

The financial world is facing several challenges. The US and Europe seem to be heading into recession. Europe, in particular, and the US to a lesser extent, are facing an energy crisis with potentially disastrous consequences. The war in Ukraine is now marred by human-rights abuses and war crimes, not to mention the destruction of a key energy infrastructure. That could mean a gas shortage in Europe that prevents millions of citizens from heating their homes, not to mention crippling any industry that relies on gas. As often repeated on a popular television show, "Winter is Coming."

Quarterly Report: 2022-Q3

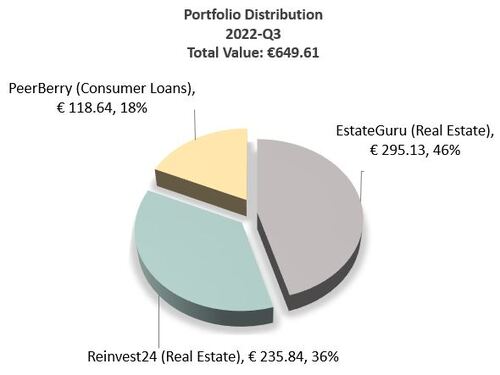

P2PIncome's financial experts have elected to focus approximately 80% of their portfolio on real estate. There are two justifications for this approach. First, real-estate loans are backed by tangible assets (collateral), which means the risk of "total loss" is significantly mitigated. In addition, real estate often yields greater profits over the long term, as rental dividends are distributed. On the other hand, it's never wise to invest exclusively in one area, for which reason 20% of the portfolio is devoted to consumer loans.

Facts and Figures

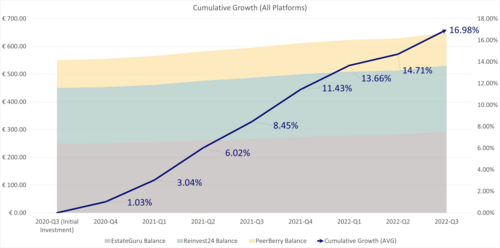

While the financial market is facing crises on several fronts, the affects have yet to reach P2PIncome's investment portfolio. To the contrary, thus far we've enjoy consistent growth over the past two years, and we continue to hope that a sound investment strategy will successfully evade the threats faced by so many. To be fair, the portfolio is quite small, but even with limited data certain extrapolations are possible. For one, it seems clear that real-estate development projects remain a strong source of passive income, though the number of available projects seems to be decreasing.

| Platforms | EstateGuru | Reinvest24 | PeerBerry |

| Q2 | €282.18 | €231.10 | €115.73 |

| Q3 | €295.13 | €235.84 | €118.64 |

| Profit (€) | 12.95 | 4.74 | 2.91 |

| Growth (%) | 4.58 | 2.05 | 2.51 |

We entered Q3 with a portfolio balance of €629.01, and completed the quarter with a balance of €649.61, for a total gain of €20.60 in just 3 months. To be sure, that isn't an accurate depiction of the situation, as the completion of real-estate projects always yields an artificially-high return.

Our cumulative growth reach 17%, up from 14.72% the previous quarter. This is consistent with the 9.5+ annualized returns we've come to expect, which bodes very well in the long term. Our only real concern is whether there will be enough projects in which to reinvest our funds, as many of the top peer-to-peer lending sites seem to have far fewer listings than they did 12 months ago.

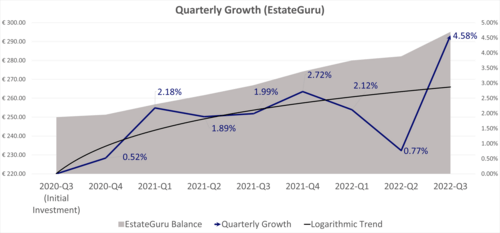

EstateGuru

We've had harsh things to say about EstateGuru in the past, particularly about the way they handled late payments and potential defaults. However, those issues are in the past, and right now EstateGuru's marketplace seems promising. It certainly offers more projects than one will find on Reinvest24 at the moment, and many of them are short-term loans with attractive interest rates and bonuses.

While 2022-Q2 was a low point for us with EstateGuru, exits from 2 projects yielded excellent profits, and we enjoyed a growth of 4.58% for Q3. Our total profits increased to €45.13, bringing our total to €295.13, from an initial investment of €250. That's 18% growth in 21 months, for an annualized growth rate of 10.25%. To be sure, we can't expect that rate to continue indefinitely, but a rate above 9% seems realistic. As always, we reinvested the profits, and will report on the progress of new investments in the next report.

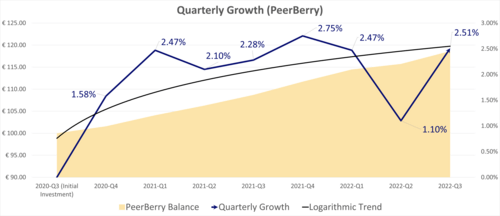

PeerBerry

PeerBerry is a world-class p2p site that we've been covering for a long time. Headed by the charismatic Arūnas Lekavičius, PeerBerry offers investors a marketplace full of consumer loans backed by an attractive "double buy-back guaranty." Our overall experience with PeerBerry has been nothing but positive, and we highly recommend them to anyone looking to get started in p2p.

In 2022-Q3, we enjoyed 2.5% growth on PeerBerry, bringing our total value up to €118.64, for an €18.64 profit on a €100 investment. That's a 21-month growth of 18.64%, and an annualized total of 10.65%. Considering these are consumer loans, rather than real-estate loans, the results are exceptional. When we went to invest our profits, however, we noticed most of the loans were long-term, but we found a few that met our criteria and are interested to see how they perform over the coming months.

In addition to its excellent overall performance, PeerBerry has been working hard to address concerns related to the Russian invasion of Ukraine. They suspended all activity in the area, and have provided investors with regular reports regarding outstanding investments in the area.

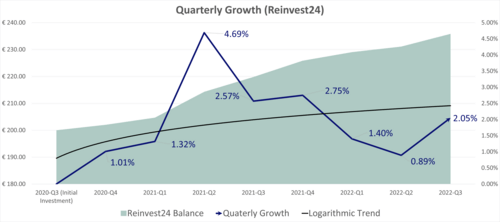

Reinvest24

Reinvest24 seems to have taken a hit as of late. The once sprawling marketplace is quite scant of listings, and we are concerned about their long-term prospects. It's a world-class platform, so we'd like to see it thrive, but over the past six months they seem not to have attracted very many projects. Instead, most of the marketplace is secondary loans. Hopefully this top-tier p2p platform bounces back.

We initially invested €200 on Reinvest24, and at the close of 2022-Q3 we had €235.84, including a 2.05% jump in the recent quarter, up from a paltry 0.89% the preceding quarter. This €35.84 profit over the course of 21 months amounts to an annualized growth of 10.25%, which is quite good, and indicates the strength of real-estate projects that issue rental dividends and capital gains. There were no large projects in which to invest, so why spread our profits across several carefully selected opportunities on the secondary market.

Events that Influenced Financial Markets During Q3

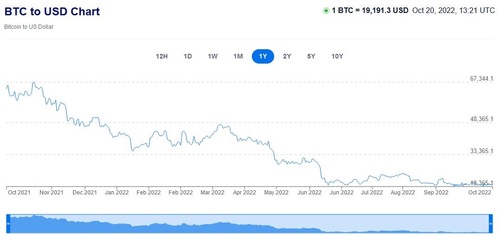

The Cryptocurrency Collapse

Near the end of 2022-Q2, cryptocurrencies such as Bitcoin and Dogecoin suffered unprecedented losses. The total decrease in valuation amounted to over 2 trillion dollars, with Bitcoin losing nearly 70% of its value in just 2 months. Many speculative investors lost fortunes, and as interest rates continued to climb investors started backing away from risky assets in favor of stable ones. Bitcoin actually posted negative yields in Q3,

To make things worse, hackers and scammers managed to skim nearly half a billion dollars in cryptocurrencies, with Ethereum receiving the brunt of the attack. Over the course of 11 cyberattacks, Ethereum lost approximately $350 million, while Binance Smart Chain endured 13 attacks amounting to nearly $30 million in loses. The obvious result is a plunge in investor confidence. According to Bloomberg Magazine, venture capitalists invested around $4.5 billion in crypto startups in Q3, which represents a decline of almost 40% from 2021-Q3.

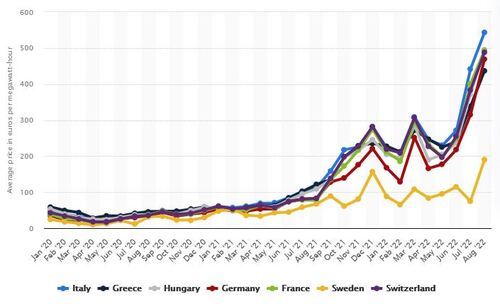

The European Energy Crisis

Europe is facing an energy shortage that threatens to cripple industries and heavily burden an already financially frustrated European population. Financial Times reports that some companies have ordered outdoor winter gear for indoor employees, because those companies don't expect to have access to gas for heating. In addition, ever-soaring energy prices are forcing citizens tighten their belts, leaving little-to-no money for investment.

To make things worse, EU member states cannot seem to agree on the correct solution. Reuters reports that while some countries are calling for wholesale gas caps, others are calling for austerity procedures. EU Affairs Minister for Finland Tytti Tuppurainen expressed concerns over any hasty market interventions and subsidies: "Instead of subsidising individual households, we should rather boost investment in green energy." Whatever the correct solution, one thing is certain, this is going to be a terrible winter, physically and financially, for people throughout Europe.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Verdict

There's no question all three of these P2P platforms are worthy of serious attention. Reinvest24 offers the power of interest, plus capital gains and rental dividends, resulting in a very attractive investment scheme. Unfortunately, we cannot place them on top while their marketplace is so light. PeerBerry is often our top choice, but given the situation in Ukraine (which is certainly no fault of theirs), we are hesitant about recommending a company facing so much pressure from institutional investors. They're addressing it brilliantly, but the risks can't be ignored. For those reasons, as well as the current size of their marketplace, we've selected EstateGuru as the top p2p lending platform for 2022-Q3.