How Our Portfolio Performed In Q4 of 2022

Please read P2PIncome's most recent investment-portfolio report for 2026.

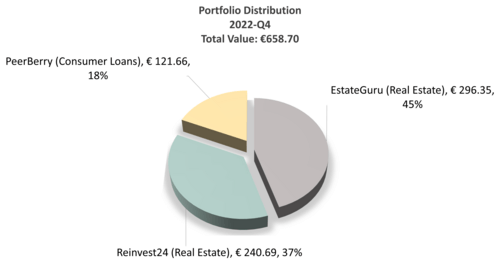

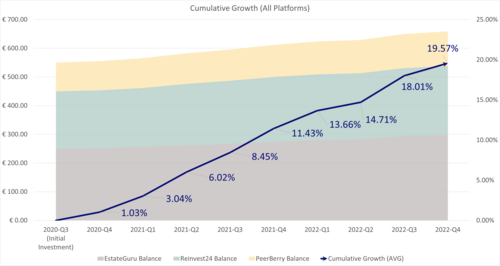

P2PIncome's financial experts present our 2022-Q4 report on the progress of our investment portfolio. Despite the many challenges facing the financial world, including the ongoing war in Ukraine, the resulting energy-supply crisis, and the collapse of cryptocurrency, our portfolio continued to enjoy modest growth. Our average annualized return reached 7.63% by end of year, and that figure is perfectly acceptable. Since its inception in late 2020, our portfolio has grown over 19.5%, from an initial investment of €550, to a current value of €658.70. That rate of growth is quite good, attesting to the resiliency of strong investment decisions, even during difficult economic periods.

Quarterly Report: 2022-Q4

Rather than invest on only one platform, P2PIncome's experts selected 3 top-tier platforms: PeerBerry, EstateGuru, and Reinvest24. In late 2020, we invested €100 on PeerBerry, €250 on EstateGuru, and €200 on Reinvest24. That amounted to an 80/20 split between real-estate loans and consumer loans. By diversifying in this way, we ensured not only that our assets weren't over-invested in one platform or in one area.

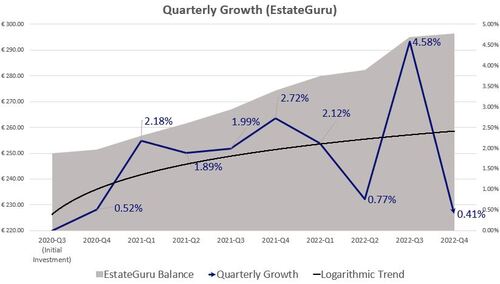

Our PeerBerry portfolio grew by approximately 2.5%, much like it did the previous quarter. Our EstateGuru portfolio barely moved, growing a mere 0.41%, but that must be looked at in context: It grew 4.58% the preceding quarter, for a two-quarter average of 2.5%. Reinvest24 investments gained 2.05%, finishing an acceptable, but not particularly impressive, year.

Facts and Figures

We entered 2022-Q4 with a portfolio balance of €649.61 from an initial €550.00-investment when we opened the portfolio in late 2020. During the last three months of the year, the investment portfolio increased by €9.09, for a total of €658.70, despite a correction from EstateGuru. That brought our portfolio's total quarterly increase to 5%, and the total value increase to €108.70 in just over two years. The brings the annualized rate-of-growth for the past two years to over 7.5%, which exceeds the benchmarks we established in our introduction to diversification.

| Platforms | EstateGuru | Reinvest24 | PeerBerry |

| Q3 | €295.13 | €235.84 | €118.64 |

| Q4 | €296.35 | €240.69 | €121.66 |

| Profit (€) | €1.22 | €4.85 | €3.02 |

| Growth (%) | 0.41% | 2.05% | 2.54% |

In P2PIncome's discussion on diversification, we set a benchmark of approximately 7% adjusted, average, annualized growth. In other words, we expected our investments to grow by an average of 7% per year, after accounting for processing fees, capital losses (defaults), inflation, and other corrections. We entered 2022-Q4 at 5.96%, thanks to sharp growth in the 3rd quarter on EstateGuru, so we were fairly confident we would reach our benchmark.

Indeed, we finished the year at 7.63%, which is excellent albeit far below the 9.90% at which we ended the previous year. PeerBerry had the best Q4 performance, with a growth of 2.54%, followed by Reinvest24, which grew by 2.05%. We exited several investments on EstateGuru the preceding quarter, so it's no surprise the total growth was around half of a percent.

EstateGuru

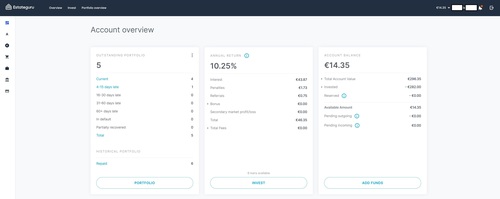

EstateGuru is a peer-to-peer real-estate investment platform on which users can purchase shares of development projects. In return for their capital, investors enjoy ongoing interest payments, as well as significant capital gains once the project comes to fruition. Borrowers are penalized for late payments, and investors share those yields, as well. We opened our EstateGuru portfolio in late 2020, with an initial investment of €250, and in the past two years, the portfolio value has grown to €296.35.

We entered 2022-Q4 just as several loans on EstateGuru had come to term and the properties sold. The resulting capital gains hoisted the account up by 4.58%, so we weren't surprised to pay the cost of the petard in the following quarter. Our account has a cash balance of €14.35, which we will immediately reinvest on the Secondary Market.

Unfortunately, EstateGuru's minimum investment on the Primary Market is €50. This is a features we'd like to see changed. While it makes sense to have an initial deposit minimum, restricting customers who have already committed assets to the platform seems unnecessary. To be sure, users have the option to withdraw their balance—or to deposit enough to make up the difference—but they should also have the option simply to invest what's already there.

While the precipitous Q4 decline depicted by the arrow might suggest a catastrophic event took place, the Logarithmic Trend tells a different story. EstateGuru's performance in the final quarter of 2022 could not have been better given the timing of the recent exits relative to the the quarter. Merely collecting small interest payments isn't how real money is made on EstateGuru. The capital gains from exists are what justify the investments. The only way to have such yields every quarter is to time your investments such that there's an exit every quarter, which is all but impossible given the unpredictable nature of real-estate development projects.

PeerBerry

PeerBerry is a world-class p2p platforms focusing on consumer loans. The platform works with dozens of loan originators throughout Europe, including Lithuania, Poland, Ukraine, Moldova, and the Czech Republic. They also work with several originators in Asia, including in Kazakhstan, Sri Lanka, Vietnam, and the Philippines, as well as one loan originator in Africa (Kenya). PeerBerry offers a double-buy-back guarantee, such that investors face very little exposure when investing on PeerBerry.

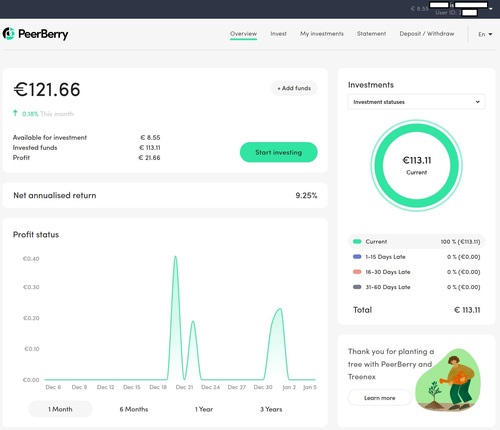

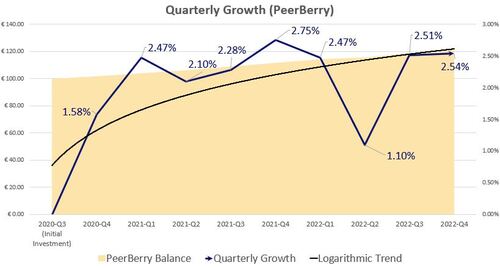

The total value of our PeerBerry portfolio increased from €118.64 to €121.66, an increase of 2.54% for the final quarter of 2022. For a consumer-loans mechanism, this is an excellent rate-of-growth, especially when coupled with the previous quarter's 2.51% growth. In general, PeerBerry tends to post quarterly gains exceeding 2%, meaning investors should be able to anticipate 8% cumulative annualized growth. Because PeerBerry has so many available loans at any given time, users can diversify with ease.

PeerBerry's minimum invest is a mere €10, making it much easier to reinvest money after an investment has come to term. On the other hand, PeerBerry is one of very few top-tier p2p platforms with no secondary market. When P2PIncome interviewed PeerBerry's CEO, Arūnas Lekavičius, he explained that because "short-term loans make up the main part of our portfolio and are highly liquid, we see no need in launching a secondary market."

The trajectory of PeerBerry's past two quarters is very promising, as is the overall record of the past 5 quarters. If we can continue to profit at this rate, it may be in our interest to invest more money on the platform. We certainly won't be withdrawing our money given such numbers. It's no surprise, therefore, that PeerBerry continues to attract investments, having just crossed the €1.5 billion in total invested funds.

Reinvest24

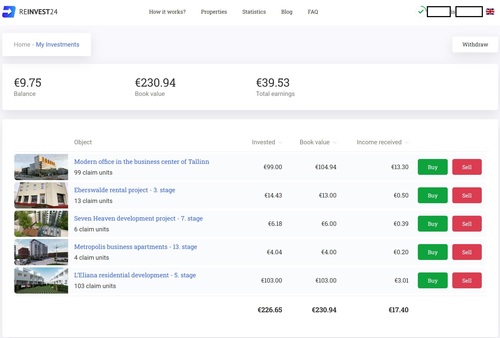

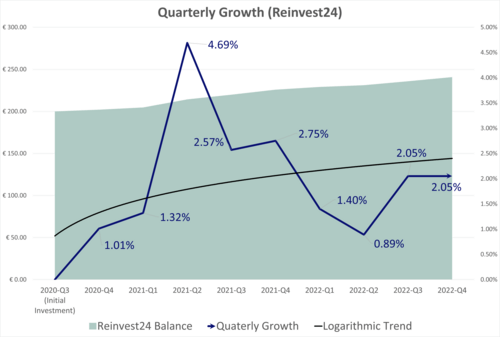

Reinvest24 specializes in real-estate development projects, most of which are in Estonia and Latvia, while the rest are in Germany, Spain, and Moldova. Until recently, the platform's marketplace was flush with projects, but in the last 2 quarters of 2022 the market seems to have come to a screeching halt. At the end of 2022-Q4, the platform had only one new project, with everything else posted on the secondary market. We hope to see a more vibrant marketplace in the coming months.

Reinvest24's performance during 2022-Q4 was consistent with the previous quarter, increasing yet again by 2.05% in the final three months of the year. While these numbers aren't terrible, it's hard not to be disappointed by the overall drop from last year. To be sure, this has been an extremely difficult year for the real-estate market, and with fears that the war in Ukraine could spill over into neighboring countries, it's no surprise the are fewer and fewer projects opening in Eastern Europe.

This is particularly true in Moldova, which is suffering a gas shortage due to its reliance on Russian gas, as well as a serious refugee crisis, as people pour in from neighboring Ukraine. According to the World Bank, "Moldova is one of the countries most affected by the war in Ukraine, not only because of its physical proximity but also because of its inherent vulnerabilities as a small, landlocked economy with close linkages to both Ukraine and Russia." The effects on Reinvest24 are easy to identify: There are currently 76 listings in arrears on the platform's secondary market, of which all 76 are in Moldova.

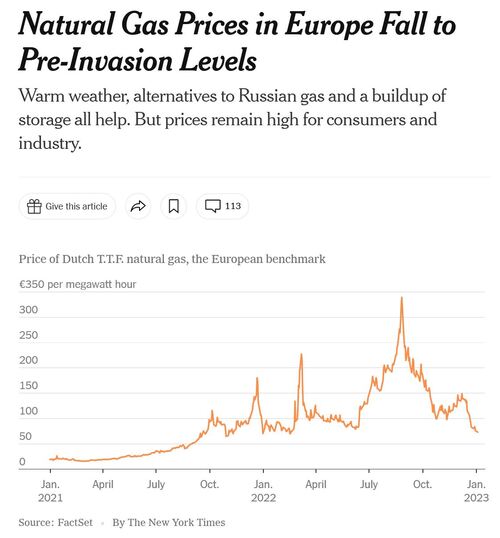

The energy crisis is also making it difficult for contractors to take on new work. After all, it's not just natural gas that has gone up in price, but crude oil and gasoline as well. Diesel prices shot up in October, increasing the cost of operating heavy machinery. How quickly the market recovers, now that prices have returned to pre-war levels, will be a determining factor in Reinvest24's upcoming performance.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Events that Influenced Financial Markets During Q4

Warm Weather May Have Saved the European Economy

In its 2022-Q4 report, the International Energy Agency (IEA) writes that this winter's "gas season opens with extreme natural gas price levels and volatility, caused by unprecedented uncertainty of supply as Russia steeply curtails its pipeline deliveries to Europe." The fear is that Russia with simply decide to cut off all access to its gas, leaving the whole of Europe with no source of heating. According to the report, "Russia’s strategic behaviour of using natural gas as a political weapon has become increasingly obvious since September 2021. Despite available production and transport capacity, Russia has reduced its gas supplies to the European Union by close to 50% y-o-y since the start of 2022."

As temperatures in the Northern Hemisphere dropped, a massive cold wave hit, forcing people to use gas and energy they really couldn't afford. Indeed, in recent months the situation had reached emergency levels, with several countries considering rations on gas and energy. Companies took extreme measures to cut energy costs, as we reported our Portfolio Report for 2022-Q3. Now the winter months are upon us, when many families feared having to choose between heat and food.

But winter hasn't come.

Rather than a fearsome wave of unbearable cold, the weather in much of Europe has been relatively warm. While the United States endured a blizzard, much of Europe enjoyed Autumn temperatures. The reprieve allowed much of Europe to replenish its supplies of crude oil and natural gas (LNG), and prices fell sharply in response. The "man on the street" is yet to enjoy the benefits, but if the trend continues, many homes will breathe a sigh of relief.

That being said, uncertainty is the bane of financial markets. Even anticipated price increases are easier for investors to handle than a roller-coaster pricing index. Not knowing "whether or when" makes it impossible to commit assets to any sort of investment. Do you short? Do you purchase a large supply? Do you avoid that market altogether? Luckily, P2PIncome's investment portfolio doesn't include natural gas.

Verdict

With so much uncertainty plaguing Reinvest24's marketplace, and with the general decline in real-estate prospects, now might be the best time to invest in personal loans. To be sure, the returns aren't usually as good as one finds with real-estate, but there is greater opportunity for diversification. If the real-estate market recovers during the first quarter of 2023, there will be many opportunities to get back into real-estate, but for now, we recommend you check out PeerBerry, and enjoy the security of their double-buy-back guarantee.