P2PIncome End-of-Year Report for 2021

Please read P2PIncome's most recent investment-portfolio report for 2026.

As we enter the new year, the dark clouds of the global SARS-CoV-2 (COVID-19) Pandemic seem to be parting, and some sunshine seems to be breaking through. A few peer-to-peer lending sites were unable to weather the storm, but the three platforms in which we had invested managed to reach the shores. In this end-of-year report, we will update the stats related to our investments in Reinvest24, PeerBerry and EstateGuru, including how much profit we earned despite the financial crisis.

Which of the three closed out the year on top by delivering the highest interest yields and most profit? Did any of the platforms suffer loses? How much total profit did we earn? Should we remain on all 3 platforms, or is it time to pull our funds from one, two, or all of them? Read our detailed report to find out about the growth of our portfolio.

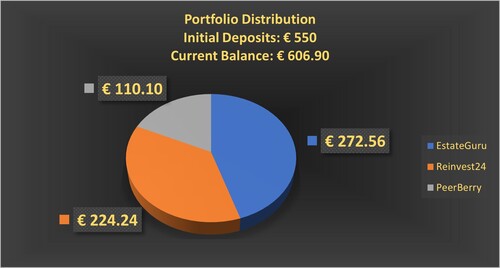

Overview of Our Current Portfolio

We opened our investment portfolio in January of 2021, committing a total of 550 euro across three platforms: Reinvest24, PeerBerry, and EstateGuru. We tracked our progress on all three platforms, and provided Monthly Reports throughout. Now it's time to draw some end-of-year conclusions, and to decide how to proceed. For starters, let's look at the numbers overall: Our 550 euro yielded a total of just under 57 euro of profit, or 10.5% annual percentage rate (APY), which is an impressive rate-of-growth, considering the challenges 2021 brought with it.

Reinvest24 outperformed the other 2 platforms by 2-3 percentage points, due to an explosive month of May. The site remains our preferred source of passive income. Meanwhile, PeerBerry was more stable than EstateGuru but not as reliable as Reinvest24. All in all a good year.

Reinvest24

Reinvest24 was founded in 2018 to service the real-estate market via a Peer-to-Peer lending format. Unlike most p2p sites, which trade in notes for personal loans, payday loans, and some business loans, Reinvest24 allows developers to crowdfund for renovations, offering both equity and rental dividends in return. The developer-borrower and its project must pass extensive screening, which helps ensure the security of the loan albeit reducing the number of loans Reinvest24 offers. Nevertheless, the built-in security of a mortgage-backed loan means investors consistently earn attractive profits: 11% to 15% on average. This makes Reinvest24 one of the very best platforms on which to grow your assets via passive income.

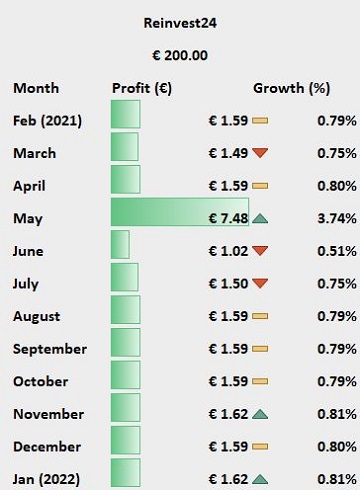

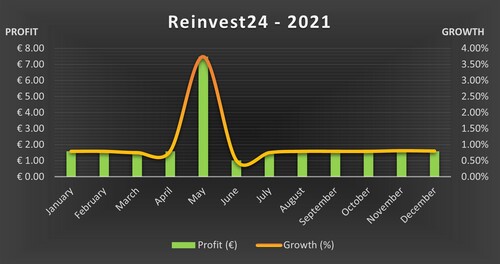

Reinvest24 - Our Investments - 2021

Initial Investment: € 200

Balance, End-of-Year, 2021: € 224.24

Annual Profit: 12.12%

Throughout 2021, Reinvest performed rather consistently, reporting 0.70%-0.80% growth every month but May, which reported an anomalous >3.5% due to the realization of equity on one of our investments. Were we to remove May and its resulting profits from our calculations the year would still be satisfactory, with gains of approximately 15.00 euro on an initial investment of 198 euro—a gain of around 7.5 percent. Including May we arrive at an impressive 22.00 euro of earnings or 11 percent. December performed on par with the other months, with a gain of 1.59 euro (0.80%).

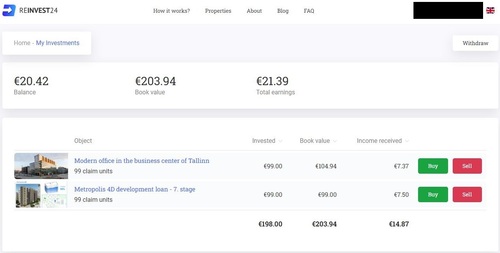

We took on two investments in 2021: an office complex in Tallin, Estonia and a Stage-7 development deal in Chișinău, Moldova. The former gained approximately 5% in book value, as well as around 7% in earnings from rental dividends. The latter, being a development loan, was never going to gain book value, but did yield 7.5 euro of profit on a 99-euro loan. In total, we earned 20.81 euro, for a profit of over 10 percent for the year. Our account, into which we originally deposited 200 euro, now stands at 203.94 euro in Book Value, plus another 14.87 euro in Income Received. We now have a balance of 20.42 euro, and will invest those earnings back into the platform in the coming months.

PeerBerry

PeerBerry is one of the top platforms for beginner investors. It's a straightforward platform that has managed to attract a large clientele due to its simplicity of use and the financial security it provides. Between the buy-back guarantees, the broad range of loans, and the occasional collateralized note, PeerBerry is a site on which you can profit without the fear of losing money. The platform also offers an excellent mobile app on which investors can track their profits and earnings, deposit and withdraw money, and select investments the same way they would on the desktop version. PeerBerry makes earning a passive income easy and simple.

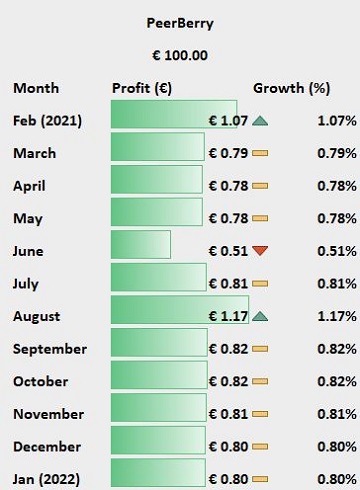

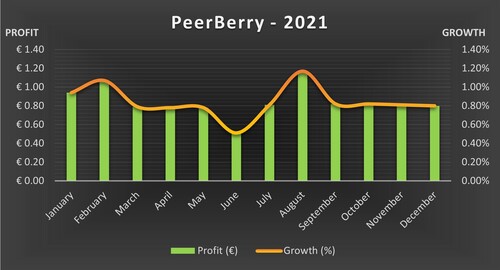

PeerBerry - Our Investments - 2021

Initial Investment: € 100

Balance, End-of-Year, 2021: € 113.13

Annual Profit: 11.13%

Over the course of 2021, our investments on PeerBerry performed as expected, gaining approximately 0.75% in value per month. February and August yielded slightly higher gains: 1.07% and 1.17% respectively, while June reported a below average yield of 0.51 percent. As a result, our 100-euro initial investment closed out the year at a healthy 111.93 euro: an earnings rate of 11.93%. There are currently 90 euro tied up in investments, and we intend to reinvested the remaining 21.93 euro soon, after we tweak our auto-invest settings.

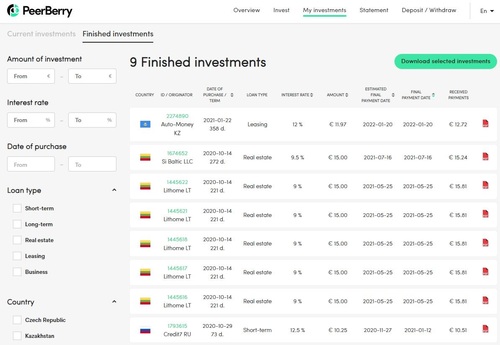

PeerBerry offers various types of loans, including Leasing, Real Estate, and Short-Term. This allows investors to diversify their portfolio with great ease, which is how we set our auto-invest tool. On occasion, we invested some of our floating balance manually, but for the most part we remained allowed the tool to do the heavy lifting and enjoyed the truest form of passive income.

We purchased 15 notes, 9 of which ended at various points in 2021. The other 6, which account for 90 euro, will conclude at some point between April and June. In each case, we allow the auto-invest tool to reinvest the profits, and the cycle continues. Our short-term loans yielded just a few cents, which is to be expected. For example, we purchased a 73-day note for 10.25 euro, which realized 10.51 euro upon end of term. On the other hand, we entered a 358-day leasing note for 11.97 euro, and earned 0.75 euro of interest. These numbers seem insignificant because we're only talking about a 100-euro investment, but you can extrapolate to larger and larger sums and conclude the PeerBerry is a solid platform on which to invest if you're goal is to turn an easy profit.

EstateGuru

EstateGuru is the undisputed king of European real-estate p2p loans. Their total portfolio overshadows PeerBerry and Reinvest24 combined, and their track record dates all the way back to 2014, making it considerable older than our other two platforms. That being said, EstateGuru's performance over the course of 2021 was far from stellar, and while there were no actual losses...yet...the profits weren't much compared to our other portfolios and led us to ask, "Should we really have our money tied up on this platform right now?"

EstateGuru - Our Investments - 2021

Initial Investment: € 250

Balance, End-of-Year, 2021: € 275.53

Annual Profit: 5.95%

We are less than thrilled with the end-of-year summary from EstateGuru. A total return so far below the anticipated amount makes us question whether this is a platform on which we should remain. The goal is earn passive income without concerns, and right now that's not happening. To be sure, investing in real-estate has its upsides: rental dividends in perpetuity are an attractive reason to enter a long-term contract. On the other hand, with returns of 10%-12% on the other platforms, there is a very serious question of opportunity cost.

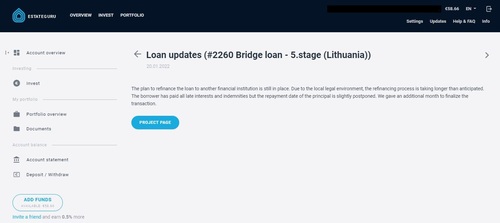

In addition, two of our loans are in states of cyclical tardiness. The borrowers come up short, pay off the interest to avoid default, and leaves us wondering when...or should we say "whether" we'll see the principle. That EstateGuru has failed to provide a more satisfactory solution leaves us with no tangible justification for keep our funds on the platform.

To their credit, EstateGuru has been forthcoming about the solution they've contrived, but as investors, we find it both frustrating and financially unwise to perpetuate such investments. Were we exclusively in the business of earning a profit, we would sell our current notes on the secondary market, cut our losses, and run. However, we are primarily interested in providing our readers with the most informative reviews and updates available, for which reason we have elected to maintain our EstateGuru portfolio. Will they experience a post-Covid surge? Will they seek a more effective solution to bridge loan #2260? Can they get back to providing growth and profits instead of interest-only payments?

Time will tell, and we'll be there to report all the details.

Comparing Platforms

Reinvest24 finishes 2021 with a clear lead over the other platforms, due to the nature of the loans themselves. By allowing the investor to hold real equity and enjoy rental dividends, Reinvest24 ensures the investor a steady stream of income in addition to security. The added liquidity is a highly attractive feature. PeerBerry is also an excellent platform, and the platform's ability to secure their investors' funds makes them a top peer-to-peer lending platform. EstateGuru, which was supposed to be our "safe bet," has been a major disappointment and at this point we would just as soon walk away from them.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 24.24 | 12.12% |

| PeerBerry | € 100 | € 13.13 | 11.13% |

| EstateGuru | € 250 | € 25.53 | 5.95% |

A Deeper Look Into These Platforms

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

There can be no doubt 2021 was a challenging year for the entire world, and the financial industry suffered greatly as a result. Nevertheless, our investment portfolio reported real growth: an earnings-rate of 10%, all in the form of convenient, passive income. In total, we increased our capital by 10.5% simply by making a few good decisions and clicking a few buttons. While we were disappointed by EstateGuru, we were totally satisfied by PeerBerry, and thrilled by Reinvest24. We highly recommend both sites, though Reinvest24 just edges out the competition. The platform is safe, reliable, and consistent, and the addition of rental dividends means more money in the bank.