Avoid Losing Crypto-Money With These P2P Lending Sites

Cryptocurrency has been a topic of some controversy for over a decade. Many people achieved instant wealth investing in Bitcoin, Ethereum, and other cryptocurrencies, while others warned of the dangers and instabilities inherent in an unregulated currency. To be sure, there's an excellent argument to be made in favor of a decentralized currency, and some people have greater risk-tolerance than others. Regardless, there's also value in listening to successful investors, such as world-renowned billionaire Warren Buffet:

If you said, "For a 1% interest in all the farmland in the United States, pay our group $25 billion," I'll write you a check this afternoon. $25 billion...I now own 1% of the farmland. You offer me 1% of all the apartment houses in the country, and you want another $25 billion, I'll write you a check; it's very simple. Now, if you told me you own all of the Bitcoin in the world and you offered it to me for $25, I wouldn't take it, because...what would I do with it? I'd have to sell it back to you one way or another. It isn't going to do anything. The apartments are going to produce rent, and the farms are going to produce food.

If you're the sort of investor who prefers slow and steady growth, rather than the roller-coaster ride of volatile markets, cryptocurrencies aren't for you. With that in mind, P2PIncome's financial experts have put together a list of 5 excellent p2p platforms offering the kinds of investments Buffett mentioned: real-estate, farming, and tangibles. Each of these companies deals in asset-backed investments and savings, and each reports consistent yields of 7% to 12% per annum.

Reinvest24

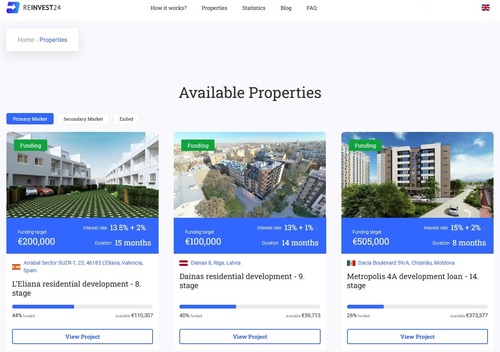

When Buffett spoke of "producing rent," he could easily have been talking about Reinvest24. This real-estate p2p platform lists property conversions, 10% of which are intended to yield long-term rental dividends. All of the projects are backed by tangible assets, and as a matter of policy, Reinvest24 requires a favorable Loan-to-Value (LTV) ratio. In addition, investors can earn capital from the subsequent sale of the properties. Reinvest24 reports a Total Combined Return: Yield + Capital Growth of 14.8%, with an average loan duration of one year. The site also reports zero Defaulted Projects, attesting to the relative security of this investment format.

Reinvest24 was founded in Tallin, Estonia, and quickly become one of the top p2p investment sites on the market. The platform is incorporated, regulated, and fully compliant with all EU banking regulations and laws. It's open to any investor with an EU-compliant bank account, and lists properties in several EU countries (including Spain, Germany, and Switzerland). The minimum investment on the site is a mere 100 euro, making it accessible to most investors, though the average portfolio size exceeds 4000 euro. Most projects have a few hundred investors, and the site's secondary market is very active.

Often, once the development stage is complete, the property begins collecting rent, and investors are entitled to a proportionate share of that rent. For example, if the total project value was 100,000 euro, and you invested 1000 euro, you own 1% of the property, and are entitled to 1% of the rental dividends. To be clear, that doesn't mean you'll get 1% of the rent, as the developer and the platform also receive a percentage. But it does mean you'll get 1% of the amount set aside for investors, as per the contract. You'll also be entitled to 1% of the capital gains, if and when the property is sold. If you're looking for ongoing passive-income streams, Reinvest24 is an excellent option.

Iuvo Group

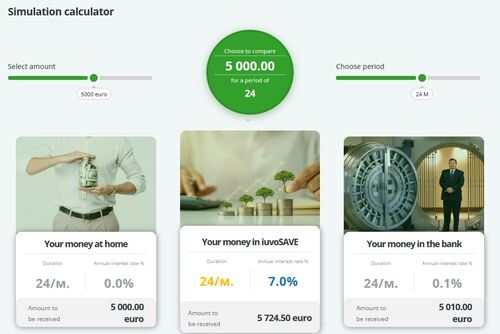

The importance of liquidity can't be overstated. It would be extremely unwise to invest every penny you have, and leave yourself with no cash-on-hand. To that end, Iuvo Group has developed a 2-pronged approach to p2p. The platforms lists loans from dozens of loan originators throughout Europe, and also offers a high-yield savings program—IuvoSAVE—where you can earn up to 7% per annum on your savings. When you consider that banks usually offer less than 1%, this is an excellent rate. The platform is open to all investors with valid EU bank accounts, and the platform supports investment in several currencies. More important, Iuvo offers a 100% Guarantee on the principle investment.

According to their website, "Iuvo is a Latin word that means 'to help,' 'to save,' and that is exactly what we want to do." Iuvo is great place to get started with your p2p journey, as the minimum investment is only 10 euro, and the minimum deposit for the savings program is only 100 euro. The site charges no fees for deposits or for purchases on their primary market. The only fee is a 1% charge for all sales on secondary market. The site reports average yields exceeding 9% per annum, and the savings program is designed to earn 7% per annum. There is also a 6%-per annum program for 6-months deposits, and a 5% program for 3 months.

Iuvo's loan activities span the whole of Europe, listing offers from such major originators as EasyCredit in Bulgaria, iBancar in Spain, iCredit Poland and iCredit Romania. Iuvo accepts loans in several currencies, which are converted to euro via the site's integrated converter. Most of the loan sums are below 1000 euro, and the average percentage rate is around 10%. Every loan listing includes the key data required to make an informed investment, including country of origin (depicted by the country's flag), the Issue Date, the Loan Type, the Loan Originator, the Score Class (from A to E, as well as high risk, or HR), the Loan Amount and Balance, the Interest Rate, the Installment Type, and the amount Available for Investment.

EvenFi

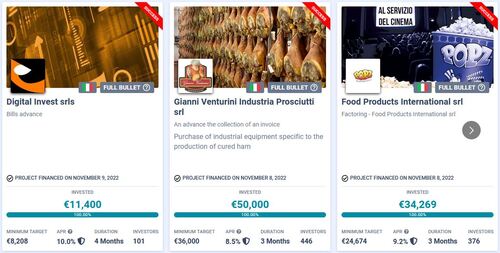

EvenFi was founded in Italy in 2018 (under the name Criptalia), with the stated goal of creating "a new financial future: simpler, free and decentralised." At the time, they were focus mostly on cryptocurrencies, but in 2020 they changed their name to EvenFi and started focusing more on p2p lending. The platform is unique in that it focuses mostly on SME's and local businesses, with an ephmasis on Impact Investments, such as artisanal shops, art exhibitions, educational events, and eco-friendly projects. The platform doesn't work with loan originators, preferring instead to work directly with the borrower to create the ideal loan structure for that business's goals.

Some investors want to make a difference, in addition to making money, and EvenFi is the best site for them. The company's model allows you to earn passive income, with yields of around 7% per annum, while promoting small-businesses, local artisans, and other socially impactful endeavors. For example, EvenFi helped New Exhibition Spain raise 65,000 euro for Dinosaurs Park, a cultural and educational theme park with exhibits about the prehistoric world. Investors earned a quick 6% on their capital in just 9 months, while helping promote education and fun for kids. Similarly, GruppoSTG Fabbrica raised 80,000 euro for the production of photovoltaic modules, which greatly reduce carbon-gas emissions.

EvenFi reports a Weighted Average IRR (net of risk) of approximately 7.5%, which is quite good albeit slightly lower than some of the top sites. EvenFi's revenue comes from the services it provides to borrowers, the platform doesn't charge investors any fees. You won't even pay commission for the sale of shares on the secondary market. If you're prepared to invest large sums, EvenFi's Premium Plans might interest you. They offer bonuses on monthly returns, ranging from 0.5% to 1.5% monthly, depending on the total size of your portfolio. Busy investors should consider using EvenFi's mobile app and auto-invest tools, which are excellent time savers.

EstateGuru

EstateGuru is real-estate investment platform listing development projects, business loans and the occasional bridge loan. You'll find listing from all over Europe, including Germany, Spain, Finland, Estonia, Latvia, and Lithuania. EstateGuru is willing to take on somewhat risky projects, but their overall record speaks for itself. In our Quarterly Report for 2022-Q3, we pointed out that our investments have enjoyed 18% growth in just 21 months, which amounts to a 10.25% annualized growth rate. Add to that the fact that EstateGuru's projects are asset-backed, and you have the makings of a great p2p investment site.

EstateGuru was founded in 2014, and despite a very slow start, by early 2022 the platform had reached half a billion euro in funds invested. The platform only accepts around 10% of the loan applications it receives, which should account for its overall stats: a 5% default rate, and another 10% running late (by more than 90 days). Nevertheless, the staff is quite skillful at restructuring loans to avoid recovery and write-offs. They are usually able to recover 100% of the funds within a year of initial default, and their 0.01% write-off rate proves they know how to get the job done. In addition, the site reports accepting only 10% of loan applications,

According to their statistics page, EstateGuru has over 150,000 investors, and the Average Outstanding Portfolio Size is around 6000 euro. That's surprising, considering the minimum investment is only 50 euro, and the average portfolio has 35 loans. That means most investors are putting up 3.5 times the minimum amount, which suggests users are happy with the platform's performance. That, in turn, helps explain why Repeat Borrowers account for over 60% of the sites activity.

Heavy Finance

In keeping with Mr. Buffett's quote above, P2PIncome's experts would like to draw your attention to a p2p lending company that focuses on farming HeavyFinance. Granting loans backed by Heavy Equipment, Arable Land, State Guarantee, and (on occasion) Personal Accountability, HeavyFinance helps farmers throughout Europe sustain this crucial industry. They also offer a Carbon Farming program, by which farmers can "generate carbon credits and sell them on the international market." HeavyFinance provides a team of scientists to sample and assess the soil, teach "best practice guidelines," and make sure you "get paid."

The HeavyFinance marketplace lists dozens of loans for farmers in Portugal, Bulgaria, Poland, and Lithuania. The interest rates range from 10% to 15%, and all loans are backed by some combination of assets and guarantees. In addition to its primary market, the platform runs a secondary market, as well as an excellent auto-invest option for busy investors. Loans can reach upwards of 250,000 euro, though most are for more modest sums, with the average being closer to 30,000 euro. HeavyFinance originates its own loans, and doesn't work with loan originators. Borrowers can contact HeavyFinance directly, via the website.

HeavyFinance has managed to attract very serious users. Despite reporting only around 5000 users, the average portfolio on the site is over 10,000 euro. Perhaps this is due to the site's exceptionally detailed marketplace page, which provides more data about each project than many of the top p2p sites. It could also be due to the eco-friendly projects listed on the marketplace, which you can locate by looking for the leaf icon. Or perhaps it stems from the fact that many of the loans are government backed. One this is for certain: HeavyFinance is a key player in the p2p farming-loan industry.

Best Sites for Investors Transitioning from Crypto to P2P

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Business Loans

Average Returns

7.4%

Minimum Investment

EUR 20

Signup Bonus

No

Registered users

20,000

Total funds invested

EUR 36 Million

Default rate

Undisclosed

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

MangoPay

Withdrawal methods

MangoPay

In this detailed review, P2PIncome's financial experts assess EvenFi.com, an Italian crowdfunding platform that emphasizes social impact in addition to profits and gains.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Agri-business

Average Returns

12%

Minimum Investment

EUR 100

Signup Bonus

Prizes

Registered users

8000

Total funds invested

EUR 36 Million

Default rate

3%

Regulating entity

European Crowdfunding Service Providers

Buyback guarantee

Secondary market

Payment methods

Paysera, Lemonway

Withdrawal methods

Paysera, Lemonway

HeavyFinance is a peer-to-peer lending and investment platform focusing on the agri-food market. Read this detailed review to learn whether you should add HeavyFinance to your investment portfolio.

Verdict

Even if you plan to continue investing in cryptocurrencies, the sites on this list offer great opportunities to earn a passive income at little risk. Whether you're into real-estate, socially-conscious projects, savings programs, or farming equipment, these are the sites we recommend for those interested in tangible investments. Of these 5, however, Reinvest24 comes out on top for two simple reasons: First, the real-estate-development market offers the best combined yields over the long term. Second, the security offered by the platforms's LTV standards means you're highly unlikely to lose a lot of money, even if something goes wrong.