P2PIncome | An Interview with PeerBerry's Arunas Lekavicius

Getting Acquainted With PeerBerry

We contacted PeerBerry for an interview and we were well-received. We were able to speak to the CEO of PeerBerry Arūnas Lekavičius and asked him what he thought of peer-to-peer lending in our modern day and what PeerBerry has in store for its investors in 2022.

Before we get into the questions and answers, let us give a quick summary of PeerBerry. PeerBerry is a modern peer-to-peer lending service that specializes in short term consumer loans. PeerBerry hosts a multiplicity of loan originators in their primary marketplace — they do not have a secondary market. The platform has become well-known for its exemplary model in buyback guarantees and impressive lending ecosystem management. Investing on PeerBerry starts at 10 EUR and investors can expect a return from 9 - 12 percent.

PeerBerry's buyback guarantee consists of two layers: a buyback guarantee for investors whose loans are overdue, and a group guarantee. The group guarantee is triggered when a loan originator goes bust. The business partners on PeerBerry step in to help facilitate the remaining loans while the loan originators find their bearings. Moreover, PeerBerry does have loans that come with collateral, which means that on PeerBerry's marketplace you can find loans that are backed by three forms of security.

If you are a risk averse investor, this generally might be of interest to you. Since PeerBerry's inception they have expanded to offer mortgage loans and business loans. The platform has a well-developed auto-investing tool, though it is unfortunate that the platforms lacks a secondary market — but their CEO has a reply for that.

Interviewing Arūnas Lekavičius

Q: Who was the person behind putting together PeerBerry’s dual buyback guarantee?

PeerBerry’s business consists of three main parties: lenders (our business partners), investors (our customers), and PeerBerry (an intermediary between investors and lenders). Taking out any of the three mentioned parties, this business model could not operate.

I want to draw your attention to the fact that the guarantees for investors are provided not by PeerBerry, but by PeerBerry's business partners - lending companies. Both, the buyback guarantee, and the group guarantee are provided by our business partners. I want to point out that over more than 4 years of PeerBerry operation, the buyback guarantee has been 100% respected, and the group guarantee has never been needed to be applied. It shows that we have financially capable and reliable business partners.

Q: How are PeerBerry's business partners able to provide very attractive returns despite keeping such a low default rate?

PeerBerry's business partners are the ones paying interest to our investors. Investors are investing not in PeerBerry. Investors are investing in loans, issued by PeerBerry's business partners, so our business partners are paying the interest to investors.

Speaking about PeerBerry, there are no defaulted loans on PeerBerry and never was throughout more than 4 years of PeerBerry operations. If you mean late loans when you ask about defaulted loans, these are different things. Late/overdue loans are not defaulted loans. Late loans generate the same interest to PeerBerry investors as the current loans. And yes, the share of late loans on the PeerBerry platform is one of the lowest in the market.

On average, our business partners have about 6-8% of defaulted loans in their total portfolio but these loans do not have an impact on PeerBerry or PeerBerry investors. A short-term lending business is impossible without some share of defaulted loans. It is in the specific of this business. Compared to the industry, the share of defaulted loans on our business partners' side is small.

The interest rates offered on loans for investment in the PeerBerry platform are one of the lowest compared to other platforms. The level of interest depends on the need for the lending company to borrow through an external source. The more profitable a company is, the less it needs to borrow through the platform, the lower the interest on investing in loans. But in such a case, investors are more guaranteed. We recommend investors carefully and responsibly evaluate high-yield offers in the market, as the higher the interest rate, the higher the risk is.

Q: Does PeerBerry have concrete plans to implement a secondary market or is the general idea to invest in short term loans for those who want more liquidity?

Currently, 75% of PeerBerry's portfolio consists of short-term loans. As short-term loans make up the main part of our portfolio and are highly liquid, we see no need in launching a secondary market. A PeerBerry investor is that one who finds PeerBerry's business model as well balanced and suitable. There is quite a lot of choice in the market for investors with different needs.

Q: Why does PeerBerry only issue out a portion of their loan portfolio to investors, is it in the interest of protecting PeerBerry or the investors?

We have agreed with our business partners that they will borrow up to 45% of their total loan portfolio through PeerBerry, not more. In fact, our partners borrow even less - up to 35% of their total loan portfolio. The loan portfolio and debt ratio are very important to ensure a sustainable business and safe investments for our investors, so we closely and consistently monitor the performance of each of our business partners. Many of our business partners are strong market players in their local markets - these are developed and profitable companies that borrow through the platform only a small part of funds for their business development.

Q: Do you at PeerBerry feel that there is quality competition? Are there any other peer-to-peer lending platforms that you contend with?

Clients only benefit from the competition in any industry. The higher the competition, the better for the client in terms of the choice and the offering. The competition in the alternative investment market is quite large and growing. In our opinion, in the industry, we represent, investment security is a key parameter of quality. If the platform is a super well-developed technology in which investors suffer losses, it is not about the quality. We consider as a quality those platforms that are transparent, keep hands on their business partners' performance, and put all the efforts to protect investors from losses.

Q: What are your thoughts on crypto/decentralized finance? Do you believe that this market will pose a risk to the peer-to-peer lending industry?

We don’t think the cryptocurrency will pose a risk to the p2p lending industry, but we do agree that cryptocurrency is here to stay, whether we like it or not. So far, none of us know exactly how the cryptocurrency market will develop, whether there will be and what the regulation of this market will be, so it is too early to talk about the possible impact of cryptocurrency on other businesses.

Q: How do you feel PeerBerry performs in comparison to Mintos?

We do not compare ourselves to any other market player. Ours and our business partners' strategy is to be profitable and to ensure full protection for our investors' money. We do not aim to be the largest. Our strategy is to be the best in terms of quality. Ensuring safe investments for our investors is a key priority for us. Compared to Mintos we are much more effective only taking the example of our team - we are 16 times smaller in terms of the team, but today, according to volumes of monthly funded loans, we are the largest zero loss alternative investment platform in Europe.

Q: Are there any developments coming up for PeerBerry? Or any other news that their investors may be interested in hearing?

The biggest news for our investors that is just around the corner is that early next year, we will introduce another product brought to investors by our team - a licensed crowdfunding platform, that will offer investment in real estate and business projects. Stay tuned.

What Do We Think About PeerBerry?

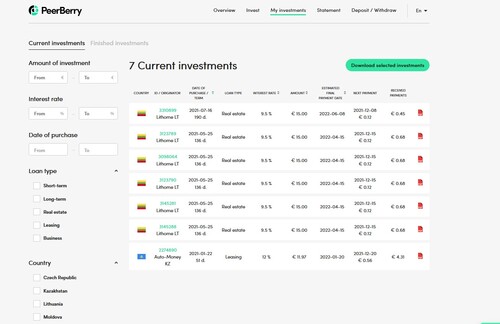

We have been investing with PeerBerry for more than a year now and we find that the platform is an exceptionally transparent, accurate, safe and profitable platform. We have been really pleased with the consistency and predictability of the payouts. Our experience reflects that borrowers on PeerBerry payout on schedule and seldom do loans go late. PeerBerry projected that we would receive a return of about 9 percent and it has come very close to that, at an interest rate of 8.8 percent. It was very interesting for us to find out that the group guarantee has never been triggered.

We would be curious to see what that would mean for a situation that would necessitate it. Surely, stepping in for a profitable, well-established lending company will be no easy task. That being said, the fact that PeerBerry has a safeguard they have never needed to use is also a very positive sign.

Our PeerBerry investing portfolio:

We think PeerBerry has the right idea when it comes to peer-to-peer lending. They are clearly very effective at managing a lending platform. We found it interesting that the CEO thinks a secondary market is unnecessary. I'm sure many investors would disagree and still find value in having a secondary market on PeerBerry.

In any case, we trust that PeerBerry is making decisions in the interest of all parties involved.

Verdict

We are definitely proponents of PeerBerry. There has been so much thought and care that was put into creating the product that is PeerBerry. There are plenty of loans being added to their primary marketplace everyday, and there is a great variety for investors who want less risk, or more risk.

The auto-investing tool acts quickly, which is something we've discussed in our August 2021 Portfolio Report. When investments finish on PeerBerry, they are quick to go back into the market, ensuring that every second your money is with PeerBerry it's being put into good use. PeerBerry has been dubbed the fastest growing platform in Europe, and we would not be surprised to see that title change into something grander in the future.