Mintos Reviewed | The Masters of P2P Lending

Mintos is a European fintech company that has positioned itself as one of the leading P2P platforms in Europe today. Mintos was registered in Latvia in 2015, with the mission "To offer short term financial and affordable solutions for modern society". Mintos provides individuals with a place where they may borrow and lend money to other individuals, rather than banks. It has proven its competency over the years and established itself as one of the superior lender/ borrower ecosystems in comparison to the rest of the P2P industry.

Mintos is institutionally funded by Skillion Ventures, angel investors based in Riga, Latvia. Mintos is one of the few P2P companies under formal regulation. They are regulated by the Latvian government and audited by Ernst & Young's Latvian branch.

Types of Loans on Mintos

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Mintos Loan Characteristics

Loan duration1 Day - 240 Months

CurrencyEUR

Buybacks Yes

CollateralYes

Available inEurope

Returns rate9 - 12%

Default Rate16%

Recovery Rate60%

FeesNone

BonusesPromotional

Mintos Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Mintos?

Mintos is top-tier p2p lending platform that aggregates loans from numerous originators throughout Europe. Mintos only came to international attention in 2017, when it suddenly bounced back from two unprofitable years in a row to earn a whopping €2.1 million in revenue. Since then, it's been a steady climb for Mintos. The platform has received a lot of praise, and is now regarded as a leader in the fin-tech industry.

Lender/Borrow Ecosystem

Mintos works directly with loan originators, companies that first put forth the investments that users can then borrow from. Investors directly deposit into loan originators who determine, based on risk and credibility, how high projected returns will be. Mintos offers an expansive marketplace for potential P2P investors to diversify their portfolio. Investors currently have the ability to invest in 30 different countries in 12 different currencies. Investors from all over the world can simply and easily invest in currencies like the EURO or European businesses.

The main distinction between Mintos and other P2P companies such as RoboCash, Swaper or EstateGuru is that Mintos works with investors and loan originators (LO).

Mintos currently has the highest number of loan originators in Europe. Most of these originators provide a buyback guarantee which varies across originators in credibility and reliability. Mintos itself is very transparent, secure and offers a guarantee on a given investment.

Loan Originators take the responsibility of vetting and servicing the borrowers on Mintos' platform. The loans are incredibly varied. Users can find loans for mortgages, cars, debt consolidation, development loans and business loans. The borrowers on Mintos are always required to put up collateral as a form security in the case of a defaulted loan.

General Data

| General | Data |

| Origin | Latvia |

| Founded | 2015 |

| Offices | Latvia, Lithuania, Germany and Poland |

| Loan Type | Consumer Lending |

| Sign Up Bonus | €10 |

| Fees | 0.85% |

| Interest Rates | >10.77% |

| Min Deposit | € 10 |

| Investment Duration | 1 - 12 Months |

| Secured Lending | Yes |

| Currency | EUR |

How to Borrow ?

Mintos is a loan originator aggregator. It is not possible to receive loans from Mintos. However, borrowers may visit their website to find out more about their local partners. If those local partners exist within the borrowers proximity then they may contact them there.

Registration and Withdrawal

To first determine who is eligible to join Mintos' marketplace, "Both individuals and entities can invest through Mintos. Individual investors must be at least 18 years old, have a bank account in the European Union or third countries currently considered to have AML/CFT systems equivalent to the EU, and have their identity successfully verified by Mintos."

Registering on Mintos is straight forward and user friendly. New users can sign up with their email, fill in user data such as identification and address. The user should make sure that all data being filled up can be verified with respective legal documents. After legal documents are submitted and verified users can start depositing and earning with Mintos.

The minimum deposit is €10 or the equivalent:

- USD 12

- DKK 80

- PLN 50

- GBP 10

- RUB 700

- KZT 4000

- CZK 300

It is generally recommended to deposit in euro as most of the platform operates with euro and to avoid loss on currency exchange.

For free euro deposits we recommend the following online banks:

They have no fees for currency exchange which will in turn prevent unnecessary additional costs. Users may also deposit with PayPal and a number of other online payment merchants.

Languages

If you prefer to work in a different language, the Mintos website offers Latvian, Czech, German, Spanish, Polish, Russian, and Dutch. Simply select the small globe-like icon next to the Log In button, and select your preferred language from the drop-down menu.

Marketplace

There are two marketplaces on Mintos' platform. The primary market includes a wide variety of loans for lenders to invest in. In this market users can filter through, currency, loan type, country, loan originator and LO Mintos ratings.

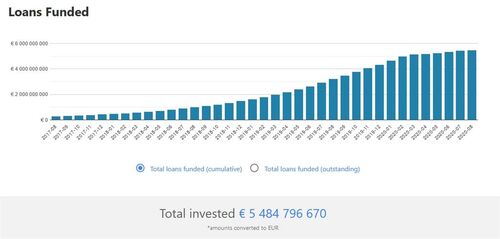

There are currently 70 loan originators on the primary market and over €5 billion worth of capital to date has been facilitated. The primary market is also the place where users may implement Minto's auto invest strategy.

The secondary market serves more of a functional tool rather than investment tool. The secondary market in short serves as a marketplace for individuals who for whatever reason need their capital back. The secondary market allows lenders to sell no longer wanted loans to other individuals at either a marked up or marked down price but generally it will most likely always be at a marked down price.

Investment Strategy

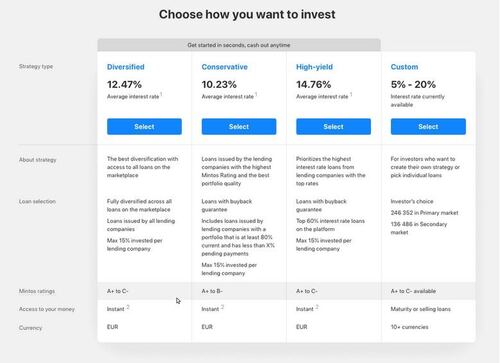

Mintos outlines to lenders four recommended ways to invest. They offer the following strategies to implement: Diversified, Conservative, High Yield and Custom. The returns from these strategies range from 5% to 20%.

The first three have been recently been introduced under Mintos' ‘Invest & Access’ feature, which is designed for new investors to safely auto-invest into Mintos. The fourth, as the name implies, 'Custom', leaves it up to the users' discretion on how to invest and diversify a portfolio.

In 'Diversified', 'Conservative' and 'High Yield' users can expect Mintos' algorithm to do all the hard work for them. With their auto-investing tool, investors can sit back and let their money work for itself.

- Diversified

This strategy would stretch an investors capital among all Mintos' marketplace loans. An investor would have his capital in lending companies whose ratings range from A+ to C-, providing the investor a fully diversified portfolio on Mintos.

- Conservative

This strategy is recommended for those who would prefer to play it safe. Investors would only have their funds borrowed from companies with a track record and credit score. Users can rest assured their funds are safe in conservative but will not enjoy high returns.

- High-Yield

This strategy prioritizes profit over everything else, including security. This is not a recommended strategy, however, users may see a much higher return with this strategy. This strategy puts investors capital in to the hands of the riskiest companies, those which have fallen in the past and have a poor credit score.

All of the programs are intended to bring profit, however, that does not mean there is no risk of failure. It is very possible that an originator will go bankrupt.

On top of the investment strategies to help users grow their capital Mintos has also implemented these three tools to protect their users funds.

- Mintos' Risk Management and LO buyback guarantees promise lenders that if repayment exceeds 60 days, LOs will buy the loans back, providing the lender with invested principal as well as accrued interest.

- Mintos provides a marketplace rating to loan originators indicating the level of credibility and success of the loan originator.

- Every loan originator requires some personal capital in their loans, incentivizing lenders, borrows and originators to lend and borrow responsibly.

Mintos ultimately understands the risk that comes with investing and the greater risk that comes with investing in an unknown market. That being said, through policy and practice they have minimized the risk for the lender, the individual who puts him or herself solely at risk of losing their principal.

These are some of the qualities that separate Mintos from other P2P lending websites. Mintos contractual agreements with loan originators give the platform an upgraded level of credibility. This is done by providing lenders a real safety net when lending capital. Mintos' approach to taking care lenders has redefined P2P lending.

Liquidity

Mintos does not charge users for either deposits or withdrawals. Mintos' liquidity is famed to be the one of the, if not the fastest paying P2P lending website. Users may withdraw any funds that are not tied up with any loans at any time. If the bank is registered in the Euro zone it would take roughly 1-3 business days, outside the Euro zone it may take a bit longer. Users can only withdraw to bank accounts that are associated with the account. The identity on the credit card, bank account or payment merchant must match the identity on the Mintos account.

Risks Involved

Transparency & Security

When considering Mintos it is also important to bring to light their successes. Ultimately, the success of a company is determined not by it's policy but by its measured success. The truth is Mintos does have the numbers to reinforce its competency and reliability.

They currently serve 300,000 investors on their platform from over 96 countries. To date, Mintos has made it's investors 100 million Euros richer. The average interest rate on the platforms marketplace is 12.10% and even during these COVID days Mintos has found a way to sustain itself and remain profitable. In May 2020, Mintos claimed even during these hard times that their investors have made €24.8 million in 2020 alone.

Mintos dedicates a great deal of resources in to maintaining transparency and updating its users on any mishaps and subsequent fund recoveries. Two of the companies most successful assets are their frequent YouTube videos where CEO Martins Sulte answers questions from users, as well as the Mintos blog. The blog does its very best to update users on the companies processes, services, updates and fund recoveries at least 3 - 5 times on a weekly basis.

Mintos as a company must be ready to deal with difficult situations. Whenever a loan originator becomes insolvent it requires a lot of work on the side of Mintos to remedy the situation. A number of loan originators on both a direct and indirect structured have gone bankrupt. Whilst Mintos is trying to recover these funds it still requires money and time.

Crisis Management

In a YouTube AMA with Mintos CEO Martins Sulte, 19th June 2020, he discusses the problems regarding COVID-19 and Mintos’ strategy on emerging as unscathed as possible. The lending market has suffered a great deal due to the recent struggling economy, putting Mintos in a difficult position.

When Martins was questioned on what is Mintos' strategy on the matter, he first answers by introducing the question of whether or not to take legal action against loan originators. He begins by stating that taking legal action is seldom the most ideal way to approach a problem. Due to the fact that it can take a very long time and yield very low results. He proposes that the best way to ensure the longevity of the business is by determining what is the medium - long term value of a given originator and proceeds accordingly.

Mintos has hired several experts from HSBC and Barclays in the field of recovery to join the team to tackle the economic turmoil that COVID 19 triggered as well as handle the problem of the loan originators defaulting.

The team itself is incredibly transparent in regards to who they are and the competencies they possess. All individuals on their website can be crosschecked with the individuals on their LinkedIn pages. At the head, Martins Sulte frequently appears online, fireside chats and on television to directly answer the concerns and inquiries of his customers and users. The level of care, transparency and humanity Mintos users are exposed to is another factor that elevates the level of trust between Mintos’ users and Mintos itself.

If Mintos Fails

All P2P platforms that are owned by a centralized entity put their users in a similar risk. The risk being if the company itself goes bust or runs out of money what then happens to the funds deposited by the investors? In the same way all investments have a risk this can be written off as one of them. Even so, it is worth mentioning that if Mintos itself fails, the lender is the only one at risk. In the hypothetical that Mintos falls, a legal team would take over the dealings of redistributing the left over capital to investors as well as chasing down borrowers to complete their side of the bargain. One of the downsides to this is that the administration fees for such protocols will come out of the pocket of the investors.

Our Readers Have Asked:

Is it safe to invest with Mintos?

No investment is ever "safe". There is an inverse relationship between risk and reward, as the more risk you take, the higher your reward, as well as the chances of losing your investment.

How much money will I make with Mintos?

Mintos proclaims that investors on their site make anywhere between 9 - 12 percent in yearly returns.

What are the risks?

Investors on Mintos can experience a 16 percent default rate on their loan contracts. Investors will see that 4/25 loans will default which all things considered isn't so bad. Mintos hosts a very large market place for all investors, including very high risk ones.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a onzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones.

Where is Mintos located?

Skanstes 50, Riga, LV-1013, Latvia

Is Mintos active in Germany?

Yes, Mintos has a branch office in Germany, located at Kemperpl. 1, 10785 Berlin.

The phone number is +49.30.255585268

Watch & (L)earn

Discover more about Mintos in this short but informative video.

Pros, Cons and the Verdict

Pros

- Auto-Investing Tools

- Established Platform

- Regulated

- Secondary Market

- Very Transparent

- Low Fees

- High IRR

- Easy to Use

- Low Minimum Entry

- Manual Selection

Cons

- Medium - High Default Rate

- Unhealthy Loan Originators

In summary, Mintos' unique features separate Mintos from the rest of the P2P lending market. It's established ability to ensure that its lenders principal is at minimal risk whilst also retaining attractive interest rates is a sight to behold.

As expressed in this review, Mintos also uses a multitude of features that they have developed to keep lenders and borrowers active and interested. While they have been around for five years and have remained profitable it is too early to tell whether or not they can withstand true economic turmoil. Users have remained loyal and grateful during the global pandemic, however, when recession hits credit companies are always the first to fall.

Although it is complicated to determine if Mintos' will grow further in these difficult times. We believe in Mintos ability to fuel and successfully further develop its lender/borrower economy.