How Our Portfolio Performed In Q2 of 2023

We've reached the halfway point of the year, which means it's time to revisit the P2PIncome investment portfolio and assess its progress. In addition, we'll look at the geopolitical and financial events that may have affected the peer-to-peer lending market. The war in Ukraine rages on, but what does that mean for financial markets? Is it just a political issue, or does it have real-money consequences for everyday citizens? To find the answers to these questions and more, read this report for 2023-Q2, the latest in our ongoing series of Portfolio Reports.

Quarterly Report: 2023-Q2

Investors should look for ways to diversify their funds. The old adage about not placing all your eggs "in our basket" applies to money. If you invest everything on one property and some catastrophic failure ruins the investment (such rioters burning down the property, or a missile attack from an invading army), you're left with nothing. If, instead, you spread your money across a few investments, no single catastrophe can ruin you.

In addition, different types of investments yield returns at different rates and times. If you commit all of your money into 5-year investments, you'll have the entire 5 years accessing those funds, unless you're willing to pay a fee. On the other hand, if you invest in various projects—some short terms and others long terms; some high risk and others low risk—you're less likely to suffer a total loss, and you'll have an easier time accessing your money.

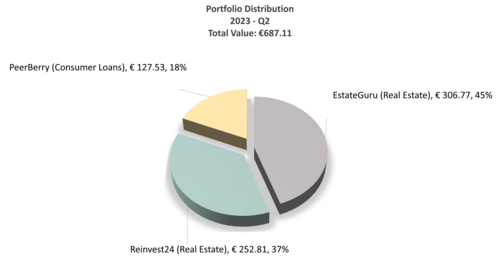

This is why the P2PIncome investment portfolio consists of 3 platforms, with several investments on each platform. It's also why the 3 platforms focus on different types of investments: Reinvest24 and EstateGuru are both real-estate platforms, but EstateGuru offers a lot of Bullet loans, and Reinvest24 tends to offer a lot of rental opportunities. PeerBerry deals in consumer loans. On each site, we have between 5 and 10 investments, so even when a borrower defaults, which can and will happen around 6% of the time, our portfolio survive to fight another day.

Fact and Figures

Near the end of 2020, we took €550 and invested it across 3 peer-to-peer lending and investment sites: EstateGuru (€250), Reinvest24 (€200), and PeerBerry (€100). We invested in several listings on each site, and have maintained the portfolio ever since. By the end of 2023-Q1, we had earned €54.99 in profit on EstateGuru (bringing the account balance to €304.99), €47.12 in profit on Reinvest24 (bringing the account balance to €247.12), and €25.34 in profit on PeerBerry (bringing the account balance to €125.34). This amounted to a total gain of €127.45 in 30 months.

| Platforms | EstateGuru | Reinvest24 | PeerBerry |

| 2023 - Q1 | €304.99 | €247.12 | €125.34 |

| 2023 - Q2 | €306.77 | €252.81 | €127.53 |

| Profit (€) | €1.78 | €5.69 | €2.19 |

| Growth (%) | 0.58% | 2.30% | 1.74% |

During the second quarter of 2023, our EstateGuru portfolio grew by another €1.78 (which represents a measly 0.54%), our Reinvest24 portfolio grew by €5.69, which converts to 2.3%, and our PeerBerry portfolio grew by €2.19, which is an increase of 1.74%. That yields an average platform growth of 1.54%, which translates to an unimpressive annualized rate of 6.16%, and a cumulative average growth of 24.5%.

More troubling was the realization that there were very few attractive investment opportunities available. In the case of Reinvest24, we were forced to let our money sit fallow, because there were no worthwhile properties on the Primary Market, and we had tied up more than enough money on the secondary market. Since then, Reinvest24 has added 3 new listings, and we hope to see more in the near future.

Since opening the portfolio, we've enjoyed averaged cumulative (quarterly) growth of around 2%. In other words, the total value of the portfolio has tended to increase by an average of 2% across the 3 sites. Even during 2022-Q2, when a global pandemic had shut down the world's economies, we saw growth of 1.05%. So we can't hide our disappointment at the paltry 0.87% growth we saw this quarter. If the market doesn't pick up, and if the platforms don't start offering more listings, our portfolio can't grow. In addition, EstateGuru is suffering a potentially catastrophic emergency in Germany, where it seems someone has been doling out loans indiscriminately. Reinvest24 has picked up some of the better loans, but not nearly enough to rescue EstateGuru's operations there.

Simply stated, the market is suffering. There are fewer investment opportunities than in the past, and many are uninviting. This is most noticeable regarding the real-estate market. People simply aren't comfortable risking their money to build homes and offices they might not be able to fill. That being said, we haven't seen any "negative returns," and while the slowing of growth is a concern, thus far it hasn't flattened the growth trends for any of the platforms on which we invest.

PeerBerry

PeerBerry is a p2p lending site focused on consumer loans. Established in 2017, PeerBerry has managed to carve out an important place for itself: It's one of the most popular p2p investment sites in the world today. The site boasts nearly €2 billion in total funds invested, and reports an "average annual investment return" of 11.25%. To date, the platform has paid out almost €25 million in interest to its more than 70,000 users. PeerBerry lists loans from over two dozen loan originators throughout Europe and Asia, including Poland, Lithuania, Kazakhstan, Moldova, Spain, Sri Lanka, India, the Czech Republic, and the Philippines.

By the end of the previous quarter, our portfolio value on PeerBerry was €125.34, which grew to €127.53 by the end of Q2. This gain of €2.19 amounts to a growth of 1.74% for the quarter, similar to the 1.70% growth of the preceding quarter. That averages out to 6.8%, but if we look at the Year-to-Date averages the outlook is a bit better. We reported 2.54% growth in 2022-Q3 and 1.23% in 2022-Q4, such that the Year-to-Date growth is 7.21%. Only time will tell which projection is closer to reality.

Reinvest24

Reinvest24 is a top-tier platform for real-estate investors who prefer peer-to-peer markets over the traditional real-estate markets. Investors need not bring hundreds of thousands to the table. With as little as €100, one can purchase a small portion of a real-estate development project and start profiting. Once the project is finished, it's either occupied with tenants or sold. If occupied, every investor is entitled to their share of the rent, which is a great source of ongoing passive income. If sold, investors are entitled to their share of the capital gains, which can often amount to significant earnings.

We finished the previous quarter with a Reinvest24 portfolio value of €247.12, and reinvested our cash balance. By the end of Q2, the balance had grown by another €5.69, due to the completion of 2 projects. That put our portfolio at €252.81—a gain of 2.3% for the 2023-Q2. Aggregating these results with the previous quarter, we see a mid-year trend of just under 8% annual growth. That's well below the "14.8% total combined return" advertised on the platform's homepage, but it's still above the 7% mark we set for the portfolio. It will be interesting to see where the portfolio stands at end of year.

EstateGuru

EstateGuru was established in Estonia in 2013, and has grown into a major player in the peer-to-peer real-estate market. The company now holds offices in Estonia, Latvia, Lithuania, Finland, Germany, and Armenia, and reports over €750 million in total loans funded. The average loan on EstateGuru is around €125,000, and the average duration of a loan is 13 months. EstateGuru maintains a Loan-to-Value percentage of 61.13, and reports historical returns of 10.63% over its decade of operation. EstateGuru's total write offs to date are €40,121, which amount to less than 0.01% of funds invested. That being said, the situation at EstateGuru's office in Germany is dire, and how the platform handles the emergency will determine whether it survives.

When we closed the preceding quarter (2023-Q1), our EstateGuru portfolio stood at €304.99, and at the end of Q2 it had only grown by €1.78 (a growth of 0.58%). To make things worse, an overwhelming €71 of our portfolio were now in default. Facing default of more than 20% of our total portfolio value makes us extremely displeased. This isn't the first time we've expressed concerns regarding EstateGuru's approach to late payments.

In our December of 2021 report, we considered pulling our money from the platform, and frankly, we would have if we weren't more dedicated to our financial reporting than the few euro we have invested on the platform. EstateGuru needs to figure out a better approach to borrower defaults. It can't just leave its users wondering what will happen every time a borrower is 2 hours late with a payment.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Events that Influenced Financial Markets During 2023-Q2

War in Ukraine Rages On

So many people predicted a quick end to the war in Ukraine, but the war continues without an end in sight. It's been over 16 months, and neither sanctions against Russia nor funding of Ukraine have yielded anything constrictive. Other than a "revolt" against Putin measured in hours, Russia seems steadfast. Its currency, the ruble, which plummeted at the beginning of the war, is back to pre-war values. The United States and EU have invested approximately €150 billion to no avail, and it almost seems Putin is waging a financial war of attrition against the West.

The CATO Institute reported in April that despite political claims to the contrary, the war in Ukraine "raised the retail price of a gallon of gasoline by at least a dollar in the U.S. (and much more in Europe)" and that the increased energy costs were "far more problematic for industry, transportation, and farming (and therefore for consumers) than the mere 'price at the pump.'"

Verdict

Our once-favored EstateGuru has fallen on very hard times. Whether the situation at its offices in Germany is the result of poor management or something more sinister remains to be seen. The company is currently investigating the matter. Regardless, it should be obvious we can't currently recommend the site as our top pick. Similarly, Reinvest24, though not facing nearly as much pressure as EstateGuru, it's low on offerings. As of this writing there are only 3 new listings on the Reinvest24 marketplace.

That leaves us with PeerBerry. The platform seems bulletproof. The moment the war in Ukraine broke out, the platform launched a strategic plan to prevent the unforeseen from affecting their users' investments. The company paused all activities in the region, and to date it has repaid over 85% of its "war-affected loans." Furthermore, by branching out as far as India and the Philippines the company has ensured it has loans to offer no matter what's going on in Europe.