Welfio Helps You Make Better Investment Decisions

With so many peer-to-peer lending platforms out there, it can be difficult to know where to invest. If you've diversified your portfolio across several platforms, which is certainly the wise thing to do, you might need to commit hours to studying and analyzing those sites before you can make an informed decision. Who has time for that?

Furthermore, not all of us are financial analysts. When you have money to deposit and a long list of investment opportunities from which to choose, the entire undertaking can feel daunting. If only there were a cross-platform tool that allowed you to assess all the investments currently available on all the major platforms, and to choose new investments at a glance. Now imagine if that tool was able to provide objective, data-driven analysis and scoring.

Welfio

Welfio is a new p2p-investment tool designed to help you follow the p2p lending market across various platforms, in a single interface. According to co-founder and CEO Ričards Kraupša, "We at Welfio are on a mission to help investors make better, smarter, and quicker investment decisions, when it comes to investing in loans." The Beta was released in mid-2022, and since then the company has continued to make improvements to the algorithm.

Welfio lists investment opportunities from top-tier p2p platforms, including PeerBerry, Mintos, Iuvo, Robocash, Esketit, and HeavyFinance. Using Welfio, users can make informed decisions based on "actionable and data-driven insights on loan investments." Welfio analyzes hundreds of thousands of transactions from over 200 loan originators, and uses that data to provide you with investment guidance. Most importantly, these aren't some financial analyst's opinions. They're the objective results of a carefully crafted algorithm.

How Welfio Works

Welfio uses data-driven analysis to help users increase overall returns, reduce capital risks associated with p2p lending, and provide simplicity in a world many find confusing. Unlike so-called "financial advice," which is often merely a person's opinion, the information provided by Welfio is mathematically sound, broad-based, and objective. That should help you select the best investments for your financial goals, rather than leave you guessing—or require you to become a full-time financial analyst. Simply open Welfio, study the Investing Guide, select your investments, and get back to living your life.

The Welfio Investing Guide

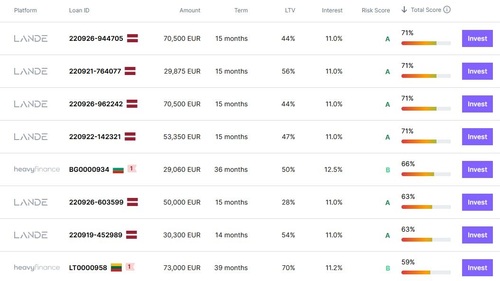

Welfio lists 3 types of investment opportunities: Lending Companies, Real Estate, and Agricultural Loans. In each section, there is a long list of investment opportunities, similar to a platform's marketplace. The Lending Companies section lets you sort by Platform, Loan Originator, nominal Interest Rate, Risk Score, or Total Score. The Real Estate and Agriculture sections include more metrics, such as the total Amount and Term (meaning duration) of the loan, and the LTV (loan-to-value) ratio.

There are some obvious ways to use such filters and metrics. For example, if you've had bad experiences with particular platform or loan originator, you might want to scroll past any projects from those companies. Some of the other metrics are a bit tougher to use, so we've taken the time to address a few:

Nominal Interest

The term nominal interest refers to the interest rate the borrower is being charged. That's not necessarily the same thing as the amount you'll earn from the loan, because the nominal rate doesn't account for how the interest is compounded, nor does it account for fees, defaults, and other such factors. Still, the nominal rate (sometimes called "stated rate") is an important metric for selecting loans, because it gives you a basis for calculation, especially when linked to the Risk Score.

Risk Score

Every investment entails risk, and it's extremely important to have some sense of how much risk you're taking on, before putting money into something. Unfortunately, it's not always clear how much risk a project entails. It's even more difficult when comparing projects from different sites. After all, it's not as though p2p sites used a uniform standard for assessing risk. For example, when you scroll through a list of properties on Reinvest24's marketplace, you know the risk your taking on based on the reported LTV. On Iuvo, you can look at the Score Class, which is graded A through D.

What you can't do, however, is determine the risk ratio between a low LTV loan on Reinvest24 and a low Score Class on Iuvo. Which of the two is riskier? You'd need years of financial-analysis training to make such a determination. That's where the Welfio Risk Score helps: The algorithm looks at over 50 metrics in order to make its determination. Because it's cross-platform, the score is uniform, which means you can compare projects and loans from various sites.

Total Score

If you just want to get straight to business, consider the Total Score to be Welfio's decisive verdict on any given project or loan. This simple score indicates the overall viability of the investment, expressed as a percentage and accompanied by a color-coded bar. It's worth noting that the term "simple" here refers to the expression of the score. The algorithm, on the other hand, in anything but simple. It's the result of several dozen metrics, including the currency stability in the country of origin, any red flags identified with the companies involved.

For example, if a company is based in a country going through geopolitical turmoil, it's important to determine how that will affect the market. Welfio makes use of a political-violence-risk score developed by Credendo, so that macroeconomic-political concerns are also taking into consideration. We're not saying you can't look into all of that on your own. What we're saying is that if a computer is already doing all of that for you, and the resulting tool is affordable, why spend your personal time on it?

Lastly, we should mention that as you specify your financial/investment preferences, the algorithm will adjust the Total Score to suit your goals. The more you use Welfio, and the more specificity you apply to your parameters, the more closely aligned the Investing Guide's Total Score will be with your needs and goals.

Pricing and Registration

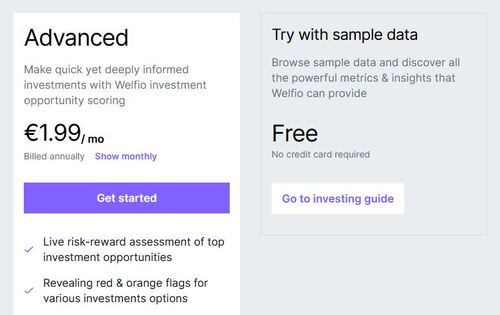

Registering an account with Welfio is quite simple. All you need to do is provide an email and generate a password. Welfio will send you a confirmation email, at which point you'll be prompted to subscribe. Welfio offers a free version of their product, using "sample data," to give you a sense of how the product works. It's a nice way to familiarize yourself with this new tool, but beyond that it's not particularly useful. Clearly, the goal is to get you to subscribe to the actual product.

The good news is the Advanced version is very reasonably priced, at only €1.99 per month for the annual subscription (billed annually at €23.86), or €2.99 a month for the monthly subscription. Payment is only possible via credit card. The payment process is secure, with a AES-128-GMC/SHA-256 encryption certified by BitDefender. Both the annual and monthly subscriptions automatically renew, but you have the option to cancel at any point prior to each renewal.

Verdict

Welfio has introduced a powerful for peer-to-peer investors. Using Welfio, you should find it a lot easier to make the right decisions regarding your portfolio, and you should anticipate better overall earnings. Obviously, nothing is ever guaranteed when it comes to investing, but the objectivity and mathematical reliability of data-driven decision-making is definitely a step in the right direction. At only €1.99 a month, the product is to cheap to ignore, and as they continue to make improvements and updates to the system and its algorithm, this could quickly become a decisive tool in the p2p investor's kit.