Debitum Network Reviewed | P2P Lending Business Loans in Europe

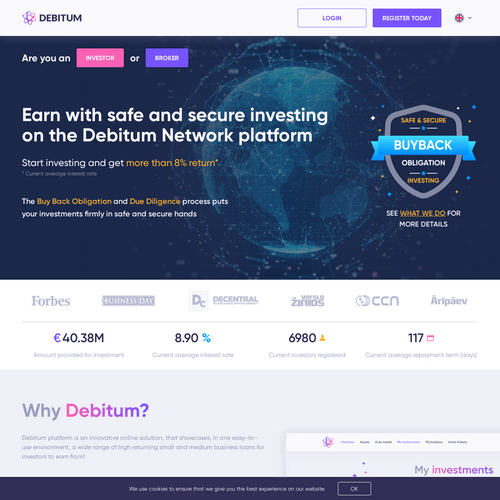

Debitum Network is a Latvian peer-to-business lending platform founded in 2018. The network operates as a loan-originator aggregator. Debitum invites loan originators in and around Latvia to host their loan contracts on Debitum's Network. Debitum Network is also a cryptocurrency that has been the subject of great controversy. The minimum requirement to invest with Debitum is 50 EUR and yearly returns range from 7 to 9 percent.

Types of Loans on Debitum Network

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Debitum Network Loan Characteristics

Loan duration4 - 24 Months

CurrencyEUR

Buybacks Yes

CollateralYes

Available inEU

Returns rate8 - 9%

Default Rate0%

Recovery Rate100%

FeesNone

BonusesEUR 25

Debitum Network Features

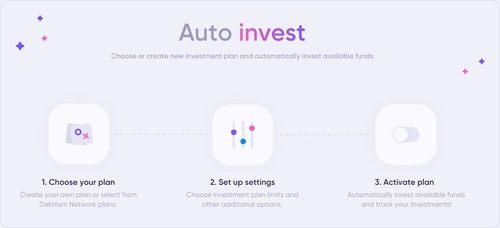

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Debitum?

Debitum primarily focuses on small business loans with a focus on businesses with limited liquidity. There are many small business owners who pass up great opportunities due to liquidity restrictions. These small businesses lack the sufficient capital on hand to invest in resources and manpower to make even larger profits in the future. Debitum serves to be a fintech solution for these small businesses by giving them the necessary liquidity to scale their businesses.

The process starts when a business strikes a deal with a customer for a large transaction. The business does not have the resource and manpower to fit the customers' demands. So the business requests a loan on Debitum's Network, and investors know the loan will be paid back because the business already has a guarantee for the money. When payday eventually comes, the borrower pays back the investor. It's quite a foolproof plan. The standard loan duration on Debitum spans between 4 - 24 months. Borrowers come from both western and eastern European nations.

Lender/Borrower Ecosystem

Since their inception in 2018, Debitum has maintained a zero percent default rate and have never lost their investors' principal investment. The platform has proven to be efficient at fund recoveries and has made developments in keeping their company decentralized.

Debitum Network has a cryptocurrency token, called DEBs, that can be utilized on Ethereum's blockchain. This token is in some sense irrelevant to Debitums lender/borrower ecosystem. It is a side feature that has some use, but in general, has been considered a poorly thought of asset due to it's value consistently decreasing. All investments on Debitum Network come with a buyback guarantee issued by Debitum. After 90 days, if the loan is not being upheld by the borrower, then Debitum will purchase the loan back from the investor, with principal and interest.

Most loans on Debitum are also backed by a form of collateral, which means there is something to sell off in case the loan contract defaults. Debitum deals strictly with small to medium sized enterprises (SMEs), which means none of the loan contracts will exceed half a million euro. Most of the borrowers simply require moving capital in order to cater to large orders that their business could not previously manage. The borrowers submit an invoice that shows that money is coming to them within 120 days and request for funds of the same amount. This provides a huge liquidity solution to small local shops and restaurants.

Peer-to-peer lending has proven to be a functioning liquidity solution for many. Due to excessive regulation and bureaucracy it has become increasingly difficult to obtain a loan from a bank. Platforms like Debitum have proven to be potential answers to those who are unable to receive liquidity from banks.

General Data

| General | Data |

| Origin | Riga, Latvia |

| Founded | 2018 |

| Offices | Riga, Latvia |

| Loan Type | Consumer Lending |

| Sign Up Bonus | €20 |

| Fees | 0% |

| Interest Rates | 10.00% |

| Min Deposit | €500 |

| Investment Duration | 4 - 60 Months |

| Secured Lending | Yes |

| Currency | EUR |

How to Borrow

Debitum Network is a loan originator aggregator. It is not possible to receive loans from the Debitum Network. However, borrowers may visit their website to find out more about their local partners. If those local partners exist within the borrowers proximity, then they may contact them there.

Registration & Withdrawal

As it is with most peer-to-peer lending platforms, getting registered on Debitum is a somewhat straight forward procedure. After filling in the basic information such as, name, email and phone number, users can then proceed to KYC verification. There is a minimum of €500 deposit. Users need a European bank account in order to deposit in Debitum.

Debitum requires additional security documents such as proof of address, and proof of payment. Investors are required to take an additional step and fill in an investor questionnaire.

It is generally recommended to deposit in euro to avoid loss on currency exchange, as the platform operates with euro.

For free euro deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account. Debitum does not charge any fees for deposits and withdrawals, however, depending on the transaction fees of a given bank, users may be charged by their bank for exchanging and handling fees.

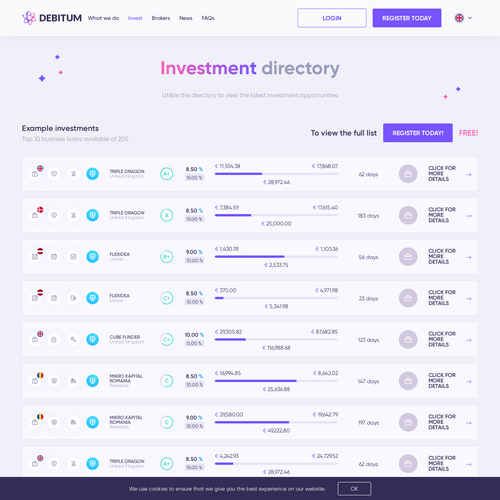

Marketplace

Debitum only offers a primary market place, there is no secondary market for added liquidity. On their platform there are absolutely no investment fees, which is certainly one of their greatest features.

Debitum's has a well-functioning auto-investing tool and they work with several loan originators around Europe, primarily in Lithuania. It is very easy to navigate on Debitum, as everything is quite straight forward. It's also very easy to digest the information presented to you. All loans come with in-depth descriptions of the reason for the loan, the industry, financial statements of the business entity, the payment cycle, and so on. It's great to see such dedication to transparency and data so that their investors will understand where their money is going.

The auto-investing tool also allows for high levels of adjustment and customization. Investors are able to configure their investing tool based on what kind of exact profit or percentage they would like to see. All in all, their marketplace is very easy to use and interactive where it needs to be. Debitum offers a return of roughly 8 percent. This is pretty standard for business loans.

Investment Strategy

On Debitum, you can manually invest or use the auto-investing software. To expand further, the auto-investing software is built to quite a sophisticated degree. The options that you can optimize on the auto-investing tool can be configured for price, percentage, location, loan originator, loan originator rank, the amount of assets and so on.

Debitum also offers multiple investment strategies where users can simply select an automatic investment algorithm that operates based on your risk preferences.

Risks Involved

Considering the level of protection investors receive on Debitum and their track record of zero percent default rate, it allows us to believe that investors on Debitum are in good hands. Otherwise, all the risks associated with Debitum are risks you would similarly find on the majority of peer-to-peer lending platforms.

Transparency & Security

Debitum is a very transparent peer-to-peer lending platform. All of their information is easily available, their entire notion is that they are decentralized and they hide nothing. They have a Debitum cryptocurrency token that is the subject of argument, so let's talk about about it. In 2017, Debitum issued an ICO sale. This is like an IPO sale, which occurs before a stock goes public and gets listed on a major exchange.

ICO's are Initial Coin Offerings and they are coins or tokens issued by the cryptocurrency developers at a discounted rate before they are listed on a major cryptocurrency exchange. Many investors bought into Debitum believing that it was a good investment with high returns. To their disappointment the value of coin has gone down substantially since, and has shown limited signs of recovery. Debitum sold 400 million Debitum tokens for roughly €6 million.

Debitum explains that the dramatic interest in their cryptocurrency was not out of innovation for technology, rather, it was for the purpose of pumping and dumping. Today, the DEB token on Debitum's Network is used for loyalty programs and liquidity, and in the future, Debitum plans to expand the utility of their cryptocurrency.

Cryptocurrencies are one of the highest risk investments in the market today, many critics have expressed that trading cryptocurrencies is tantamount to gambling.

Many people have expressed criticism over the cost of these tokens and their subsequent descent in value. The company has only been around for four years and considering the nascent stage of cryptocurrency, we believe it's too early to tell what impact and influence the Debitum Token will have on the future of it's decentralized ecosystem.

Crisis Management

During Covid-19, Debitum Network found itself in an interestingly favorable position. Many of the countries they operate did not have access to digital financial services. The banks in Latvia, Romania and Lithuania are not all completely digitized. There still exists a great disparity between those who live in capital cities, and those who live in the country side. Platforms like Debitum provide a great deal of value as credit provides for people who don't have sufficient access to credit.

With this scenario in mind, the Lithuanian government encouraged peer-to-peer lending platforms like Debitum to provide credit. Because of these reasons, the ecosystem continued to function during the crisis. Debitum claims that in the worst case scenario, Debitum could continue functioning for at least 12 months.

Our Readers Have Asked:

Is it safe to invest with P2PIncome?

No investment is ever "safe". There is an inverse relationship between risk and reward, asthe more risk you take the higher your reward, as well as the chances of losing your investment.

How much money will I make?

Debitum suggests that most investors will make between 8 to 9 percent on their yearly returns.

What are the risks?

Debitum has never lost their investors' capital, giving them a risk assessment that is considerably low. You can always opt for A or B rank loans which will expose you to as little risk as possible.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and a necessity to protect your investment account from bad actors and hackers.

Is P2P Lending a Ponzi Scheme?

Some peer-to-peer lending platforms are dishonest and shady. The industry is still in its nascent stage and while there are definitely some illegitimate companies, there are also many honest, hard-working and profitable ones. Debitum is certainly one of those companies that is honest, hard-working and profitable.

Where is P2PIncome Located?

Lacenu iela Kadaga, LV-2103, Latvia

Watch & (L)earn

Discover more about Debitum in this short but informative video.

Pros, Cons and the Verdict

Pros

- High Transparency

- High Returns

- Zero Default Rate

- Great UI/UX

- Buyback Guarantees

- Collateral Based Loans

- Business Loans

Cons

- High Min Entry

- No Secondary Market

Peer-to-peer operating systems, whether that be internet, lending platforms or blockchains, are all meant to be decentralized. The very notion of peer-to-peer should serve to act as a balance of power within an ecosystem. Debitum Network began as a hybrid cryptocurrency and has shifted into a fiat lending platform.

Debitum does need a token or a blockchain to achieve what they want to do. As a business and as decision makers, Debitum made the choice to adapt their business model to what they believed to be the best appropriate course of action for their company. Even though investors of today has lost money, it does not mean that investors will lose money 10 years down the road. Debitum has released many statements indicating their commitment to expanding their cryptocurrency.

The platform itself is a great experience. Easily one of the most intuitive websites we have reviewed. The minimum entry is high, but perhaps, as more users enter the platform, there will be lower minimums to invest. An 8 percent return on a business loan is close to the industry standard. And, considering that all loans come with guarantees and security, the ROI that you receive is considerably good value.