Faircent Reviewed |India's Largest Peer-to-Peer Lending Platform

Faircent is a Peer-to-Peer lending platform in India founded in 2013. It is India's first completely regulated and licensed P2P platform and services loans all over India. Faircent is essentially a virtual marketplace where Indian citizens can borrow and lend to each other at more affordable rates. Credit markets are a necessity for businesses and personal livelihood. Faircent aims to enable more people the chance to earn on their income.

Types of Loans on Faircent

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Faircent Loan Characteristics

Loan duration6 - 36 Months

CurrencyINR

Buybacks No

Collateral No

Available inIndia

Returns rate8 - 25%

Default Rate7 %

Recovery Rate0%

FeesNone

BonusesNone

Faircent Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Faircent?

Fair is one of Indias largest Peer-to-Peer lending networks. They are the first platform of it's kind in India to be fully regulated and licensed by the relevant financial authorities (RBI) in India. They understand what makes Peer-to-Peer lending an incredibly attractive avenue and have created a marketplace to mitigate investment risk and provide their investors with steady returns.

The team behind Faircent believe that banks that have been profiting handsomely from outdated financial institutions that have long monopolized the market of lending. Faircent aims to break down those barriers, that once separated individuals from banks, and enable retail investors to profit the same way banks do.

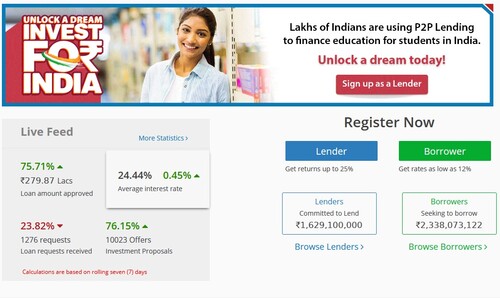

Lender/Borrower Ecosystem

The process starts with the borrower entering into a formal contract with the lender/s, all of which is coordinated and provided by Faircent. The overarching conditions of the contract are set by Faircent, but the final details are negotiated by the lender and borrower.

Interest rates range on Faircent from 8% for low risk loans up to 25% for high risk loans. There is a 2% charge for every personal transaction and 3% for every institutional transaction. There is a minimum deposit of 50,000 rupees to invest on Faircent, which is roughly 680 - 690 USD. Only citizens and residents of India can participate in this lending borrowing ecosystem.

Loans issued on Faircent are mostly unsecured consumer loans, unless the loan is for a mortgage or automobile. The borrowers are procured by Faircent itself. Faircent is a major loan originator in India, which issues loans to several provinces within the nation.

Faircent does its best to act as a neutral facilitator between their lenders and borrowers. Investors are not guaranteed any principal investments, the website states that they do not provide any additional legal protection or financial advice. Only serious investors who are familiar with Peer-to-Peer lending should use Faircent.

| General | Data |

| Origin | Gurugram, India |

| Founded | 2013 |

| Offices | Gurugram, India |

| Loan Type | Consumer Lending |

| Sign Up Bonus | 0 |

| Fees | 2.5 - 8.5% |

| Interest Rates | 12 - 33% |

| Min Deposit | 50,000 ₨ |

| Investment Duration | 12 - 60 Months |

| Secured Lending | Yes |

| Currency | ₨ |

How to Borrow?

Faircent offers consumer loans on their platform for a total of 10,000 Lakh. In order to receive a loan from Faircent borrowers must submit an array of inforomatoin including but not limited to, credit Score, Identification such as driving license or passport, bank account statement as well as any criminal history.

Registration & Withdrawal

Registering on Faircent is possible as an individual or a company, however the services are solely available to people who live in India. Furthermore, in order to invest on Faircent, investors must be educated and well-versed in a locally recognized profession. Not just anybody can become an investor with Faircent, as there are many requirements that one has to overcome, with having a stable occupation being one of those requirements.

It is also not enough to verify your identity and invest some money. The investment entry is high, with a minimum of at the least 680 USD. The platform requires the last few credit card or electricity bills, a three month statement from your bank account, as well as proof that you have an occupation which has been stable for, at the very least, one year.

Registering with Faircent is only for experienced investors and well-to-do individuals.

To register as a borrower on Faircent is also a long and tedious process that requires many documents from the borrower.

Which includes but is not limited to:

- Proof of ID

- Birth Certificate

- Bank Account Statement

- Mobile bills

- Electricity BIlls

- IFSC Code

- Income Statement

Borrowers are also required to submit a 500 rupee payment fee for Faircent to verify if the borrower is eligible to use their platform. This is for the purpose of verifying a borrower's CIBIL score. Those with a low score are unable to participate in Faircent's ecosystem and lose the 500 rupees.

Marketplace

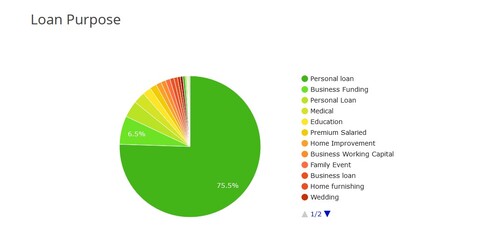

Faircent offers a multitude of loan types on their marketplace. Borrowers can apply for loans for several different agendas such as:

- Student Loans

- Wedding Loans

- Vacation Loans

- Mortgage Loans

- Debt Consolidation

In terms of diversification, Faircent provides a wide array of loans from borrowers all over India. The majority type of loans and the vast majority of loans issued on Faircent are personal loans.

Somewhat different to the majority of Peer-to-Peer lending companies around the world, Faircent does not utilize the concept of microfinance. Although it's Peer-to-Peer lending, investors and borrowers contract between one lender and one borrower. Most Peer-to-Peer lending platforms allow hundreds if not thousands of investors invest in one loan contract. This is so investors can spread out their risk among many borrowers.

On Faircent, it is one borrower and one investor that make up the Peer-to-Peer experience. Or in other words, making one person liable for an entire loan rather than spreading risk over a number of loans along with multiple other investors.

Both strategies come with their owns pros and cons. Microfinance is, however, one of the attractive aspects of Peer-to-Peer lending as a whole. Perhaps Faircent will look to installing something of that nature.

Investment Strategy

There are two ways to invest on Faircent, there is manual selection and automatic selection. Like any other platform, Faircent has a tool that requires a number of parameters to be filled out in order for investors to start receiving a return.

The majority of loans are secured consumer loans, so your investment strategy will most likely be associated with choosing borrowers who you believe are capable of committing to the agreed upon loan contract.

Faircent issues quarterly reports and a breakdown analysis which can be easily located on the homepage.

These quarterly reports are highly detailed and consist of real data the company uses to understand their investors and borrowers. They are definitely worth a look to understand what kind of marketplace and investment strategy both an investor and borrower will encounter.

Risks Involved

Faircent displays all of the monies earned on their platform as well as the actors involved. Faircent only works as an intermediary between lenders and borrowers and is, legally speaking, not liable for the losses endured on their platform.

In the case of mass loan defaults the platform has no legal obligation to recover the funds of their investors.

The rates on the platform for both borrowers and lenders are determined by the agreed parties within the limitations of the platform. For example, loans have to range from 12 - 24% in order for them to be listed on Faircent. Borrowers who have poor credit histories or no credit histories are subject to a 24% interest.

Transparency & Security

It is a smooth and easy process to understand how FairCent works. Everything is highly detailed on their site in order to explain to their users how their investors make money and how their borrowers issue out loan requests. That being said, Faircent assumes no position to be liable for investors' capital and can be considered high risk for investors who are unfamiliar with P2P lending markets.

Their statistics, team, blogs, updates and policy are frequently updated to ensure that their presentation is an accurate reflection of their product.

There are many different types of loans and the platform reports a default rate of below 1%. As they see it, people in India have been looking for a service in their market, as the bank is unable to provide them the liquidity and financial stability that they require.

Crisis Management

Faircent issued a number of different loan initiatives in order to help the ease the economic turmoil induced by the corona virus pandemic. Their philosophy is that financial institutions have a responsibility to help mitigate the overall economic damage of any recession.

One of the products is known as the "Anti-Lockdown Loans" where borrowers can request loans of up to 1000 USD and have an exemption from repayment and interest for 3 months. It is a counter to what was implemented primarily in Europe, but also in many parts of the world, known as Credit Holidays

Credit Holidays did something of a similar effect for their borrowers. Governments would issue out a 3 month pass to not pay back on their debts. Investors at this time were not receiving their repayments or interest. Causing many investment platforms to shut down due to lack of liquidity. For a platform to be able to issue credit for this amount of time without early repayment penalty and a month grace period is a serious sign of stability.

Our Readers Have Asked:

Is it safe to invest with Faircent?

No investment is ever "safe". There is an inverse relationship between risk and reward, as the more risk you take the higher your reward, as well as the chances of losing your investment.

How much money will I make with Faircent?

Faircent proclaims that investors on their site make anywhere between 8 - 25 percent in yearly returns.

What are the risks?

Investors on Faircent can experience a 7 percent default rate on their loan contracts. Despite the low default rate, Faircent does not make much of an effort to retrieve funds, which they themselves are rather explicit about. Investors on Faircent are by and large pretty safe historically speaking, yet there is a certain requirement of due diligence that must be undertaken in order to invest successfully with Faircent.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. Faircent is certainly one of those companies that is honest, hard working and profitable.

Where is Faircent located?

DLF Phase IV, Gurugram, Haryana 122002, India

Watch & (L)earn

Discover more about Faircent in this short but informative video.

Pros,Cons and the Verdict

Pros

- Regulated

- Licensed

- Long Track Record

- High Volume

- High Returns

- Manual Selection

- Auto-Invest

Cons

- Unsecured Loans

- No BuyBack

- High Fees

- High Minimum Entry

- Many Requirements to Invest

- No Fund Recovery Strategy

- No Microfinancing

- No Collateral

Faircent, as a Peer-to-Peer lending platform, clearly has it's strengths. Being a legitimate, regulated and profitable Peer-to-Peer lending service is an achievement in itself. Faircent also does extensive due diligence to ensure the actors on their platform don't pose a threat to the overall community.

Even so, it appears that when a borrower does default on his or her loan, then Faircent does not implement any fund recovery strategies. Faircent also emphasizes that they are not liable for missing or defaulted payments and that it is all part of the risk investors ought to take.

A good investor should always understand the risk he is about to undertake. The only problem here is that there are a great deal of international Peer-to-Peer lending platforms that have much lower minimum entries that do provide some form of promise that they do have a way to protect investors.

For now, Faircent remains a big fish in a small pond. Faircent mainly deals with unsecured consumer loans, which is the biggest industry in Peer-to-Peer lending and also the highest risk. Faircent sets the benchmark to invest with them, very high. Those who are still new and accustomed, may find better investing solutions outside of Faircent. Only those who are financially literate and stable will find themselves investing pleasurably with Faircent.