The Best Peer-to-Peer Lending Sites for Latvian Investors

The Baltic state of Latvia sits in between Estonia to the north and Lithuania to the south. Much of Latvia's western coast runs along the Gulf of Riga, which shares its name with the country's capital. The rest of Latvia's western coast runs along the Baltic Sea, while Latvia's eastern border meets Russia and Belarus. A former member of the greater Soviet Empire, Latvia gained its independence in late 1991, and has since sought to transition to a free-market economy. Most of Latvian business sectors have been privatized, and the country is a full member of the European Union.

Despite suffering a major financial crisis in 2008, the Latvian economy is strong, relative the region. This is due in part to the Residence by Investment program initiated in 2010, which grants visas to foreign investors and entrepreneurs willing to purchase over €250,000 in real-estate or to employ 50 or more people. Latvia enjoys a high "ease of doing business" score, which has attracted peer-to-peer lending firms. Among the top platforms operating in Latvia are Mintos and Debitum, while several other platforms offer loans and real-estate investment opportunities throughout the state.

Mintos

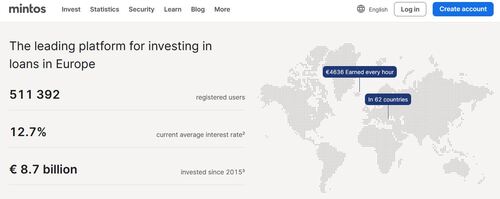

Founded in Latvia in 2015, Mintos is one of the most popular peer-to-peer lending sites in the world. Mintos reports over 500,000 registered users from over 60 countries. Those users have invested a combined €9 billion and enjoyed a weighted average interest rate of approximately 12.5%. Mintos aggregates loans from over 40 loan originators, including Eleving Group, Sun Finance, IDF Eurasia, Iute Credit, and Delfin Group. More than 50% of the loans listed on the Mintos marketplace are personal loans, and another 15% are car loans. The site also lists agricultural loans, business loans, and mortgage loans.

Very few p2p lending operations have enjoyed as much success as Mintos, which now controls over 50% of the European p2p market share. While most platforms speak of "millions" Mintos is creeping toward its first €10 billion in funds invested. In fact, Mintos has more value on its secondary market (€400 million) that most p2p platforms have between primary and secondary combined. The platform deals is many different types of loans, including agricultural loans, car-rental loans, invoice financing, and even forward flow loans (by assigned agreements only).

In addition to its marketplace, Mintos offers an investment vehicle called Mintos Core, which they describe as "a ready-to-go portfolio developed to match common investing goals." Mintos Core is fully automated, so busy investors need not spend any time worrying about their funds. All notes in the portfolio are backed by a buyback obligation, and the dynamic diversification strategy ensures the portfolio is never stagnant. In addition, Mintos Core never devotes more than 15% of the portfolio to one lending company, thereby avoiding crisis. Lastly, the system allows borrowers to cash out at any time, thereby protecting investor liquidity in case of emergency.

Reinvest24

Reinvest24 is a real-estate loan originator. The platforms was actually founded in Latvia's northern neighbor, Estonia, but lists many properties within Latvia. Reinvest24 has nearly 25,000 users from over 140 countries. Those users have funded over €35 million in projects, and enjoyed an annual effective rate of 16%, including rental dividends and capital gains. Reinvest24 boasts zero defaults since its inception. On average, 300 users fund each project, with the individual portfolio size hovering around €5000.

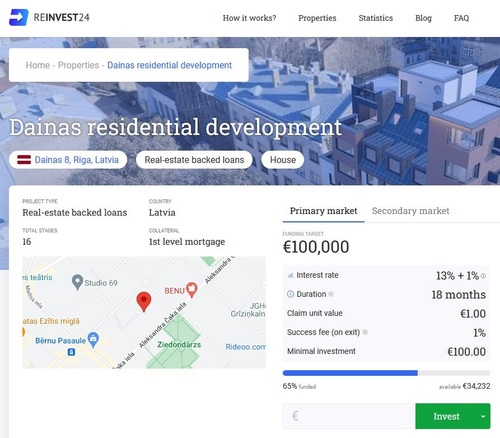

Reinvest24 is crowdfunding platform offering shares of real-estate projects in Latvia, Estonia, Moldova, Germany, and Spain. The company lists four types of projects: Development, non-performing loans (NPLs), rental projects, and real-estate backed loans. The development projects are all assessed by Reinvest24 and purchased by their special-purpose vehicle (SPV). Interest rates are paid from any proftis generated by the project, and the funds are secured by a mortgage and other collateral (if need be). The Reinvest24 SPV also purchases completed projects to rent out, and users can earn rental shares from those investments.

On occasion, Reinvest24 will lend funds collateralized by property. In such cases, the borrower's property has been assessed as a first-rank mortgage. The Loan-to-Value (LTV) ratio for such loans ranges from 50% and 80%, and most often the borrower is on a short list of developers with which Reinvest24 has cultivated a relationship. NPLs are always secured with collateral, and their LTV never exceeds 60%, making it a relatively safe investment vehicle. Reinvest24 reports an average annualized return (including yield and capital growth) of 14.8%, making an attractive option for anyone ready to invest in long-term projects and loans.

Debitum Network

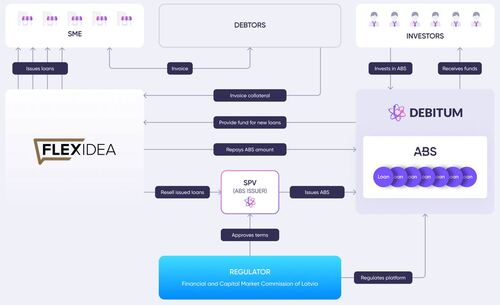

Debitum Network was founded in Latvia in 2018, and has managed to grow into an excellent small-sized p2p platform. Debitum has approximately 4000 registered users, who have invested over €75 million—suggesting a surprisingly high average portfolio. The company only works with 4 loan originators: Triple Dragon (UK), Evergreen Capital (Estonia), Flexidea Polska (Poland), and Flexidea (Latvia). The latter accounts for around 6.5% of all loans, while the majority of loans come from Triple Dragon. The average annual interest rate is over 9.5%, and Debitum reports a zero default rate, stating on their website that "[e]very investment on Debitum has been repaid and no investors have lost their investment."

Debitum works with only four loan originators to issue large scale business loans. Borrowing entities must provide "proof of financial stability," as well as "growth potential" and a clear management strategy. Looking through their marketplace you might be surprised to find dozens of listing for amounts exceeding €250,000. While the minimum investment on the platform is only €50, the first-deposit minimum is €500, making it a platform best suited to premium investors. All loans are backed by assets, with many backed by 3 or more. Debitum prides itself on its 0% default rate, as well as its buyback rate, which is below 1.5% (executed at 90 days).

Rather than offer individual loans, Debitum works with Asset-Backed Securities (ABSs). Simply stated, the platform pools several loans into an "asset," and lists that asset for investment. The upside to this approach is that even in one of the individual borrowers defaults, the total liability of the asset isn't realized. This diversification strategy protects investor capital, and helps explain the platform's 0% default rate. Debitum's interest rates range from 9% to 12%, and they impose stiff penalties for late payment (as high as 18%). Many of the ABSs on Debitum are long-term investments, with some large offerings at over 3 years.

HeavyFinance

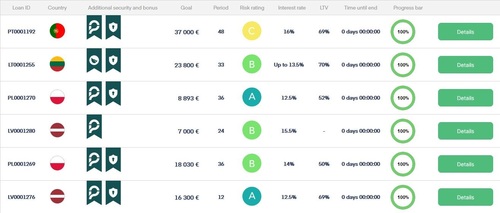

While most p2p lending platforms focus on consumer loans and real estate, HeavyFinance emphasizes agricultural loans backed by land, government guarantees, and farming equipment. The company was founded in Lithuania in 2020, and maintains offices there, as well as in Latvia, Poland, and Portugal. HeavyFinance reports approximately 7000 registered users, including 150 Registered Legal Entities, with an average portfolio of just under €9000. The company has issued over €30 million in loans, and the Weighted Average Interest Rate, as reported on their website, is around 12.5%. HeavyFinance only works with collateralized loans, and reports an overdue rate of 6.6%, which they describe as a "healthy level."

Latvians interested in helping their own country's agricultural industry will be happy to learn about HeavyFinance. The platform provides farmers the funds needed to build, till, harvest, and market their products. HeavyFinance doesn't work with loan originators. Instead, farmers looking for funding can contact the loan division via the website's For Farmers page. Investors can go to the For Investors page, where they'll find tabs for the Primary Market, the Secondary Market, the Auto-Invest, and a special collection of Green Loans, which are eco-friendly p2p-lending options.

The average duration of a loan on HeavyFinance is around 30 months, and the average loan amount is approximately €30,000. Surprisingly, the investor-per-loan average is around 50, meaning most users are ready to put down significant sums of money. That being said, the minimum investment on HeavyFinance is only €100. Investors looks for secure listings can browse the marketplace for the government icon (a small Greco-Roman building with a flag on top and a check mark). The icon appears in the Additional Security and Bonus column, and loans bearing the icon are guaranteed by the Lithuanian Government, making them "as safe as it gets."

n terms of financial security, HeavyFinance is among the safest platforms on which to invest, because a large percentage of the loans are backed by government guarantees

Our Recommended P2P Lending Sites for Investors in Latvia

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Business Loans

Average Returns

8 - 9%

Minimum Investment

EUR 500

Signup Bonus

EUR 20

Registered users

10,000

Total funds invested

EUR 80 Million

Default rate

0%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Debitum Network is an innovative fintech platform that wishes to bridge fiat and crypto into one platform. Debitum Network is a loan originator aggregator with an 8 percent average for investors. Read our analysis on Debitums strengths and weaknesses as a peer-to-peer lending platform.

Market Type

Agri-business

Average Returns

12%

Minimum Investment

EUR 100

Signup Bonus

Prizes

Registered users

8000

Total funds invested

EUR 36 Million

Default rate

3%

Regulating entity

European Crowdfunding Service Providers

Buyback guarantee

Secondary market

Payment methods

Paysera, Lemonway

Withdrawal methods

Paysera, Lemonway

HeavyFinance is a peer-to-peer lending and investment platform focusing on the agri-food market. Read this detailed review to learn whether you should add HeavyFinance to your investment portfolio.

Conclusion

Latvian investors have many great platforms to choose from, both at home and abroad. Many things go into choosing the ideal platform, including the minimum deposit requirements, the estimated returns, the type of loans, and perhaps even a touch of patriotism. If the latter is among the factors that matters most to you, P2PIncome's experts recommend you register for an account on Mintos. The site was founded in Latvia and keeps its offices in Riga. Mintos is licensed and supervised by the Central Bank of Latvia. In addition, Mintos controls over 50% of the European p2p-lending market share, making it one of the most powerful platforms of its type.