Why You Need to Diversify Your P2P Lending Portfolio

P2PIncome - Understanding Risk, Reward, and Diversification

What goes into building a peer-to-peer lending portfolio? Why is diversification so important? Why not simply find a solid investment and put all your capital into it?

To find the answer, we turn to the seminal paper Portfolio Selection, published in 1952 by future Nobel Prize laureate Harry Markowitz. "One type of rule concerning choice of portfolio is that the investor does (or should) maximize the discounted (or capitalized) value of future returns," Markowitz writes. This rule suggests you should simply look for a solid investment, and when you find it, you should put your money into it and wait for the good times to come rolling in. However, Prof. Markowitz issues a stern warning:

The hypothesis (or maxim) that the investor does (or should) maximize discounted return must be rejected. If we ignore market imperfections the foregoing rule never implies that there is a diversified portfolio which is preferable to all non-diversified portfolios. Diversification is both observed and sensible; a rule of behavior which does not imply the superiority of diversification must be rejected both as a hypothesis and as a maxim.

With that bold assertion, Prof. Markowitz begins his argument for what would eventually be known as the Markowitz Model of Modern Portfolio Theory, for which he would receive the Nobel Prize in Economic Sciences in 1990.

The Markowitz Model, for Beginners

Risk Versus Reward

Even without getting into the mathematical complexities of the Markowitz Model, we can easily grasp its premise: Every investment involves "risk," and an investor is not going to blindly accept the risk of losing money without some promise of reward (or "return"). This risk-versus-expected-return profile is what determines the attractiveness of any investment or portfolio. If two portfolios offer the exact same returns, but one entails less risk, logic dictates you choose the portfolio with lower risk exposure. In addition, if the expected return of any one investment doesn't justify its own risk profile, the offering is flawed and you should reject it.

Examples from Day-to-Day Life

The notion of risk versus reward isn't unique to finance. Renowned mathematician and physicist John von Neumann, generally credited with developing the field of Game Theory, proved that risk-reward ratios are found in a vast array of games and human interactions.

In the game of basketball, for example, a basketball player earns 2 points for a standard basket, but 3 for a long-distance shot—a "three pointer." A long-distance shot is implicitly more difficult, given that margins-of-error in trajectory decrease with distance. Given the shot is more difficult to execute, taking the shot logically entails greater risk. Similarly, a boxer seeking a knockout victory must extent their arm enough to generate knockout power. Doing so exposes them to counter-blows. This exposure is the risk, while the knockout is the potential reward.

Most games reward greater risk. If the game offers a perfect risk-reward ratio, we consider the game "balanced." If not, the imbalances in the game soon become apparent and the participants will likely cease to play. It's important to understand that within this framework "Game" Theory doesn't refer to board games and video games, but to any activity involving a desired outcome. Game Theory sees everything from investment to chess to dating to work within that framework.

Diversification

Now that we have a better understanding of risk and reward, we can address the question of diversification. The exposure to risk inherent to any sound investment requires some counterbalance. If all of your money is tied up in one investment, and something catastrophic occurs (variance), you have no options left. On the other hand, if you've spread that same amount over several investments and something goes wrong with one of them, the other investments remain unhindered. The likelihood the entire portfolio will collapse due to unforeseen disaster is very low, and a sound diversification strategy will offset all but the most extreme examples.

Putting It All Together

If an offering requires you to invest 100,000 dollars for a period of 5 years, and promises to earn a total of 0.1% during that period, there's no justification for the investment. You'll make the same amount of money leaving your capital in the bank, where there's zero risk. The returns offered by the bank, where your money is guaranteed by the government, is known as the Risk-Free Rate. Another example of a risk-free investment is a US Treasury Bill (T-Bill), which is also guaranteed by the government. For something to makes sense as an investment it must promise more than the Risk-Free Rate.

But even if you find an offering with a EV greater than the Risk-Free-Rate, you shouldn't put all of your investment capital into it. Instead, you should have several such offerings in your portfolio. Some of these investments should enjoy greater EV (and greater concomitant risk), while others should enjoy only nominally high EV. By doing so, you spread your exposure over many investments, reducing the effects of variance and protecting your money.

Loss Aversion and Risk Aversion

Nobel-Prize winning economic psychologist Daniel Kahneman, along with his long-time associate Amos Tversky, identified the notion of Loss Aversion in their 1979 paper "Prospect Theory: An Analysis of Decision under Risk." They found that most people elect to avoid loss, even when the loss is only perceived and the potential gain is greater than the loss.

For example, when given the choice to accept $100 dollars, no strings attached, versus a coin flip for $300, people are more likely to "take the money and run." To be sure, the expected value (EV) of a $300 coin flip is $150, but the risk of winning $0 is viewed as a "loss" to be avoided. This Loss Aversion naturally leads to a generalized aversion to risk: Risk Aversion.

We find many examples of risk aversion leading to missed business opportunities. In 1984, sports-apparel company Adidas declined an opportunity to sponsor NBA prospect Michael Jordan, believing he was "too short," and that they should keep their focus on the more popular 7-foot-tall players. They were certain such an investment would loss money. As a result, Jordan turn to competing company, Nike, which jumped at the opportunity. They offered Jordan a $25,000,000 contract, and the rest, as they say, is history.

Perhaps even more shocking is the story of Ronald Wayne, who sold his 10% stake in a small company called "Apple" in 1976, for a whopping $1500. Wayne admits to having developed extreme risk aversion due to failure in a previous business venture. Fearing the computer company would fail and his assets would be seized, he elected to walk away from what would eventually become one of the largest corporations in human history.

Quantifying Risk

There are varying degrees of risk to any endeavor, and precisely quantifying risk, reward, and their ratio is a task that requires an advanced degree in the mathematical-economic field of Game Theory. To be sure, some risks are obviously absurd and require nothing more than common sense. Lending money to a borrower with an abysmal credit score is a terrible idea because the only evidence available suggests the borrower will default. But what if the borrower has an unimpressive, yet not "abysmal" score? What if the borrower has a great score but the loan amount threatens to disrupt your financial equilibrium?

The first rule of sound investment is never to investment money you cannot afford to lose. Once you've accounted for expenses, calculated necessary savings, and determined how much you can afford to invest (with the understanding that you could lose all of it), you're ready for the next step: risk-reward valuation.

Realistic Reward Valuation

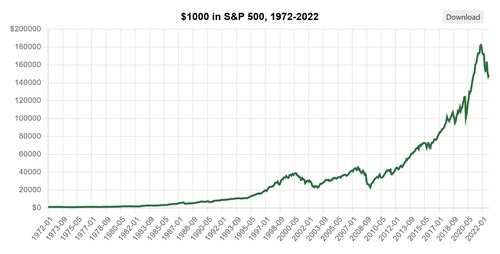

You've gotten your budget in order and discovered you have 1000 dollars you can freely invest. You understand that you risk losing all 1000 dollars but you also understand that over the long term, investments tend to succeed. Someone who invested a $1000 in the S&P 500 in 1972, would have nearly $150,000 by 2022. That's a total return of 15,000%, and even after adjusting for inflation, the return amounts to over 2000%. That a steady rate-of-return of approximately 6.2% per annum, after adjusting for inflation, even though there were several major dips in the market during those 50 years.

An annual rate of 6% is an excellent benchmark for investors, especially those with limited capital. When assessing your risk tolerance, consider 6% to be the starting point. In other words, build your portfolio such that the average estimated rate-of-return across all your investments remains slightly above 6% per annum. That includes all fees and payments you'll dole out in order to maintain your portfolio, such as processing fees, usage fees, and membership costs.

Loan Types

You have 1000 dollars that you can afford to invest. You know better than to invest it all in one place, and you know that an annual rate-of-return around 6% is a good benchmark. What now?

Now it's time to look at loan types, and what each offers. For the sake of brevity, let's compare 3 types of loans: real-estate development, consumer loans, and business loans.

Real-Estate Development

Real-estate development loans tend to offer great security, because they're backed by real assets. If the project fails, there's something tangible to liquidate. In addition, such loans usually include a secondary income stream, in the form of rental dividends and/or capital gains. For that reason, you'll often see higher rates-of-return posted on real-estate platforms than on consumer-loan platforms.

On the other hand, real-estate development loans often tie up your money for long periods of time. If you're hoping to see rental dividends, for example, you'll likely have to keep your money in the project for over a year. While that money is tied up, you won't have access to it, and if you have a true emergency and need those funds (liquidity), you might end up having to sell at sub-optimal prices.

Consumer Loans

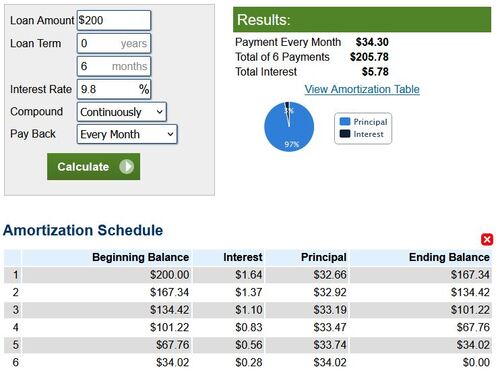

Unlike the real-estate market, which moves at a snail's pace, the consumer-loans market offers quick turnaround. You can easily find 1000 dollars (or euro) worth of small loans with terms (duration) of only a few months. You lend 200 dollars, wait 6 months, and get back the 200 dollars plus interest. The amount of interest is based on the credit-worthiness of the borrower, as per the idea of risk-versus-reward. A 200-dollar, 180-day loan collecting an interest rate of 9.8% will yield approximately 5.78 dollars.

That might not sound like a lot of money, but consider how much those 200 dollars will earn if they're sitting on your desk. Furthermore, if we continue with our 1000-dollar scenario, that amounts to 28.90 dollars (for 5 such loans). Those small sums begin to add up quickly, especially if you continue to reinvest them for over a decade. Moreover, quick loans mean greater liquidity.

Business Loans

Unlike personal consumer loans, business loans are often secured by tangible goods. For example, the business can be liquidated and the revenues divided among the lenders. Sometimes there is equipment of great value that can be seized without having to liquidate the entire company. Some businesses have outside guarantors, or even by the government. The latter is quite common in the farming industry and for eco-friendly projects. Furthermore, some businesses continue to payout dividends after the loan comes to term, making them more like real-estate loans than personal loans.

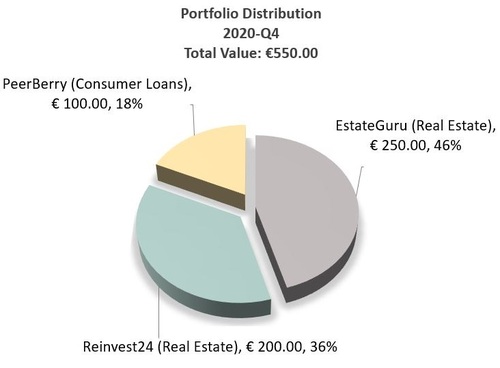

The P2PIncome Portfolio

In late 2020, P2PIncome opened an investment portfolio, the progress of which you can find in the Portfolio Reports section. The portfolio is comprised of 3 top-tier platform: PeerBerry, EstateGuru, and Reinvest24. This diversification strategy recognizes the greater security and higher long-term profits one enjoys from real-estate platforms such as EstateGuru and Reinvest24, while leaving some room for liquidity-positive consumer loans and bridge loans.

To get a better sense of what these sites have to offer, take a look at the P2PIncome Reviews of all three sites, as well as the other top platforms.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

How Our Articles on Loan Purpose Can Help You

As you browse the articles by Loan Type, you'll learn about the best P2P platforms for various types of loans. You'll find real-estate loans, consumer loans, loans for farming equipment, cash advances, and many other types. You'll learn which sites are best for each type, allowing you to diversify as much as you'd like. In each case, the articles conclude with a suggested site, which is the site P2PIncome has deemed best for that loan type. You can select the Go To button to reach that site and begin investment in that loan type.