Peer-to-Peer Lending in the Netherlands

The Netherlands is a great place to be a peer-to-peer lending investor. There are a lot of benefits to investing into an industry that is still new and findings its bearings. Peer-to-peer lending is also becoming a very popular place to invest specifically for youth groups. It's very quick and easy to invest in peer-to-peer lending and the barriers of entry are virtually non-existent. So whether you are from Amsterdam, Rotterdam or Eindhoven, you are in luck, because these are the best peer-to-peer lending platforms you have access to.

PeerBerry

PeerBerry is a fairly new platform that is growing at a considerable rate and has been since it's inception in 2017. Investing on PeerBerry is very simple and ideal for beginner investors. PeerBerry has designed in its ecosystem multiple security levels as well as a sophisticated auto-investing tool. PeerBerry provides investors with 9 - 12 percent whilst also maintaining a zero percent default rate. Most platforms report very low default rates in their beginning years and as the years pass, the number starts to increase.

PeerBerry was formed by a loan originator called Aventus Group, Aventus Group is the primary loan originator that issues loans on PeerBerry. Lending on PeerBerry starts at 10 EUR and is available for investors all over the world including the Netherlands. PeerBerry is a highly active peer-to-peer lending platform that has won several awards in alternative finance conventions.

PeerBerry operates a very well-designed peer-to-peer lending ecosystem. PeerBerry is a loan originator aggregator that hosts multiple loan originators on their platform. Similar to the platform Mintos, but PeerBerry differs from Mintos in a few ways. PeerBerry offers a more fortified security as well as a different business model entirely. PeerBerry only offers a small percentage of the total loan portfolio for any given loan offering. The majority of the lending process is handled by PeerBerry's loan originators, investors are simply reaping the benefits of an already working product. PeerBerry does not offer a secondary market, although they do offer short term loans and dual buyback guarantee. PeerBerry also reports a zero percent default rate and there are no fees associated with investing in PeerBerry.

ReInvest24

Reinvest24 is a new approach to peer-to-peer real estate crowdfunding. Rather than purchase loans backed by mortgages, investors on reinvest24 temporarily purchase the equity from the borrower. This change in payment method provides two things, it provides payment in the form of rental dividends and the chance for the investor to benefit from a growth in capital gains. All real estate equity offers come with a prepared business plan as well as a strategy to ensure the property is sold and capital gains are made. The minimum investment on Reinvest24 is a 100 EUR and yearly returns range from 11 - 15 percent, which is considerably high for being a very low risk platform.

Reinvest24 is one of the first of it's kind in peer-to-peer lending industry. The business model resembles a peer-to-business because many of the projects are rental agencies that are already partnered up with Reinvest24. The peer-to-peer lending platform is still a very small operation with a small investor base. The team discovers through leg work and good relations high value projects which they then offer on their platform.

Reinvest24 is a new platform with a very low default rate. Default rates generally start off good but tend to weaken over time. We have high hopes for the future of Reinvest24, their business model is elaborate and yet easy understandable. We took a liking to the platform and it is one of the platforms that we regularly review in our monthly investing submissions. Reinvest24 also has a secondary market which is highly active. The platform has no buyback guarantee and investors can expect small degrees of cash drag on Reinvest24's platform.

EstateGuru

EstateGuru is a highly used peer-to-peer lending platform. EstateGuru provides their investors a yearly return of nine to twelve percent at a minimum investment of 50 EUR per investment. EstateGuru holds the number one position in Europe in terms of loans, investors and projects for crowdfunding based real estate platforms.

Initially, EstateGuru only offered loans in the Baltic regions of Europe. Nowadays, EstateGuru has expanded to offer loans from all over Europe's property market. These loans come in various forms which determine the pay out, frequency and overall risk of the loan project.

- Hotels

- Apartments

- Condominiums

- Houses

- Malls

- Offices

Each investment is subject to different investing rules and it is recommended for investors to choose the investments they understand best. Otherwise, Estateguru offers their clients an easy to use website, percentage based bonuses on investing and an intuitive auto-invest feature. Unlike their competitors, Estateguru requires higher amounts of investment in order for it to be useful. Investors should have at the very least 250 EUR to use Estategurus auto invest feature. EstateGuru also has a secondary market and all loans are backed by either a first or second rank mortgage. EstateGuru is open to investors from all over the world but due to their European nature we believe that EstateGuru would be a great place for dutch investors to get into peer-to-peer real estate lending.

Mintos

Mintos is a massive peer-to-peer lending platform in Europe and to a large extent the whole world. Mintos processes a billion EUR in loans per year. Having been found in Riga, Latvia in 2015 Mintos has already climbed to the top position of peer-to-peer lending services. Mintos is a loan originator aggregator which means they invite a multiplicity of loan originators to come and provide their loan offerings to Mintos' retail investors.

This marketplace hosted by Mintos is one of the largest, most diverse and well put together. The primary marketplace offers almost every type of loan currently available, at different risk level, minimal investment and location. There are always new loans on Mintos, who are managed by Mintos' loan originator credit system. Furthermore, the peer-to-peer lending platform also a secondary market which is highly active and utilized by investors. All in all, the greatest thing about Mintos is the lack of fees. Investors are only charged for using the secondary market, everything is else is not an added cost to the investor.

Mintos is open to investors around the world and every investment contract on Mintos is accompanied with a buyback guarantee. Loan originators on Mintos are given ratings on Mintos based on their financial statements, as well as user engagement. The more popular the loan originator, the more loans it will issue on Mintos' Marketplace. Mintos is always opening it's arms to investors in Europe, including Dutch investors.

Swaper

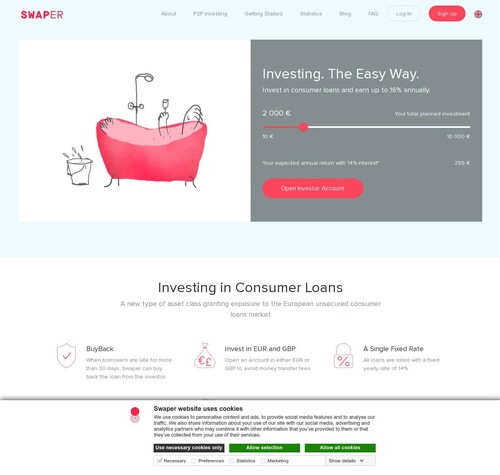

Swaper is a peer-to-peer lending platform based in Estonia owned by Marina Tjulinova and formed by loan originator Wandoo Finance. The platform was created with the purpose of being an easy auto-investing solution for investors who needed a better deal than a savings bank but were disheartened by the copious amounts of time it took to properly invest. Swaper provides only an automated service for investors to earn a 14 percent in yearly returns. There is a 10 EUR minimum to invest on Swaper and returns are roughly 14 percent. Investors with portfolios over 5000 EUR receive 16 percent yearly.

We find it a little strange that Swaper does not offer their investors the option to invest manually. Investors only have an auto-investing tool, which is also rather strange considering that Swaper provides a fixed percentage of either 14% or 16%. Nevertheless, Swaper has a secondary market where you can manually sell and buy the loans that Swaper chose for you for a 2% fee. Other than the fee to use the secondary market there are no fees associated with Swaper.

Swaper currently only services loans from one loan originator, Wandoo Finance. The loan originator is a lending group in Europe that specializes in lending capital to companies that develop financial technologies. Swaper has a zero percent default rate, strong buyback guarantees and a very active secondary market. Regardless of the lack of manual investing we would consider Swaper a great platform for Europeans.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

14 - 16%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

6000

Total funds invested

EUR 400 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Swaper only offers auto investing in unsecured consumer loans in Poland and Spain. Swaper is a subsidiary of Wandoo Finance Group, a loan originator that also services the loans on Swaper's platform. Swaper advertises a 14% IRR and premium investors who have invested over 5000 EUR receive an IRR of 16%.

Verdict

Many of the platforms listed in this guide are great platforms for any European country including the Netherlands. Reinvest24, Mintos and Swaper are impressive platforms, all with incredible strengths that would make any peer-to-peer lending service an enjoyable one. And yet, if we had to choose we would select PeerBerry. Their approach to crowdfunding property is an excellent one with great potential to reap high earnings. We know that PeerBerry is still a young platform but we have concluded that PeerBerry showcases signs of intelligent business decisions, platform management and customer service. PeerBerry is a great platform for Dutch investors, the website operates during Dutch hours, they accept the EUR and abide by EU standards and practices.