The 5 Best P2P Lending Alternatives to Mintos

Diversification is a key component of a great investment portfolio. Whether it's what we invest in, our where we do it, we should never be tied down to just one system, asset, or position. There are myriad peer-to-peer platforms that offer added value, of which Mintos is certainly one. P2PIncome's financial experts have recommended Mintos in the past, and Mintos remains an excellent investment site. Nevertheless, there are other great platforms, and we've taken the time to assess the 5 platforms that best serve as alternatives to Mintos. These sites offer top-tier mobile apps, attractive rates and bonuses, friendly customer service, and other features that justify investing your money on these platforms.

PeerBerry

PeerBerry isn't just an excellent alternative to Mintos, it's a world-class site that ought to be in your portfolio, regardless. P2PIncome's financial experts have been running a sample portfolio for well over a year, and in our end-of-year report for the 2021 fiscal year we discuss our various successes and overall satisfaction with PeerBerry. This easy-to-use platform is particularly good for beginner investors, though it's certainly well-suited to experienced ones, as well. The superb mobile app rounds out a list of impressive features that make PeerBerry one of the top platforms on the European market.

What makes PeerBerry a Worthy Alternative to Mintos?

Our investments in PeerBerry, which began with a deposit of 100 euro, reported stable growth rates throughout 2021. PeerBerry managed to ride out the disastrous Covid Pandemic that ravaged the markets in 2021, and when war broke out in Ukraine in early 2022, they responded immediately by halting all activity in the region, effectively protecting their clients' assets from the fall of the ruble and the effects of sanctions imposed on Russia. This kind of leadership is to be expected from the executives at PeerBerry, as P2PIncome's experts learned when speaking with CEO Arunas Lekavicius.

Facts and Figures

- Annual ROI: 10.86%

- Monthly Funding Volume: € 50 million

- Default Rate: 0%

Standout Feature - Best Mobile App

If you're looking for one standout feature that really makes PeerBerry unique, look to their mobile app, which we selected as the best mobile app among European P2P Sites. Using the app, you'll be able to perform all of the same actions you'd normally perform on the website. The interface is even stylistically similar to the site, which gives it a sense of familiarity for those who have used the site for while. You can adjust the auto-invest tool, study the details of various loans on the marketplace, and investment on the marketplace. You can inspect your portfolio and deposit or withdraw funds. You can also receive timely push notifications, to keep you apprised of the latest in the world of p2p lending.

Iuvo Group

Iuvo Group is an award-winning peer-to-peer and online banking platform that offers a loan marketplace, a secondary market, and the IuvoUp long-term-savings plan. On the Iuvo marketplace, users can purchase notes on small consumer loans (1000 - 2500 euro) from over a dozen European originators, and enjoy an average annual yield of 9.2%. All loans come with a 100% buy-back guarantee. In addition, users can deposit funds into the IuvoUp savings plan, which offers up to 4% annual growth.

What makes Iuvo a Worthy Alternative to Mintos?

In 2020, Forbes Magazine, one of the financial industry's leading periodicals, recognized Iuvo as the Best Company in the finance category. Emphasizing prosperity, creativity, and simplicity, Iuvo seeks "to help" ("iuvo" in Latin) investors realize their long-term financial goals by promoting savvy investment and responsible savings. CEO Ivaylo Ivanov heads an experienced team of finance specialists with a passion for fintech. Iuvo is a registered and regulated site that boasts impressive statistics, including tens of thousands of investors in over 150 countries, offerings in 5 major currencies, and the full backing of their parent company: Management Financial Group (MFG).

Facts and Figures

- Average Annual ROI: 9.2%

- Monthly Funding Volume: € 6.8 million

- Default Rate: 8%

Standout Feature - Best High-Yield Savings Account

In addition to its peer-to-peer lending and investment services, Iuvo operates a savings system on which investors can deposit funds into a high-yield account: IuvoUp. Offering High-Yield, Quick Liquidity, Passive Income, and Short-Term Choice, the IuvoUp program is an excellent way to make sure you get the most out of your cash. According to the site, "IuvoUP aims to entirely change the financial system" by providing users with "an easily accessible way to increase your free capital." The site even provides an interactive savings calculator with which users can estimate their long-term gains.

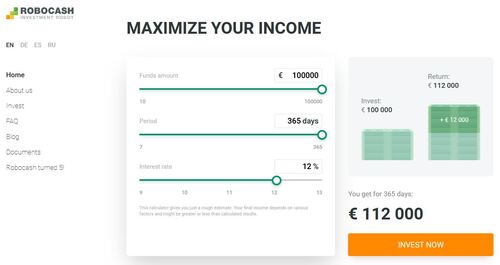

RoboCash

As the name suggests, Robocash is a fintech platform that focuses on fully-automated peer-to-peer lending. Robocash was established in Croatia in 2017, but its parent company, Robocash Holdings, is comprised of 8 companies, with more than 1200 employees worldwide. The enterprise is owned and operated by Dr. Sergey Sedov, a Russian economist and entrepreneur with a doctorate in Economics from the Institute of Economics at the Russian Academy of Sciences.

What makes Robocash a Worthy Alternative to Mintos?

Robocash is part of a larger conglomerate, "Robocash Holdings," which has offices in Spain, Switzerland, Croatia, Russia, Kazakhstan, Latvia, the Philippines, Singapore, Vietnam, and India. Though the platform is only available to users with accounts within European Union (EU) and European Economic Area (EEA), the scope of the holding company's dealings means the lending platform is well-funded and protected in cases of default. The site offers impressive yields, and the platform is intuitive and user friendly.

Facts and Figures

- Average Annual ROI: 12%

- Monthly Funding Volume: € 12.5 million

- Default Rate: 2%

Standout Feature - Best Auto-Tool System

When using Robocash, you enjoy the truest form of passive income. You need only open the account, deposit funds, and adjust the settings to suit your financial goals, and you're done. The platform will take care of the rest, efficiently moving your money through the many short-term consumer loans on the marketplace (ranging from 15 - 60 days). In the process, you should enjoy yields approaching 12% without lifting a finger. You also need not worry about losing your initial investment, because Robocash offers a buy-back guarantee.

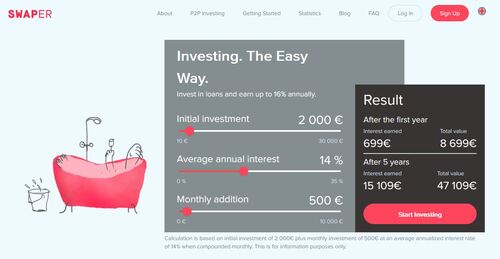

Swaper

Based in Estonia, Swaper entered the peer-to-peer lending market as a subsidiary of Wandoo Finance. Though ownership has since changed hands, the two companies are still linked via the marketplace, which only offers loans originated by Wandoo. All loans on Swaper are listed at the fixed rate of 14%, and investors in the Loyalty Bonus offering yields of up to 16%. The Swaper mobile app is quite good, and automated-investment system makes it easy to earn passive income.

What makes Swaper a Worthy Alternative to Mintos?

Swaper offers some of the highest interest rates in the business. Whereas Mintos averages around 10.5%, Swaper averages closer to 13%, and higher for their preferred customers. Swaper is also the only site on this list that offers investment options in the British Pound (GBP), which can be a plus given how strong of a currency it tends to be. Swaper focuses on short-term loans (max. 60 days), all of which are guaranteed by a buyback system that automatically activates whenever a borrower is more than 30 days late with a payment. Unlike most buyback systems, Swaper guarantees the principle and accrued interest. Swaper also has an active secondary market.

Facts and Figures

- Average Annual ROI: 14%

- Monthly Funding Volume: € 6.5 million

- Default Rate: 8% (est. actual rate undisclosed)

Standout Feature - Best Loyalty Program

There are many sites with loyalty programs, but many of them require large deposits. For example, for 40,000 euro you can join the PeerBerry Platinum program, but in order to enter the Swaper program you only need to sustain a balance over 5000 euro. In exchange for your loyalty, Swaper will add an extra 2% to your yield, taking the total to 16%. If the account balance dips below the 5,000 for longer than 3 months, the user will lose "loyalty" status, but it only takes 3 months over 5,000 to reestablish the status.

EvenFi

EvenFi is a unique platform, in that it emphasizes "social impact" by crowdfunding for local SMEs, particularly those involved in green-friendly infrastructure projects. Based in Italy and licensed by the Spanish Comisión Nacional del Mercado de Valores (CNMV), EvenFi offers a range of loan formats, including lump-payment "bullet" loans, bridge loans, and even custom-tailored loans. In addition to green projects, EvenFi lists a lot of culinary and tourism projects, as well as several fashion-related projects.

What makes EvenFi a Worthy Alternative to Mintos?

While the point of investment is passive income and profit, there's what to said for making a difference in the process. EvenFi doesn't offer the highest interest rates around, but the platform offers an added value unlike any other on this list: social impact. By focusing on projects that will help make the world a better place, such as green infrastructure, educational exhibits, and funding for the expansion of local SMEs, EvenFi has carved out a special place on the p2p market.

Facts and Figures

- Annual ROI: 7.4%

- Monthly Funding Volume: € 1 million

- Default Rate: 7%

Standout Feature - Best Marketplace Format

EvenFi's marketplace is one of the most impressive you're like to see on a peer-to-peer site. Whereas most platforms merely offer a quick listing with the most basic details (amount, term, interest rate), the EvenFi marketplace provides a complete prospectus for every listing. Every project is described in detail, and often includes multimedia and outside lists for continued research. The prospectus lists the Business Idea and how it will be marketed (Marketing Opportunity), as well as the intended Business Model and relevant Milestones. Each project includes a Minimum Target, which must be collected before a set deadline or the offering is terminated. There's even an Earnings Calculator to help you estimate your likely profit.

Conclusion

Each of these sites is worthy of your attention, and each offers unique features. P2PIncome's financial experts have reviewed each of these sites in the past, and continue to recommend them all. That being said, PeerBerry is among the top sites for European P2P lending, and the combination of ease-of-use, mobile app, attractive rates, and longstanding reputation make it our top pick.