EvenFi Reviewed | Socially Conscious Business Lending

EvenFi is an Italian peer-to-peer crowdfunding platform that promotes socially responsible projects and seeks to aid the growth of small-to-medium entities (SMEs). Among their successful projects are the international launch of a local baking brand, funding for an educational-exhibition company that promotes artistic collaborations and informative exhibits, several green-infrastructure projects, and numerous real-estate renovations. EvenFi boasts over 15,000 investors, with a combined total funding volume of over 15 million euro. According to the site, investors enjoy an average return rate between 7.4% and 7.98%, and a max rate of 9%. EvenFi is regulated by the Comisión Nacional del Mercado de Valores (CNMV) in Spain.

In this detailed review, P2PIncome's financial experts assess the EvenFi platform and marketplace, and provide a recommendation.

Types of Loans on EvenFi

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

EvenFi Loan Characteristics

Loan duration4 - 60 Months

CurrencyEUR

Buybacks No

Collateral No

Available inEU

Returns rate7.4%

Default RateUndisclosed

Recovery RateUndisclosed

FeesNone

BonusesNone

EvenFi Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

EvenFi.com Pros & Cons for Investors

Pros

- Regulated

- No Hidden Fees

- Local SMEs

- Sophisticated Marketplace

- Secondary Market

- Few Loans in Recovery

Cons

- Slightly Low Rates

- Platform Languages Limited

- Inconsistent Stats

Investing with EvenFi

It's one thing to earn passive income, but what if you could make the world a better place in the process? What if it were possible to improve the economy while promoting local and socially conscious entities? EvenFi's business model revolves around that very principle. They seek to fund projects important to communities and small-business owners. Whether it's funding for cultural exhibitions that synthesize education and entertainment (so-called "edutainment"), or whether it's providing the capital needed to design and implement energy-infrastructure solutions, EvenFi promotes the financial side of social change.

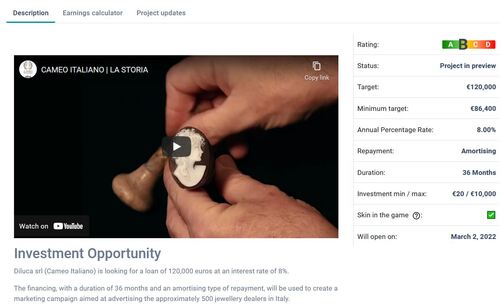

Every project listed includes an Investment min/max option, with the min usually set to 20 euro, and the max ranging from 3000 euro to as much as 10,000 euro. One point EvenFi stresses is that they have skin in the game for every loan they post, because they "believe in the value of the companies" listed on their marketplace.

Types of Investments

EvenFi prides itself on working with small-to-medium enterprises (SMEs) that focus on local sustainability and seek to generate job opportunities in the area. They also fund real-estate renovations projects, particularly those that involve green-energy solutions, such as solar panels. According to the site, the loans range from 30,000 euro to 500,000 euro, though most of the loans are below 150,000 euro. Among the loans granted have been bridge loans for startups, financing for energy-efficiency projects, funding for the international launch of a brand, the purchase of a commercial property, and even a bullet loan for the development of a local amusement park.

The loan structure will depend on several variables, including the company's credit rating, the loan amount, the project itself, and the term of the loan. EvenFi offers the standard amortized loan, with a monthly payment plan, as well as interest-based bridge loans. In addition, they offer bullet loans, where the principle is paid back in full at the end of the project. They even offer multi-bullet options, where the principle is paid back in blocks, usually scheduled to suit the project's milestones and payments rendered by those clients. In certain cases, EvenFi will even custom tailor a loan to the specific needs of the borrower.

Investment Customization Tool

If you prefer to take a hands-off approach to investment, make use of EvenFi's auto-invest tool. Set the tool based on your preferred investment strategy and allow the algorithm to do the work for you. As EvenFi offers various types of loan structures (amortized, dynamic, bullet) you must set the tool to accept or reject each option. You can also decide what level of risk to accept, by including or excluding various credit ratings (A - D), and the desired APR.

Once the settings are in place and you've activated the auto-invest tool, it will continue to work in perpetuity. For example, when a loan comes to term and the investment is paid back, the platform will automatically reinvest your balance, making it the truest form of "passive" income. It's important to note that the auto-invest tool distribute funds evenly, based on your settings, so if you have two sets of preferences you should expect half your money to go to one, and half to the other.

You always have the option to adjust your settings, and it's probably best to do so from time to time. While the idea of totally passive income is nice, the economy is dynamic, and one's economic needs change over time. We suggest you look over your settings every financial quarter, whenever an investment comes to term, and whenever you deposit money into the account. That way you can make sure the settings are inline with your goals.

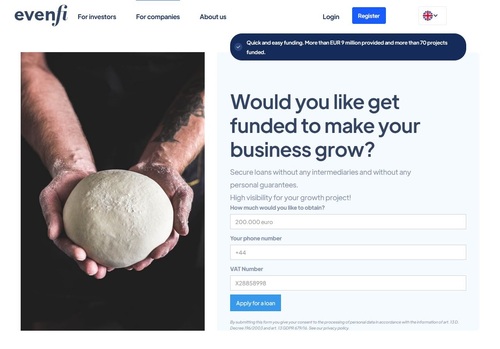

Borrower Data Verification

To start the loan-application process, potential borrowers can fill out a simple online form that only asks for the desired amount, a phone number, and a Value-Added Tax (VAT) number. Thereafter, a representative from EvenFi will contact the borrower to discuss the nature of the loan, including the project type, the loan amount, and the loan structure (amortized, bullet, multi-bullet, etc.), and the term. To move forward, the borrower must provide proof of 3 to 5 years of successful business activity, of which at least the last 2 years were in the black.

EvenFi guarantees a final decision within 2 working days, but it's not clear what percentage of loan applications are rejected. What is clear is that the platform is quite good at filtering out undesirable borrowers. In their first two years of business EvenFi only saw 4 loans (out of over 120) go to recovery, and only 6 faced any late payments. Based on the European Banking Authority (EBA), these numbers are well below the estimated benchmarks for SME loans in the EU's member states.

EvenFi Rates and Returns

Determining EvenFi's exact rates is slightly problematic, because the reported numbers are not consistent throughout the site. For example, the English version reports an average APR of 7.4%, while the Italian version reports 7.98%. That's a non-trivial difference when dealing with large, long-term investments, where compounding interest rates significantly affect the final total. Whether something was lost in translation or whether the various languages are updated at different times is impossible to determine, but we feel comfortable assuming it was a good-faith error given the overall level of transparency on the site.

Inconsistencies aside, the site's general message is clear: They aim for returns between 7% and 9%. Those rates make sense, as the vast majority of the businesses to which they issue loans have a credit rating of B or better. As a result, the interest rates charged are lower than one might see with C or D rated borrowers.

On their statistics page, EvenFi reported an average internal rate of return (Avg. IRR) of 4.13% for 2020 and 6.85% for 2021. These numbers were net of risk, meaning they account for the estimated potential losses due to default. During that same period, the number of projects leaped from 23 to 97, with a combined total lent amount of over 12 million euro.

Who is EvenFi?

EvenFi is an Italian crowdfunding platform launched in 2020 after the rebranding of blockchain company "Criptalia," which has been founded in 2018. EvenFi shifted to peer-to-peer lending "with the aim of democratising finance through technology." Their stated mission is "to create a new financial structure simpler, free and decentralised." To that end, they invest in growth projects, with the hopes of "having a positive impact on the real economy."

Lender/Borrower Ecosystem

EvenFi's sphere of influence is relatively limited. They issue loans in Italy and Spain, focusing on the large SME market, as well as green infrastructure projects. Businesses can contact EvenFi directly to apply for a loan, either via the online application process on the website, or via phone call/email. Once a loan has been approved, it is placed on the Projects Preview list on the Marketplace page, where investors can study the Description to determine whether the project suits their interests.

On their website, EvenFi proudly proclaims that they invest in every project listed, but the exact amounts are undisclosed.

General Data

| General | Data |

| Origin | Italy |

| Founded | 2018 |

| Offices | Via Monte Sabotino 2 24121 Bergamo (Italy) |

| Loan Type | Business |

| Sign Up Bonus | None |

| Fees | None |

| Interest Rates | 7.4% |

| Min Deposit | € 20 |

| Investment Duration | 4 to 60 months |

| Secured Lending | No |

| Currency | Euro (€) |

Registration & Withdrawal

To open an account on EvenFi, simply select the Register button at the top of the homepage. If the button reads "registrati" then you're on the Italian version, which you can switch to either English or Spanish by changing the flag to the right. Provide your first and last names as well as an email, and set a password. Once you've verified your age and email you will be prompted to complete your profile by adding a phone number and address. You will then need to agree to the EvenFi terms & conditions and verify your identity.

Next, you will need to Select Investor Type, choosing from Individual investor, Business, Organization, and Soletrader. You must have a European bank account to move money to and from EvenFi but that can be a Wise account. EvenFi also works directly with MangoPay to secure the payment and withdrawal process.

Residents of Italy will have the taxes on profits automatically withheld and reported, saving them the time and energy. Residents of other countries are responsible for their own tax reporting.

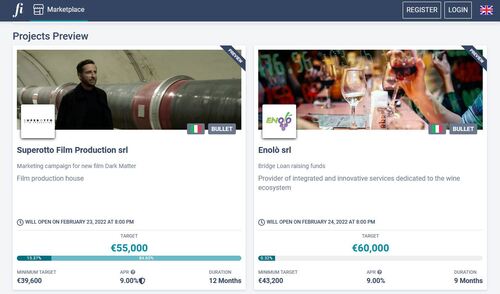

Marketplace

The EvenFi Marketplace is an impressively sophisticated feature we'd love to see implemented by other p2p platforms. Rather than a bland listing of loans, EvenFi provides a complete prospectus on every project. The information provided includes a general description of the Investment Opportunity, followed by the Business Idea, the Marketing Opportunity, the Business Model, the Milestones reached by the business prior to the issuance of the loan, the current Management overseeing the project, and the project's Financial Projections. On occasion, EvenFi uploads a marketing video, as well as relevant links.

To enter the Evenfi Marketplace, simply select the Select the Go to the Marketplace button on the homepage. There you will find a list of every project approved by EvenFi going back to their rebranding from Criptilia to EvenFi. The list begins with Active Projects, which are projects currently in the process of collecting funds. Next are the Project Previews, which are those listings yet to begin collecting funds, but ready for investor interest. Completed projects are then listed chronologically in the Closed Projects section, with each project labeled either Terminated or Success.

A loan is Terminated when it fails to reach the Minimum Target within the allotted time. A loan is considered a Success if it does reach the minimum, at which point the funds are released while the listing continues toward the Target amount. On occasion, you will notice a Terminated loan has been reregistered, and on a few occasions the second attempt has succeeded.

Next to the Description tab is the Earnings Calculator, where users can approximate their potential income from the loan by entering any investment amount over 20 euro and below the max for the loan. The calculator produces an amortization chart that includes the Payout Number, the Date, the Principle paid, the Interest paid, the Total paid, and the loan Balance. Lenders can also go the Project Updates tab and track the progress of their investment.

Risks Involved

Transparency & Security

The EvenFi website is SSL secured, with a certificate from BitDefender, one of the top cybersecurity companies in the world, serving more than 500 million systems around the world. In addition, EvenFi adheres to the EU's cybersecurity policies, privacy policies, and data-protection policies.

EvenFi updates their statistics quarterly, and provides contact details for reaching their CFO. Criptalia, and by extension, EvenFi, is registered with the Comisión Nacional del Mercado de Valores (translation: National Securities Market Commission) in Barcelona. This government agency is directly charged with financial regulation of the securities market in Spain, under the direction of the Ministry of Economy.

This commission is a member of the Committee of Europeans Securities Regulators, which oversees the relevant markets for the EU.

Crisis Management

EvenFi managed not just to "survive" the Covid Pandemic but to thrive. The company posted impressive growth during one of the most difficult global crisis in recent history. They funded scores of new projects, and while several of the early attempts were terminated, EvenFi eventually adjusted and began to see profits well beyond the previous year. Though one can only draw so much from the above, it stands to reason that EvenFi is well-suited to the dynamic nature of the lending business.

Our Readers Have Asked:

Is it safe to invest with EvenFi?

All investments carry inherent risk, and the potential profitability of any investment is proportionate to that risk. That being said, EvenFi takes great care with their loan offerings. They handpick borrowers with excellent credit ratings, and they tailor loans to mitigate losses. EvenFi has performed very well since its founding, and there is every reason to feel safe with them.

What minimum credit score needed to get a loan from EvenFi?

In Europe, credit ratings are listed on an A-through-D scoring system, rather than the American numeric system. Most of the loans listed on EvenFi are B+ with the occasional C appearing at an interest rate of 9%.

Which credit bureau does EvenFi use?

Credit bureaus are an integral part of the American financial system, which is why many people are surprised to learn they aren't used in Europe. That's not to say there are no credit-assessment agencies or protocols in Europe. Rather, the process by which credit and borrower worthiness are assessed in Europe is based more on bank history, with a lot of weight given to the borrower's monthly income and current debt.

How to become an investor at EvenFi?

To invest on EvenFi, you simply need to open an account, deposit money, and start investing. To do so, you must have an EU bank account.

How much money will I make?

On average, EvenFi investors enjoy 7.4% returns, with the XIRR hovering around 6.5%.

What are the risks?

The main risks are opportunity cost and late payments, while there is always the (unlikely) risk of a default and loss of capital. As such, you should always assess your personal risk tolerance before investing any money.

Why do I need to submit ID verification?

The goal of the "know your customer" (KYC) process is to prevent fraud. Peer-to-peer lending platforms request personal information so they can be sure they are dealing with a real person, and that they have that person's permission to proceed with a loan or investment. Platforms can't risk lending tens of thousands of euro to a fake profile, and you certainly don't want someone borrowing or investing money in your name without your permission. By requesting photo ID, bank details, credit histories, and other relevant information, everyone can feel certain the process is legitimate.

Furthermore, EvenFi is a regulated entity that must adhere to the laws of its jurisdiction. As such, they must make sure the investor has the legal right to invest money on their platform. The EU has restrictions on various types of investments, embargoes on certain countries, and tax laws that must be followed. All of the above are mitigated by careful KYC processes.

Is P2P Lending a Ponzi Scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies. P2PIncome's financial experts make it a priority to identify and review the most reputable organizations, and we follow up to make the companies remain legitimate.

Where is EvenFi Located?

EvenFi has offices in Bergamo, Italy and in Barcelona, Spain. They also have a social-media presence, on Twitter, Facebook, and LinkedIn.

Verdict

EvenFi has posted impressive overall growth since its inception, particularly in terms of total investors and total funds invested. Their model attracts investors for whom gains and social impact are equally important. Their emphasis on local SME's translates into a vast array of diversification opportunities for investors interested in quick, mid-yield-loan notes. The platform is very transparent, providing detailed information about every loan and the people behind the project. It's true their reported yields are slightly lower than some other sites, but all-in-all they're a platform we feel comfortable recommending.