Learn How to Use Wise to Fund Your P2P Lending Accounts

When investing money in the peer-to-peer market, you'll obviously need to have a way to transfer funds to and from the platform and your bank. However, not everyone is comfortable linking their personal bank account to an online platform, no matter how trustworthy the site. Furthermore, bank transfers can be rather costly, with fees sometimes exceeding 5% including currency-conversion fees.

The use of a "buffer" platform like PayPal is an excellent way to mitigate the risks associated with sharing personal information, as well as the costs levied by banks and credit-card companies. Unfortunately, PayPal isn't an option for p2p transactions in Europe, which is why the experts at P2PIncome have decided to help you learn about an alternative you can use for your investments: Wise.

Formerly known as "TransferWise," the company was established in 2011 to fix international money transfers for all of us who’d been overcharged and underserved by banks. Over the next decade, Co-founder and CEO Kristo Käärmann realized the company was expanding into something far more complex, and in later February 2021 he announced the official name change to "Wise," explaining that their new name "our name catches up with who we’re already building for — a community of people and businesses with multi-currency lives."

Thought it prefers to call itself an e-money institution, the Wise platform offers a complete online-banking experience, from a credit/debit card, to a legally licensed European account with an International Bank Account Number (IBAN), access to over 40 currencies, and 24/7 customer support in several languages. Wise charges minimal fees compared to other online banks, and their conversion rates are competitive.

The Registration Process

Opening and account on Wise is rather straightforward. Once you've landed on the homepage, look for the Register button at the top of the page. If you prefer a different language, you're in luck. The site supports over a dozen languages, including German, French, Russian, Turkish, Japanese, and Hungarian. Having selected your languages, select the Register button, which will take you to a page with two options: registration via email or automated log in via Google, Facebook, or Apple.

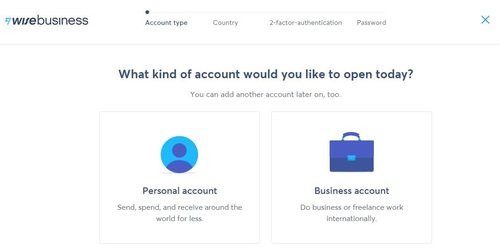

Account Type

Wise is licensed and regulated in each country of operation, which means it answers to various sets of laws at once. This will affect the way you bank with them, depending on your residency and the countries with which you work. It will also affect the type of account you have. For example, you'll have to decide whether you want to open a Personal Account or a Business Account.

The main difference between the two accounts is which currencies you can use and what restrictions are placed on them. For example, Wise does not offer Business Accounts for the Brazilian Real, and you can only send money to one specific bank in Ukraine, and it must be a private account. Similarly, some countries have strict embargoes on other countries, so you won't be able to transfer funds between them. Lastly, Wise Business does not deal in certain restricted trades, such as the adult industry, alcohol and tobacco, gambling, pharmaceuticals, firearms, and other activities that requires strict licensing and oversight.

While this litany of restrictions may seem complicated, it's important to remember that Wise answers to several regulatory agencies in the US, UK, and EU, which also means your money is perfectly safe. It's also important to remember that you can open more than one account on Wise, so you're not making a lifelong commitment when selecting an account type.

Residency

Once you provide a login option (email or social media), and selected the type of account you want to open (personal or business), you'll be asked to select Your country of primary residence from a dropdown list. For legal reasons, it's important to be accurate about your residency. The EU, for example, has a set of laws knows as anti-money laundering and countering the financing of terrorism (AML/CFT) to which Wise and its users are answerable. The United States and UK have similar sets of laws. Therefore, if you are a resident of more than one country you might need to consult an attorney on how to proceed.

2-Factor Authentication

Having selected your country of residence, you'll continue to the 2-factor authentication set-up. This involves providing Wise with your phone number, which Wise will use to contact you whenever you want to enter you're account.

Why is 2-factor authentication important?

Security is always a concern when it comes to money. Sometimes we're a bit lazy when it comes to passwords. We use things like our birthday or our license-plate number, because we don't want to forget the password. Unfortunately, this makes it easy for people to hack into our accounts. By adding our phone number, we add a layer of security. Whenever someone tries to enter your Wise account, the platform's authentication system contacts you directly, via SMS, phone call, or push notification on the app. To enter the account, the person would have to have direct access to your phone, which means your money is safer.

What if someone steals my phone?

P2PIncome experts recommend using the biometric-entry options on your phone, such as facial recognition or finger print. That way, even if your phone and password are stolen, the hacker will not have access to your Wise account. Obviously, you need to take immediate action to secure your accounts, just as you would if you've lost your purse or wallet.

Personal Details

Before you can deposit funds into your new account, you'll have to enter some personal information, including your full name and current address. You can edit these details at any time by selecting the Edit details button. Having completed this step, you are now a registered Wise user, and can start using your new account to send and receive funds, convert money to various currencies, and of course fund your p2p activities.

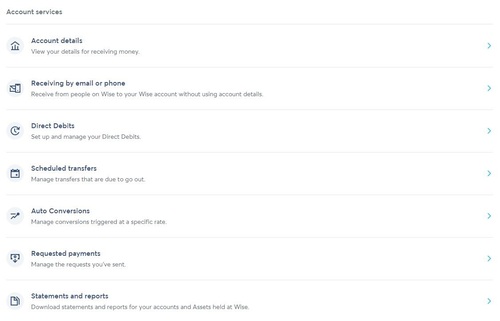

Depositing Funds

Now that you have an account with Wise, you can start using it to fund your online monetary activities, including all of your peer-to-peer investments on various platforms. To do so, select the Get started link on the homepage, and then select Let's go on the Get started with balances page. You'll see a Choose currency dropdown list on which you can select from over 40 currencies, including all the major currencies: US dollar, UK Pound sterling, Euro, Japanese Yen, and the UAE dirham.

Keep in mind that not every currency operates the same way on Wise, and you'll need to learn the rules for each currency as you go. To help, Wise has pages devoted to each and every relevant currency, so you can determine how to work with that currency, how to convert it to other currencies, and how to send and receive funds in that currency.

Balances

Each currency you use on Wise will have its own Balance, all of which will be listed along the side of your homepage, for quick and convenient tracking. You're allowed to open numerous Balances, and you'll be able to transfer money from one Balance to another while paying zero fees and enjoying one of the lowest conversion rates available.

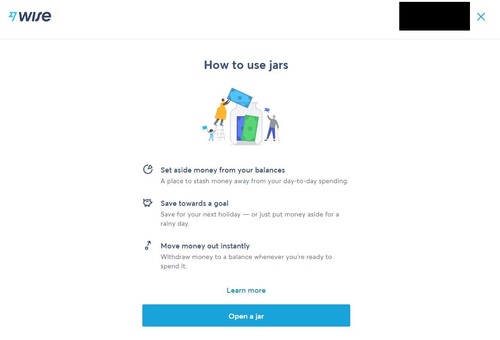

Jars

In addition to your Balances, you can open Jars, which Wise defines as a way to "stash money away from your day-to-day spending." Your money won't be locked into a savings account, and you can "move money out instantly," but you won't be able to spend it using your debit card or direct payments, which means it's protected against impulse purchases. As with Balances, Jars are currency specific, and if you take some time to study the market, using the Jars can be a great way to benefit from currency fluctuations.

Peer-to-Peer Platforms

Your Wise account will give you access to several of the best p2p platforms on the market, including Reinvest24, Iuvo, PeerBeery, and October, where you can earn passive income from several types of investments. Reinvest24, for example, deals in real-estate equity notes, while October deals mostly in business loans. Iuvo and PeerBerry aggregate loans from various originators.

Once you've linked your Wise account to any of these platforms, you'll be able to transfer funds to and from the platform and your Wise account.

Verdicts

Best Real-Estate P2P Platform

While all of the platforms we've mentioned are excellent, we highly recommend Reinvest24 for anyone who's interested in the real-estate market. P2PIncome's financial experts invested 200 euros on Reinvest24, to get hands-on experience with the site. In our end-of-year report, we posted the results for 2021, during which we earned over 12% in returns. Add to that the inherent security of an equity-based investment, and Reinvest24 outranks all other p2p sites covered by P2PIncome.

Best Loan-Originator Aggregator

Despite being relatively new on the p2p scene, Iuvo has already received some impressive awards and accolades. Forbes Magazine, which is undoubtedly one of the world's foremost financial publications, selected Iuvo as "best company in the finance category for 2020." Iuvo is wholly owned and funded by Management Financial Group, and has over 250 million euros in total investments. If you prefer investing in personal loans over real-estate, this is our top recommendation.