P2PIncome | An Interview with Reinvest24's Tanel Orro

Getting Acquainted With Reinvest24

We were able to get in touch with Reinvest24's CEO, Tanel Orro, to find out what he thinks of the current peer-to-peer lending market and its trends. Tanel had some valuable insights on where he thinks peer-to-peer lending is going, along with advice for new and seasoned investors.

But before we get in to the interview, let's briefly discuss what Reinvest24 is. Reinvest24 is a new style of peer-to-peer lending. Rather than simply selling loan contracts, they sell temporary real estate equity. This equity comes in the form of partial ownership of a piece of property and it is accompanied by a business plan that attempts to bring back two forms of returns. Investors on Reinvest24 earn from rental yields and capital gains as a consequence of holding equity. Reinvest24 works with several partners around their local offices, in Estonia, Moldova and Spain.

Their local partners vet the real estate market for good value properties that could yield high amounts. After acquiring such properties, they renovate and do what's necessary to also increase the value of these properties for the intention to sell them. Reinvest24's team does sell these properties, although it's not always guaranteed. When able to sell the projects listed, the yields can jump from 8 percent to 15 or 16 percent in yearly returns. There is a 100 EUR minimum deposit to invest with Reinvest24 and average returns range from 14 to 15 percent in interest per the fiscal year.

Interviewing Tanel Orro

Q: What makes Reinvest24 more secure than other peer-to-peer lending sites?

Reinvest24 is best known for its unique rental projects, where investors have the opportunity to invest in real estate loans, benefiting the same way as owning a percentage of the property. We developed this concept a lot and recently comprehensively explained its benefits, as well as securities in these two blogs on Rental Projects - part 1 and part 2. I would really suggest You get acquainted with them, as it explains everything really well.

Apart from the things that we mentioned there, we work only with projects that have collateral. To date, the default rate of our projects remains to be 0% and even during the COVID-19 pandemic, we were able to exit numerous projects, generating an average return of 14.8% per annum to our investors.

Q: How are you able to provide above market interest rates while maintaining a low risk record?

The interest rates like this don't come out of nowhere. That's why we are searching for the projects in the developing markets and locations that have potential for price growth. Take a look, for example, at Moldova. The country is 10 to 15% behind The Baltics, in terms of its development, which leaves a big space for the increase of property prices. And our estimations were right, as the real estate prices in Chisinau increased by 4.2% compared to the fourth quarter of last year.

Besides, we personally manage the majority of our projects, which allows us to cut the expenses as much as possible, without saving on the quality of materials we choose.

Q: What is the environment like at Reinvest24's office? Is it a comfortable chill vibe environment or fast-paced?

The Reinvest24 team is unique in a way of providing a complete freedom of choice for our employees. We are an international team and therefore our employees have a possibility to work from their homes or enjoy the true beauty of the quite trendy nowadays concept of workation. For example, our Head of Marketing was working half of the year from Tenerife, balancing between our daily operations and catching breathtaking surfing sets.

Of course, we also have beautiful office premises in Spain, Valencia, in Moldova Chisinau and in Tallinn, Estonia. The last one is our main office and is located in one of the projects that we currently finance - Kadrioru plaza. This building is quite unique as it has all the services you normally would need for a living - bank, legal offices, art gallery, beauty corners, restaurant, office spaces and exhibitions.

Q: What does Reinvest24 hope for the future to look like regarding the platform?

We are in the final stage of becoming a regulated market participant. We strongly believe in a secured investment environment, therefore we did not see any other possible development for us. Apart from that we are planning to expand to Moldova with our own operations and overall strengthen our presence on all 5 markets we are currently working on. Additionally, we plan to introduce website improvements, such as a new overview of projects, statistics page and investor's cabinet, as well as introduce the loyalty program.

Q: Do you at Reinvest24 feel that there is quality competition? Such as EstateGuru, October or PeerBerry?

I do believe that for every product there is it's own target audience. I would say that In the p2p world, there is no such thing as a traditional way of competition, as many investors are diversifying their portfolio, using a couple of platforms and not just one. The industry has developed a lot during the past years and taking into account that the long-awaited regulation will come into force later this year, it will strengthen the alternative investment industry even more. By that, I mean that there will be fewer market participants, but those who will stay, will become the masters of their products and services provided.

Q: What are your thoughts on crypto/decentralized finance? Do you believe that this market will pose a risk to the peer-to-peer lending industry?

We are following how the cryptocurrency market is evolving and find this asset class very volatile and quite unpredictable. At least the current stage of it. However, it does not mean people cannot earn money on it. As per real estate investments, a lot of money is invested in real estate, maybe even the most. As mentioned above, it is also considered to be a safer form of investment. Everyone might agree that housing, industrial buildings, warehouses, shops and service spaces are constantly being added and therefore demand increases worldwide.

Smart investors will definitely keep a large fraction of their portfolios in real estate, in addition to other financial instruments.

Q: Do you feel that the interest in peer-to-peer lending is growing?

The interest is definitely growing day by day as it is a developing industry. So is peoples' education about finance, investments and passive income tools. The willingness to afford a better life will always drive people to explore and learn new things.

Investing in peer-to-peer lending, as well as any other financial instrument, has its own ups and downs. For example, the demand and interest were quite high before the Covid pandemic. In 2020 the market was really shaken by the defaults of numerous platforms, which greatly damaged the trust of even reliable platforms. Right now, it is coming back to the previous levels, speeding up and attracting more and more professional investors.

Q: Are there any developments coming up for Reinvest24? Or any other news that their investors may be interested in hearing?

We have just announced an exciting partnership with our developer, which will bring great developments to our platform in the near future. The ultimate goal of the platform is to provide the safest real estate investment environment. With this in mind, recently we introduced an exclusive opportunity to monitor the construction of Moldova's development projects in real time, making Reinvest24 the first to provide it to its investors.

Investors now can view the live streams of security cameras from construction sites and see how buildings are rising. The live broadcast takes place around the clock and can be viewed on the Reinvest24 blog, where a separate article is dedicated to each project.

What Do We Think About Reinvest24?

Reinvest24 is still new in comparison to most of the peer-to-peer lending platforms. They still do not process as many loans as PeerBerry or Mintos. But in the time they have operated, they have been low risk, and provide very favorable returns. In our own personal experience, we have found that Reinvest24 is a great platform with consistent yields. We document Reinvest24 in our monthly reports where we personally experience the platforms we review. We have found Reinvest24 to be very interesting, primarily because of the two forms of earnings. The rental dividends are part and parcel of any real estate crowdfunding platform, but the idea of capital gains has piqued our interest.

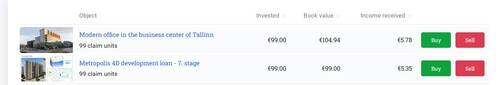

Our ReInvest24 investing portfolio:

The idea of selling temporary equity so that investors may benefit from the gains in value of the property is impressive. It's also never been done. Reinvest24 will definitely redefine the way we crowdfund property. Every project on Reinvest24, despite there being only a few, is of great value. With every piece of property there is a clearly defined business plan to receive regular interest and capital gains. However, the capital gains are not always guaranteed. In our sixth monthly report for the year 2021, on investing with Reinvest24, we document an increase in capital gains on one of our loan contracts.

Verdict

We really like Reinvest24. They have a well-thought-out business plan that has proven itself to work. Reinvest24 provides a great deal of security while still providing above market interest rates. Reinvest24 is still a newer platform than most and yet, they have made great strides to becoming a popular, regulated ,well-functioning ecosystem. After our interview with Tanel, we see that Reinvest24 is in good hands with a CEO who leads with clarity and rationality.