YieldStreet Reviewed | The Pinnacle of Alternative Finance

Founded in 2015 by Milind Mehere (now a member of the board) and Michael Weisz (CEO), Yieldstreet is elite peer-to-peer platform offering a vast array of investment opportunities to accredited American investors. Whether you're looking to invest in real-estate, cryptocurrencies, art, car-insurance, resorts, or a diversified fund, Yieldstreet is ready to take your call. The platform boasts over $4 billion dollars funded, allowing its more than 400,000 users to earn 9.7% in annualized returns. Over 90% of Yieldstreet investors enjoy returns within 0.5% (or better) of their target.

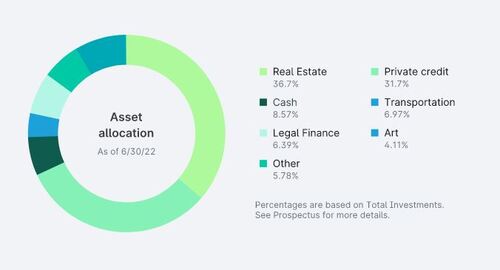

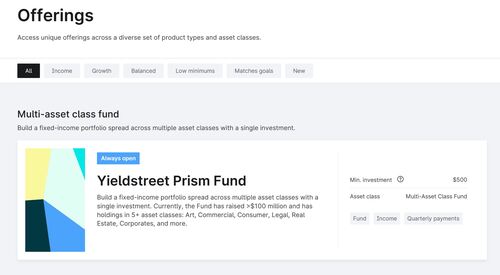

To further broaden access and "generate income by investing across multiple asset classes," Yieldstreet initiated its Prism Fund, which is open to unaccredited users. The fund has over $100 million in assets under management, despite the relatively low minimum investment of $2500, and reports a distribution rate of 8%. Yieldstreet also offers an IRA that facilitates alternative investments, charging only a flat account rate, rather than transaction fees. This is p2p at its very finest.

Types of Loans on YieldStreet

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

YieldStreet Loan Characteristics

Loan duration6 - 36 Months

CurrencyUSD

Buybacks Yes

CollateralYes

Available inUSA

Returns rate8 - 15%

Default Rate2.5%

Recovery RateUnreported

Fees2.5%

BonusesMax. USD 2000/Quarter

YieldStreet Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Yieldstreet.com Pros & Cons for Investors

Pros

- SEC-Regulated

- Extensive Diversification

- Digital Wallet

- IRR of 9.7%

- Prism Fund and REIT

- Self-Directed IRA

Cons

- Only Open to US Citizens

- Requires Investor Accreditation

- High Minimum Investment

Investing with Yieldstreet

Yieldstreet is a multidimensional platform offering investment opportunities across a wide range of sectors. The platform is open to all US citizens, though there are state-level restrictions you should investigate before committing your funds. In addition, the platform requires accreditation for all investments other than the Prism Fund and Growth & Income REIT options.

To receive accreditation you must prove you qualify based on either income, net worth, or licensing. The minimum income requirement is $200K a year for two consecutive years, or a joint income over $300K. The minimum net-worth requirement is $1 million (individually or jointly), not including primary residence. Lastly, anyone with a Series 7, Series 65, or Series 82 in good standing can apply. Accredited investors have a vast array of options on Yieldstreet, including real-estate and development, cryptocurrency, insurance financing, art, supply-chain financing, legal finance, and short-term notes.

Investors without accreditation have the option to invest in the Prism Fund, which Yieldstreet markets as "an income-generating alternative investments portfolio for everyone." The minimum investment in the fund is $10,000, which might seem like a lot, but the other options have even higher minimums. The fund offers quarterly distributions, which are automatically reinvested unless one opt-out in favor of cash. Quarterly liquidation-options are available with board approval, thereby ensuring liquidity. There is a 1.5% fee on invested funds, but no other fees or hidden costs.

Types of Investments

Yieldstreet lists numerous types of investments, and savvy users should have no trouble constructing a portfolio suited to their financial goals. You can select from a long list of short-term note series, REIT, cryptocurrency funds, insurance financing funds, blue-chip art, supply-chain financing, and legal financing. You can also buy into a diversified fund with income structured notes with varying characteristics, and underlying stocks from major names, such as Target and Goldman Sachs.

Auto-Invest Tool

Yieldstreet doesn't have an auto-invest tool, in the traditional sense. In other words, there's no Yieldstreet tool that automatically takes your money and invests it in a new offering. The only thing of that sort on the platform is the cash-out/reinvest option on the Prism Fund. Meaning, when the Prism Fund quarterly payout takes place, you can choose either to have those moneys automatically reinvested into the fund, or you can cash them out.

What Yieldstreet does have is a program, called the AutoInvest Program, that automatically informs participants about new offerings. The notifications are based on investor criteria, but the tool doesn't actually invest the money for you. It merely informs you of the opportunity in advance of the official announcement. If you do decide to invest, the funds are immediately withdrawn from your Yieldstreet Wallet account.

In Yieldstreet's defense, their dealing with investors ready to put up tens-of-thousands of dollars, and those kinds of investors are re usually interested in a hands-on approach. As for the unaccredited investors, they're either investing in the Prism Fund, which is a managed fund, or they're investing in REIT. We supposed the latter could theoretically offer a traditional auto-invest tool, but it would be hard to justify the capital expenditure for such a minor segment of the platform's activities.

Borrower Data Verification

Yieldstreet gleans its offerings from three sources: Origination Partners, Direct Borrowers, and Brokers and Bankers:

When selecting Origination Partners, Yieldstreet investigates how long the entity has worked in a given market, and how successful the entity has been therein. They look at appreciation, interest payments (amount and consistency), and of course principle repayment. The check to see how the originator handles problematic loans, whether they're able successfully to renegotiate terms, their default rate, and general crisis management. Yieldstreet is only interested in top-tier originators with which they can cultivate a long-term working relationship.

For each asset class, Yieldstreet has different standards, based on factors such as loan-to-value (LTV) ratio, duration, and attributes unique to that class. For example, the volatility innate to cryptocurrencies versus the long-term nature of investing in blue-chip art necessitate varying standards. Similarly, the short-term notes can't possibly be assessed the same way as a residential real-estate project. Yieldstreet looks for originators with proven authority in their asset class. To quote Mitch Rosen, Senior Director of Real Estate for Yieldstreet, "[W]e want to focus with that particular originator in what they're best at."

On occasion, Yieldstreet will lend money directly to entities "underserved or ill-equipped to engage with traditional lenders." In those cases, the borrower's creditworthiness and the purpose of the loan are assessed by Yieldstreet, to determine whether the loan is feasible, and if so, under what terms? In addition, Yieldstreet is in touch with numerous Brokers and Bankers who have regular access to investment opportunities. Note that on average, Yieldstreet rejects the vast majority of propositions: as much as 90%, according to some estimates.

Yieldstreet Rates and Returns

Yieldstreet reports net annualized returns of approximately 8.2%, not including short-term notes. It's important to keep in mind, however, that specific asset classes enjoy different returns. For example, blue chip art tends to appreciate slowly, while short-term notes, by definition, come to term quickly. It's really not reasonable to compare the two. A savvy investor will diversify a portfolio to account for various rates of maturation, interest, return, and liquidity. Alternatively, one can elect to hand control over to Yieldstreet by investing in one of their diversified offerings.

Who is Yieldstreet?

Yieldstreet is an award-winning American alternative-investment platform founded by Milind Mehere, currently a board member, and Michael Weisz, the current CEO. The uniqueness of Yieldstreet is in its "mission to expand access" to the world of high-end investment. The company's founders identified a serious gap between the investment opportunities open to the ultra-wealthy versus the average investors. To bridge that gap, they created a platform that allows middle-class investors access to the "same investment products used by hedge funds."

In addition to all of the investment opportunities, Yieldstreet is a world-class resource for anyone seeking to learn more about finance and alternative investments. The site has dozens of blog posts, videos, and even a podcast. Learn about Distribution Waterfalls, Tail Risk, Blockchains, and the difference between Absolute versus Comparative Advantage. The Investing 101 section is particularly helpful for those just starting out.

On the other end of the spectrum, if you have deep pockets, Yieldstreet has a Diamond program. The program is open to anyone with an investment balance of $500,000 or more, and offers perks such as a Fee-Free IRA Account, Early Access to certain offerings, and invitations to exclusive events.

General Data

| General | Data |

| Origin | USA |

| Founded | 2015 |

| Offices | 300 Park Avenue 15th Floor, New York, NY 10022 |

| Loan Type | Various |

| Sign Up Bonus | No |

| Fees | 1.5% |

| Interest Rates | 8% to 15% |

| Min Deposit | $10,000 |

| Investment Length | 1 month to 5 years |

| Secured Lending | Yes |

| Currency | USD |

Registration & Withdrawal

There are several phases to the registration process, starting with opening an account. You can elect to answer their questionnaire first, after which they'll build you a custom Dashboard, or you can simply open an account via Google, Apple, or email. Once you've done so, you will have to undergo a Know Your Customer process like those required by all other investment platforms.

If you're an accredited investor, you'll have to provide all the relevant paperwork, including bank statements, asset statements, investment-property proof of ownership, IRA/401k statements, and a credit report. If you are seeking accreditation based on license, you can simply give them your CRD number and proof of identify. Note, that if you're not going to prepare the paperwork yourself, you must use either a CPA, an attorney, a licensed and registered SEC/FINRA broker, or a licensed investment advisor. You will need to update your accreditation every 5 years.

Marketplace

The Yieldstreet marketplace lists Offerings in 5 financial categories: Income, Growth, Balanced, Low Minimums, and Matches Goals. Each category includes several offerings, each with its own listing, and link to a detailed description. The listing includes a short description (or "teaser") of the offering, as well as the main details: Minimum Investment, the Asset Class, the Originator/Sub-advisor/Sponsor, and a few search tags.

The minimum investment ranges from $10,000 to $15,000. Most of the $10,000 offerings are short-term-note series, with average realized net returns of 3% to 5%. As Yieldstreet points out, this is far better than you'll get from a CD. In addition, the interest is paid monthly, and the principle is repaid when the notes mature, thereby accommodating investors liquidity.

The Asset Classes are the types of investments available, such as real estate. The Growth & Income REIT fund, for example, offers users the change to invest in "commercial real-estate properties across key US markets." The main emphasis of the fund is capital appreciation, so users shouldn't be surprised that the minimum investment is $5000. The fund is managed directly by Yieldstreet and is IRA eligible. Mostly importantly, the REIT offerings are open to all investors, not just those with accreditation. Like the Prism Fund, the REIT funds payout quarterly.

Another asset class you'll find is Diversified Cryptocurrency Funds, managed by highly reputable sub-advisors like Osprey Funds, as well as blue-chip art, from originators like Athena Art Fiance Corporation. These offerings have minimum investment requirements of $10K and more, and both are IRA eligible. The Originator/Sub-advisor/Sponsor is the entity directly involved in the management of the offering. Often it's Yieldstreet, but on some occasions it's an entity working in close contact with Yieldstreet, such as Osprey.

Risks Involved

Transparency & Security

Yieldstreet is a regulated by the SEC as a 506(c) entity, and must therefore comply with the SEC's rules and regulations. The platform is "subject to periodic examinations by the SEC," and it audited annually by Deloitte & Touche LLP. Investors have access to the audit reports. Furthermore, Cipperman Compliance Services LLC oversees all SEC compliance for Yieldstreet. In terms of cybersecurity, the site is certified by DigiCert, and all user information goes through encrypted channels. Yieldstreet offers 2-factor authentication, and the Yieldstreet Wallet is insured for up $250,000.

Our Readers Have Asked:

Is it safe to invest with Yieldstreet?

Yieldstreet has an excellent reputation, and because it's a regulated by the SEC, it's about as safe as an alternative-investment platform can be. In addition, more than 75% of investors on the platform are repeat investors, which suggests user confidence is very high.

What minimum credit score needed to get a loan from Yieldstreet?

Yieldstreet doesn't disclose its exact selection process, but it's fair to assume they won't work with borrowers with a score below 650.

Which credit bureau does Yieldstreet use?

Yieldstreet does not disclose which credit bureau(s) they use.

How to become an investor at Yieldstreet?

To invest with Yieldstreet, register for an account, complete the KYC, submit accreditation papers, deposit funds into the Yieldstreet Wallet, and select offerings that suit your financial goals.

How much money will I make?

According to Yieldstreet's reports, investors enjoy annualized net returns of approximately 9.7%, which means if you invest $10,000, you should have around $10950 a year later. However, that's a gross over-simplification. Many of the investment opportunities are designed for quick turn around. The short-term notes, for example, average closer to 4.5%, but you money is only tied up for a few months. On the other hand, some of the art investments might yield 20%, but those require large investments lasting several years.

What are the risks?

There are always risks involved when investing money. For example, the volatility of the cryptocurrency market means you could invest in something that loses value. You could invest in a real-estate property that shuts down. You should always take care to assess the risk profile of any offering on any platform, and never invest money you cannot afford to lose.

Why do I need to submit ID verification?

The goal of the KYC process is to prevent fraud. Peer-to-peer lending platforms request personal information so they can be sure they are dealing with a real person, and that they have that person's permission to proceed with a loan or investment. Platforms can't risk lending tens of thousands of euro to a fake profile, and you certainly don't want someone borrowing or investing money in your name without your permission. By requesting photo ID, bank details, credit histories, and other relevant information, everyone can feel certain the process is legitimate.

Furthermore, YieldStreet is regulated by the US SEC, and is subject to rigorous auditing. As such, they must make sure the investor has the legal right to invest money on their platform. The US has restrictions on various types of investments, embargoes on certain countries, and tax laws that must be followed. All of the above are mitigated by careful KYC processes.

Is P2P Lending a Ponzi Scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies.

Where is Yieldstreet Located?

Yieldstreet's offices are located at 300 Park Avenue 15th Floor, New York, NY 10022.

Verdict

Alternative Investments are a great way to earn passive income, and Yieldstreet is one of the very best alt-investment platforms in the US. Whether you're a new investor looking to buy into a fund, or an accredited investor ready to drop tens or hundreds of thousands on cryptocurrency, real-estate, and art, this is a platform you need to consider. The business partners and loan originators are industry leaders, the returns are excellent, and there is no shortage of offerings. Yieldstreet is highly recommended.